East of Suez Market Update 12 May 2025

Bunker fuel prices across the major East of Suez ports have largely tracked Brent’s upward move, and prompt availability is tight in Fujairah.

IMAGE: Vessel docked at berth in Fujairah, UAE. Port of Fujairah

IMAGE: Vessel docked at berth in Fujairah, UAE. Port of Fujairah

Changes on the day from Friday, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($8/mt), Fujairah ($4/mt) and Zhoushan ($2/mt)

- LSMGO prices up in Singapore and Zhoushan ($6/mt), and down in Fujairah ($3/mt)

- HSFO prices up in Zhoushan ($12/mt), Singapore ($7/mt) and Fujairah ($5/mt)

- B24-VLSFO at a $231/mt premium over VLSFO in Singapore

The price of VLSFO in the three major Asian ports has surged in the previous session, with Zhoushan recording the highest gains. Singapore's VSLFO benchmark has drawn support from a 150-500 mt VSLFO stem fixed at $508/mt for prompt delivery yesterday.

Prompt availability in Singapore is slightly on the tighter side, with VLSFO lead times of around 3-8 days now. HSFO lead times are at around 3-7 days. LSMGO is more readily available, with recommended lead times of around 1-6 days now.

“There are very limited suppliers offering for small HSFO parcels [in Singapore] and premium is expected for quantities 500mt and below,” a source says.

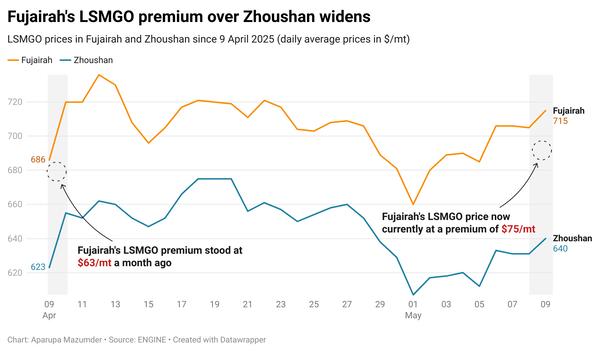

The price of LSMGO has seen gains in Singapore and Zhoushan, while its price in Fujairah has declined. Despite the drop, Fujairah’s LSMGO price currently stands at a $124/mt premium over Singapore and $66/mt over Zhoushan's.

In Fujairah, HSFO availability is tight, but some suppliers can provide stems for prompt delivery with premiums on price, according to another source. VLSFO availability in the UAE port is expected to improve after 16 May.

Brent

The front-month ICE Brent contract has gained by $1.83/bbl on the day from Friday, to trade at $65.55/bbl, at 17.00 SGT (09.00 GMT) today.

Upward pressure:

Brent’s price gained momentum over the weekend as officials from the US and China, the two top crude oil consumers of the world, reached a mutual trade agreement in Geneva, boosting demand growth sentiment.

Washington has decided to reduce levies on most Chinese goods from 145% to 30% and Beijing said it will lower duties on US imports from 125% to 10% for a 90-day initial period.

“Oil and metals prices rose after the US and China said they will temporarily lower tariffs on each other’s products,” two analysts from ING Bank said.

Over the weekend, US treasury secretary Scott Bessent met with Chinese vice premier He Lifeng, to address trade tensions that that could potentially ease demand concerns.

“Crude oil gained… as optimism over trade talks raised the prospect of a limit to demand weakness,” ANZ Bank’s senior commodity strategist Daniel Hynes noted.

Downward pressure:

Brent’s price gains were capped by some oversupply concerns, as the global oil market braces for surplus OPEC+ barrels.

The Saudi Arabia-led oil producers group surprised the market in April by tripling its planned output hike to 411,000 b/d for May and agreed to extend that increase through June – the second month in a row that they plan to expedite the unwinding of their joint 2.2 million b/d output cuts.

“Concerns over higher supply continue to hang over the market,” Hynes said.

Besides, OPEC+ producer Kazakhstan said that it has no plans to curb oil output this month, Bloomberg reports. The country, after repeatedly exceeding production quota over the past year, said earlier that it would put national interest before the oil coalition’s and continue to maintain higher production levels.

“Saudi Arabia, the de facto leader of the OPEC group, doesn’t appear to be afraid of lower oil prices but it does appear to be becoming less tolerant of over-producing members,” Hynes added.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.