Europe & Africa Market Update 12 May 2025

European and African benchmarks have moved in mixed directions over the weekend, and the Gibraltar Strait ports are facing congestion.

IMAGE: Aerial view of Durban port landscape. Getty Images

IMAGE: Aerial view of Durban port landscape. Getty Images

Changes on the day from Friday, to 09.00 GMT today:

- VLSFO prices up in Gibraltar ($6/mt) and Rotterdam ($1/mt), and down in Durban ($9/mt)

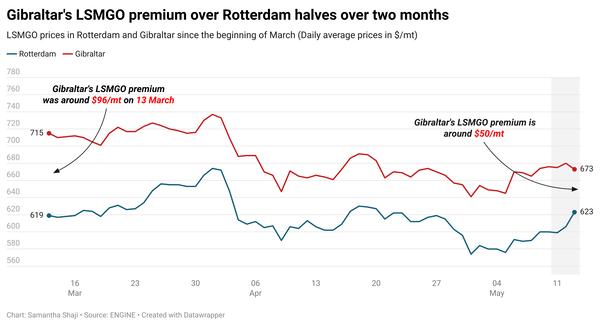

- LSMGO prices up in Gibraltar ($13/mt), and down in Rotterdam ($12/mt)

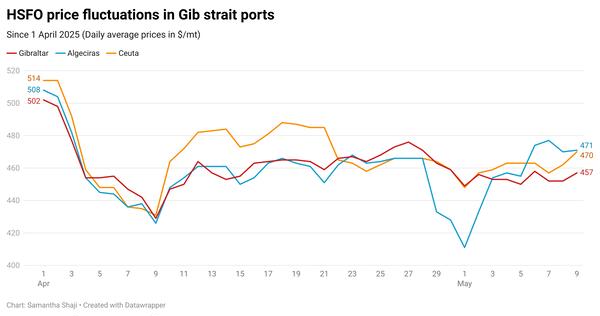

- HSFO prices up in Gibraltar ($7/mt) and Rotterdam ($3/mt), and down in Durban ($4/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $25/mt to $262/mt

Prices of conventional fuels in Rotterdam, Durban and Gibraltar have moved in different directions in the past session. All fuel prices in Gibraltar have gained over the weekend, while Durban's HSFO and VLSFO prices have slipped.

Rotterdam’s B30-VLSFO price has gained over the past two sessions and reached $714/mt.

Gibraltar’s LSMGO price gain of $13/mt is the highest increase of the fuel grades between Rotterdam, Gibraltar and Durban.

Congestion that persisted in Gibraltar for more than a week caused by limited barge availability. The number of vessels awaiting bunkers in the port has been reduced to five, according to port agent MH Bland. Vessels are advised to expect delays of up to 12 hours.

Suppliers in Algeciras are delayed by between 2-16 hours, down from last week’s delays of up to 24 hours, MH Bland says. Suppliers in Huelva and off Malta are also advising some delays.

Bunker operations are running without delays in the Spanish port of Ceuta, the port agent added, after last week’s expected delays of 4-8 hours.

Off Walvis Bay and Lome, lead times of 3-6 days and 5-7 days are advised, respectively. Suppliers in both locations have good prompt availability, a trader told ENGINE.

Brent

The front-month ICE Brent contract has gained by $1.83/bbl on the day from Friday, to trade at $65.55/bbl at 09.00 GMT.

Upward pressure:

Brent’s price gained momentum over the weekend as officials from the US and China, the two top crude oil consumers of the world, reached a mutual trade agreement in Geneva, boosting demand growth sentiment.

Washington has decided to reduce levies on most Chinese goods from 145% to 30% and Beijing said it will lower duties on US imports from 125% to 10% for a 90-day initial period.

“Oil and metals prices rose after the US and China said they will temporarily lower tariffs on each other’s products,” two analysts from ING Bank said.

Over the weekend, US treasury secretary Scott Bessent met with Chinese vice premier He Lifeng, to address trade tensions that that could potentially ease demand concerns.

“Crude oil gained… as optimism over trade talks raised the prospect of a limit to demand weakness,” ANZ Bank senior commodity strategist Daniel Hynes noted.

Downward pressure:

Brent’s price gains were capped by some oversupply concerns, as the global oil market braces for surplus OPEC+ barrels.

The Saudi Arabia-led oil producers group surprised the market in April by tripling its planned output hike to 411,000 b/d for May and agreed to extend that increase through June – the second month in a row that they plan to expedite the unwinding of their joint 2.2 million b/d output cuts.

“Concerns over higher supply continue to hang over the market,” Hynes said.

Besides, OPEC+ producer Kazakhstan said that it has no plans to curb oil output this month, Bloomberg reports. The country, after repeatedly exceeding production quota over the past year, said earlier that it would put national interest before the oil coalition’s and continue to maintain higher production levels.

“Saudi Arabia, the de facto leader of the OPEC group, doesn’t appear to be afraid of lower oil prices but it does appear to be becoming less tolerant of over-producing members,” Hynes added.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.