East of Suez Market Update 9 May 2025

Bunker fuel prices across the major East of Suez ports have tracked Brent’s upward move, and prompt availability is tight in Singapore.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($20/mt), Singapore ($18/mt) and Zhoushan ($17/mt)

- LSMGO prices up in Zhoushan ($22/mt), Fujairah ($20/mt) and Singapore ($2/mt)

- HSFO prices up in Zhoushan ($21/mt), Fujairah ($14/mt) and Singapore ($10/mt)

- B24-VLSFO at a $219/mt premium over VLSFO in Singapore

VLSFO and LSMGO prices in the UAE’s Fujairah port have surged in the previous session. A higher-priced 500-1,500 mt VLSFO stem fixed at $492/mt in Fujairah has contributed to push its benchmark higher.

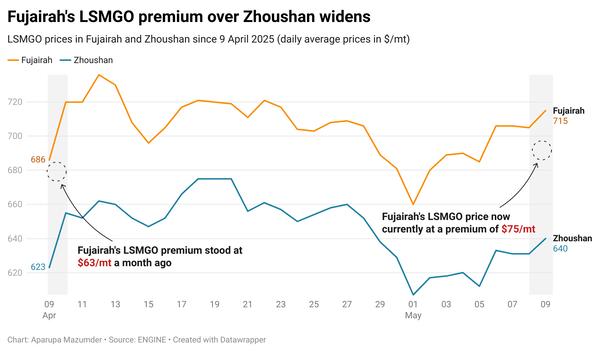

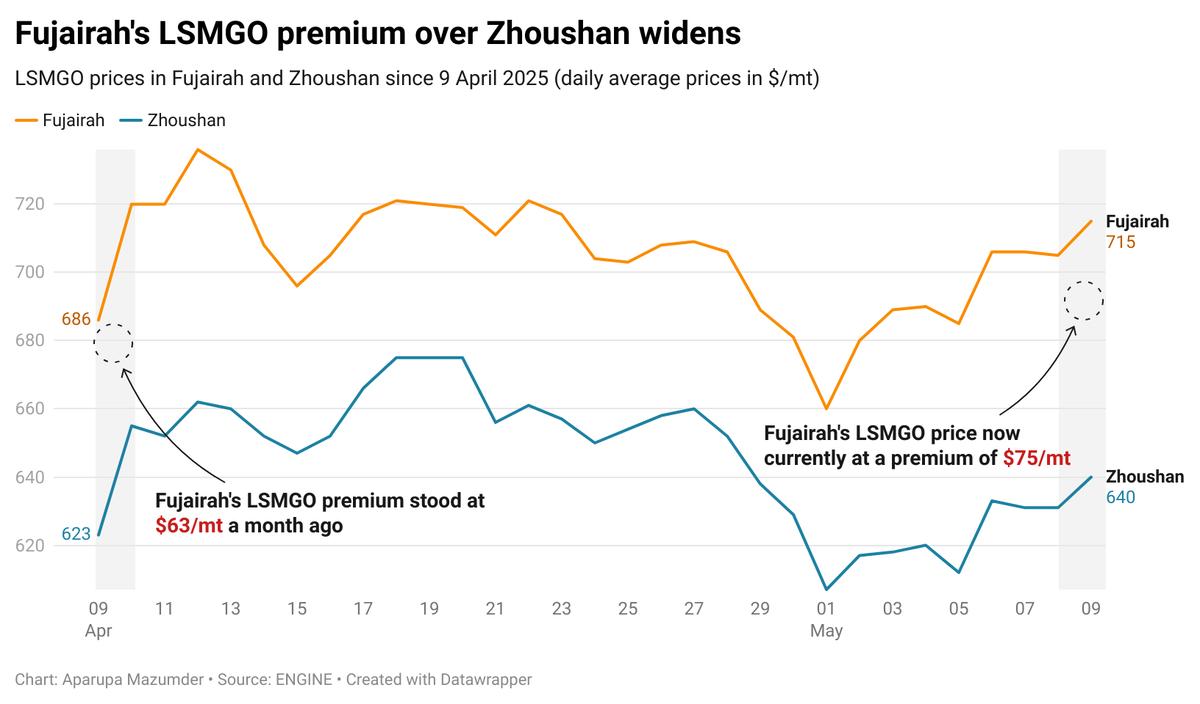

Prompt bunker availability is tight in Fujairah. The port’s LSMGO price currently stands at a $133/mt premium over Singapore and $75/mt over Zhoushan.

Singapore's LSMGO benchmark has drawn support from a 0-50 mt LSMGO stem fixed at $603/mt for prompt delivery yesterday.

Bunker availability in Singapore is a bit tight, with VLSFO lead times of around 9-17 days now. HSFO lead times have increased and are at around 7-13 days. LSMGO remains readily available, with recommended lead times reduced from 6-8 days last week, to 3-10 days now.

Bad weather may cause possible bunkering disruptions in Vietnam’s Hai Phong port today and on 11 May. Thailand’s Koh Sichang port may face disruptions on 14 May, a source says.

Brent

The front-month ICE Brent contract has gained by $1.97/bbl on the day, to trade at $63.72/bbl at 17.00 SGT (09.00 GMT) today.

Upward pressure:

Oil prices have moved higher, ahead of the US-China trade talks in Switzerland that are scheduled for tomorrow.

“The fate of the US-China trade war is a major factor for sentiment in the oil markets,” VANDA Insights’ founder and analyst Vandana Hari remarked.

Progress is expected over the weekend, as US treasury secretary Scott Bessent meets Chinese vice premier He Lifeng, to address trade tensions that that could potentially ease demand concerns.

Currently, China’s has a 125% tariff active on US goods, while Washington continues to impose duties of 145% on Chinese products.

“Trump said that the 145% levy against China could be lowered if trade talks go well,” ANZ Bank’s senior commodity strategist Daniel Hynes noted.

Downward pressure:

Some oversupply concerns in the global oil market have put downward pressure on oil today.

OPEC+ producer Kazakhstan has no plans of cutting oil production in May and plans to pump a daily average of 277,000 mt of crude and condensate, according to a Bloomberg report. This news has capped Brent’s price gains, analysts said.

“News reports that OPEC+ member Kazakhstan has no plans to cut oil production in May were drawing market attention back to ongoing tensions within the alliance over quota-busting,” Hari said.

Kazakhstan, after repeatedly exceeding production quotas over the past year, said earlier that it would put national interest before the oil coalition’s and continue to maintain higher production levels.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.