East of Suez Market Update 8 May 2025

Bunker fuel prices across major East of Suez ports have tracked Brent’s downward move, and prompt availability has improved in Zhoushan.

IMAGE: Aerial view of Zhoushan, Zhejiang, China. Getty Images

IMAGE: Aerial view of Zhoushan, Zhejiang, China. Getty Images

Changes on the day, to 17.00 SGT (09.00 GMT) today:

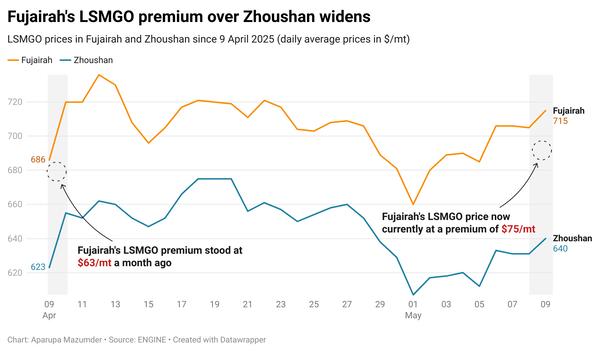

- VLSFO prices down in Zhoushan ($11/mt), Fujairah ($4/mt) and Singapore ($3/mt)

- LSMGO prices down in Zhoushan ($16/mt), Fujairah ($14/mt) and Singapore ($13/mt)

- HSFO prices down in Singapore ($10/mt), Zhoushan ($9/mt) and Fujairah ($8/mt)

- B24-VLSFO at a $201/mt premium over VLSFO in Singapore

VLSFO prices have declined in three major Asian bunker ports, with Zhoushan recording the steepest fall. Despite the decline, Zhoushan’s VLSFO price stands at a $2/mt premium over Singapore and $8/mt over Fujairah.

In Zhoushan, lead times for VLSFO are at around 5-11 days, a trader told ENGINE. LSMGO availability is good at the port, with lead times advised at 4-10 days while 5-10 days is recommended for HSFO.

Prompt bunker availability is tight in the UAE port of Fujairah, with lead times for all grades of over at least seven days. “[The] market is tight till 14 May, most suppliers are not entertaining bigger stems due to instability of the market and due to shortage of cargo,” a source says.

In Hong Kong, lead times for all fuel grades continue to remain at about seven days, showing no change from recent weeks, according to a source. VLSFO is very tight, another source says. Bunker operations at the port may face some disruption due to bad weather today and again on 13 and 14 May.

Brent

The front-month ICE Brent contract has declined by $1.01/bbl on the day, to trade at $61.75/bbl at 17.00 SGT (09.00 GMT) today.

Upward pressure:

Brent has drawn some support after the US Energy Information Administration (EIA) reported a drop is US crude stocks.

Commercial US crude oil inventories declined by 2 million bbls to touch 438 million bbls for the week ending 2 May, according to data from the EIA. The latest EIA data “leaves crude oil inventories at their lowest level since March,” two analysts from ING Bank noted.

A drop in US crude stocks typically indicates higher demand and can lend some support to Brent's price.

Besides, fresh developments in the US-China trade dispute provided some support to Brent. US treasury secretary Scott Bessent is set to meet with a top Chinese official in Switzerland on 10 May to continue negotiations over the tariff war that has disrupted global trade.

Downward pressure:

Brent’s price slumped after the US Fed’s policy meeting, as the market found little reason for optimism over demand growth.

In a largely anticipated move, the US Federal Open Market Committee (FOMC) maintained its key interest rate at a range between 4.25-4.50%.

The news follows mounting tensions among global trade partners amid the ongoing US tariff dispute and growing concerns over oil demand.

“It was a sea of red across commodities as news that the Federal Reserve left US interest rates on hold, and signs it's likely to remain there,” ING Bank analysts said.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.