Europe & Africa Market Update 30 Apr 2025

Bunker benchmarks in Europe and Africa have continued to decline, and bunkering has resumed in Gibraltar.

IMAGE: Huge container ship being unloaded with cranes at a container terminal in Antwerp. Getty Images

IMAGE: Huge container ship being unloaded with cranes at a container terminal in Antwerp. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($14/mt), Gibraltar ($11/mt) and Rotterdam ($9/mt)

- LSMGO prices down in Gibraltar ($12/mt) and Rotterdam ($6/mt)

- HSFO prices down in Durban ($15/mt), Rotterdam ($10/mt) and Gibraltar ($9/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $10/mt to $216/mt

Conventional fuel prices have declined in the past day, following Brent’s fall for a second consecutive day. The South African port of Durban has recorded the highest losses among the three ports.

Bunker prices across all grades have decreased in Rotterdam, with HSFO clocking the largest decline. The port’s Hi5 spread has widened in the past session, increasing by $1/mt to $35/mt. Conversely, its B30 VLSFO price has edged up to $658/mt.

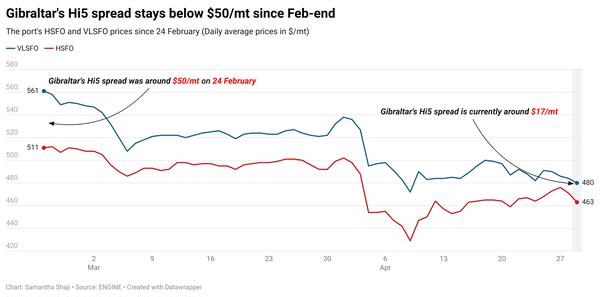

Gibraltar's bunker prices have also declined. However, its Hi5 spread has narrowed from $19/mt, to $17/mt now. Bunkering operations at the port have now resumed though face congestion – there are 19 vessels waiting for bunkers at the port, according to port agent MH Bland.

Operations in Algeciras remain suspended due to adverse weather. However, bunker deliveries are possible in the port's shielded inner anchorage area, the port agent said.

The port agent also mentioned that operations in the port of Huelva remain suspended.

Brent

The front-month ICE Brent contract has declined by $1.30/bbl on the day, to trade at $63.30/bbl at 09.00 GMT.

Upward pressure:

Supply concerns in the global oil market continue to support Brent futures.

On Tuesday, the US government sanctioned three vessels and three shipping companies for allegedly supporting Yemen-based Houthi militants. The vessels allegedly delivered liquefied petroleum gas (LPG) and gas oil to the Houthi-controlled Ras Isa port.

The move reinforces Washington’s commitment to tightening sanctions on Iran and its proxies including the Houthis in Yemen, Hezbollah in Lebanon and Hamas in Gaza. Brent’s price found some support after the announcement, according to market analysts.

Downward pressure:

Brent’s price has moved lower after the American Petroleum Institute (API) reported a rise in US crude stocks.

US crude oil inventories gained by 3.8 million bbls in the week ending 25 April, according to API estimates.

Market analysts expected a much smaller rise of 390,000 bbls. A buildup in inventories typically signals weaker oil demand, which can put downward pressure on Brent's price.

The API report was “largely bearish”, according to two analysts from ING Bank.

Besides, concerns about oil demand growth amid the global trade war has weakened market sentiment, according to analysts. Oil prices remain under pressure amid ongoing tariff tensions and growing speculation that OPEC+ may ease production restrictions in the upcoming months.

“Lingering tariff risks and expectations of OPEC+ loosening output curbs continue to pressure oil prices,” the analysts added.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.