Europe & Africa Fuel Availability Outlook 30 Apr 2025

Tight bunker supply in Skaw, Gothenburg

Piraeus to commence ULSFO supply

Good prompt supply in Walvis Bay

IMAGE: Port of Hamburg with the Elbe river. Getty Images

IMAGE: Port of Hamburg with the Elbe river. Getty Images

Northwestern Europe

The ARA hub is seeing tight prompt supply of HSFO and VLSFO, a trader told ENGINE. Recommended lead times for both grades are at 7-8 days. However, prompt LSMGO supply is good with lead times of 3-5 days advised.

Antwerp, one of the three main ports in the ARA hub, faced staffing as well as vessel intake issues due to a national strike that began late evening on 28th April. The Zandvliet operating area in the port began operations early this morning, according to port authorities.

The ARA’s independently held fuel oil stocks declined by 4% so far this month compared to March, according to Insights Global data. At 7.01 million bbls, the region’s fuel oil stocks inched upwards since last week.

The region has imported 226,000 b/d of fuel oil so far this month, an increase from 198,000 b/d of fuel oil in March, according to data from cargo tracker Vortexa. The ARA has imported low sulphur fuel oil (LSFO) and HSFO in a 52/48 ratio so far this month, leaning towards LSFO as compared to last months’ equal split.

The UK has emerged as the region’s top import source, taking up 27% of the total share. Other import sources include Mexico (15%), the US (14%), Russia (13%), France (9%) and Lithuania (7%).

The region’s independent gasoil inventories - which include diesel and heating oil – have also averaged 4% lower this month. The ARA hub has imported 227,000 b/d of gasoil and diesel so far this month, marking a dip from 346,000 b/d imported in March, according to Vortexa data.

The Danish port of Skaw as well as the Swedish port of Gothenburg currently have limited bunker supply, with lead times of 10 days advised for both ports across the fuel grades, a trader told ENGINE.

Prompt bunker supply is good in Germany’s Hamburg port, a trader said. All bunker grades require lead times of 3-5 days, consistent with the last few months.

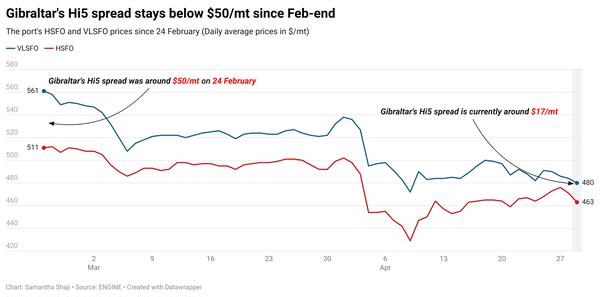

Mediterranean

Prompt supply for all grades is tight in the Gibraltar Strait ports, compared to last week’s readily available prompt supplies, a trader said. Recommended lead times for HSFO and VLSFO is 12-14 days while that for LSMGO is 7-8 days.

Bunkering operations in the ports were suspended at the beginning of this week owing to adverse sea and wind conditions as well as delays on part of suppliers. Gibraltar and Algeciras are partly functional now, though congestion persists.

In Canary Islands’ port of Las Palmas, lead times for HSFO and LSMGO remain 12-14 days while the earliest delivery date for VLSFO has been extended to mid may, a trader said.

The avails for bunker in the Spanish port of Barcelona are good, with lead times of 5-7 days recommended, a trader mentioned.

Piraeus, the Greek port, is set to supply ULSFO from mid-May onwards, a trader told ENGINE. However, prompt supply of conventional fuels is on the tighter side.

The Turkish port of Istanbul has prompt ULSFO supply while supply for HSFO, VLSFO and LSMGO remain tight.

Malta Offshore has tight prompt bunker supply, especially LSMGO, the trader said.

Africa

Though demand for bunkers in Durban is low, lead times of 2-4 days is advised, a trader informed ENGINE.

Durban's LSMGO supply still remains dry, a trader said. The grade has been dry since the last week of January, when suppliers ran out of LSMGO stock.

Port Louis in Mauritius continues to have normal bunker availability. Lead times of 3-5 for prompt delivery is advised for all grades.

In Luanda, VLSFO availability remains good, but LSMGO supply is very tight, a trader said.

Prompt delivery in Walvis Bay is also good with lead times of 3-6 days recommended.

By Samantha Shaji

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.