Europe & Africa Market Update 29 Apr 2025

Bunker benchmarks in Europe and Africa have fallen tracking Brent’s decline, and prompt bunker supply in the Danish port of Skaw is tight.

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($26/mt), Gibraltar ($4/mt) and Rotterdam ($2/mt)

- LSMGO prices down in Rotterdam ($20/mt) and Gibraltar ($12/mt)

- HSFO prices down in Gibraltar ($12/mt), Durban ($11/mt) and Rotterdam ($10/mt)

- Rotterdam B30-VLSFO premium over VLSFO down by $53/mt to $206/mt

Durban's HSFO and VLSFO prices have plummeted, recording some of the highest losses in the past session.

In the Dutch port of Rotterdam, prices of all grades have fallen. The price moves have caused it’s Hi5 spread to widen from $26/mt to $34/mt now. It’s B30 VLSFO price has also seen a steep fall of $55/mt in the past day, now trading at $657/mt.

Antwerp, one of the three main ports in the ARA hub, is currently facing staffing as well as vessel intake issues due to a national strike that began late evening yesterday. The strike is expected to extend until 30 April, according to the port authority.

Prompt bunker supply for all grades is tight in the Danish port of Skaw, with lead times of 10 days recommended, a trader told ENGINE.

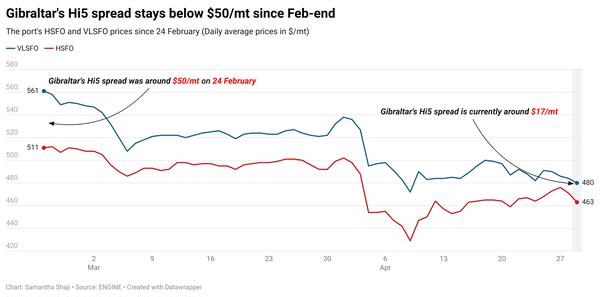

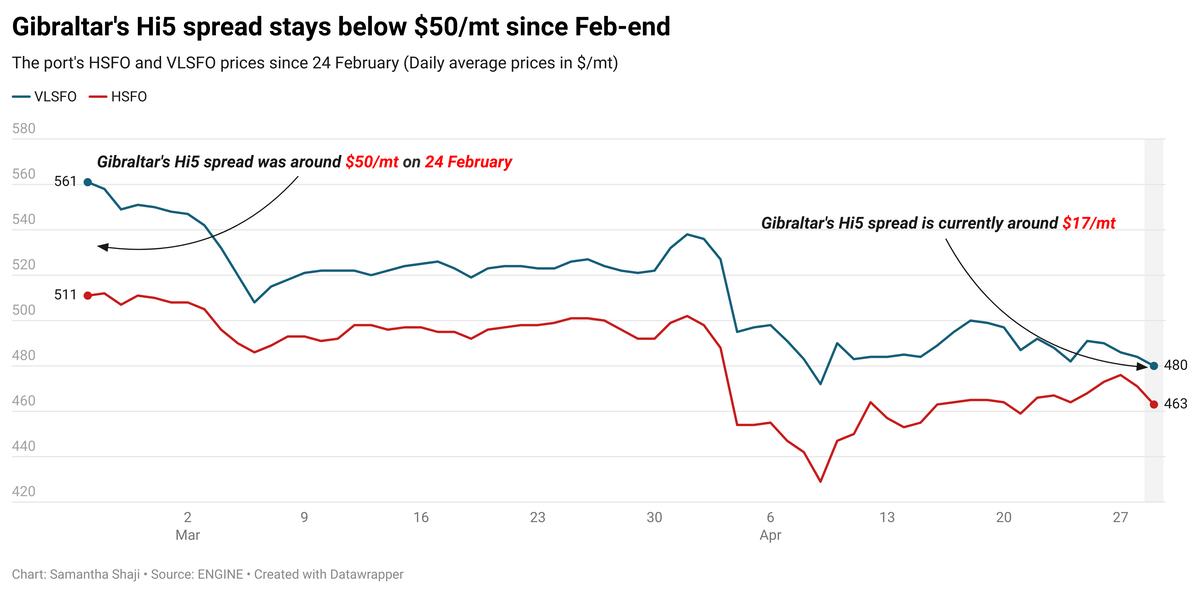

Bunker prices across all grades have come down in Gibraltar. The port's Hi5 spread has also widened from $11/mt to 19/mt but remains under $50/mt, maintaining its two-month streak.

Due to adverse weather conditions, the Mediterranean port has suspended inbound vessel traffic today, according to port agent MH Bland. Currently, there are 11 vessels in queue to receive bunkers, the port agent added.

Bunker operations have been suspended in Huelva and in the OPL and Delta areas of Algeciras since yesterday amid rough weather conditions. Some congestion is reported at the inner anchorage of Algeciras, where operations are still underway.

Brent

The front-month ICE Brent contract has moved $2.15/bbl lower on the day, to trade at $64.60/bbl at 09.00 GMT.

Upward pressure:

Renewed pressure on Iran-backed armed groups has supported Brent’s price.

President Donald Trump-led US administration has sanctioned three vessels and three shipping companies for allegedly supporting Yemen-based Houthi militants.

The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned the vessels for delivering liquefied petroleum gas (LPG) and gas oil to the Houthi-controlled Ras Isa port.

In Iran’s port city of Bandar Abbas, a huge blast caused an explosion of chemical materials that killed at least 70 people and injured more than 1,200, Reuters cited the country’s state-owned media report on Monday. The port is Iran’s biggest container hub, according to the report.

Downward pressure:

Brent futures have plunged due to multiple factors, all ultimately pointing to one key concern: weakening demand.

Any quick resolution to the trade war between the US and China now seems a little far off, according to market analysts. This outlook has renewed demand growth concerns for commodities like oil.

The potential increase in supply from the OPEC+ alliance is adding further downward pressure on crude oil. “Downside risks for oil prices continue to persist as OPEC+ plans to revive production in its upcoming meeting scheduled for next week,” two analysts from ING Bank noted.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.