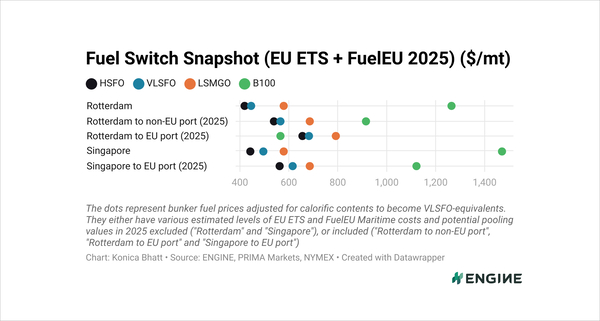

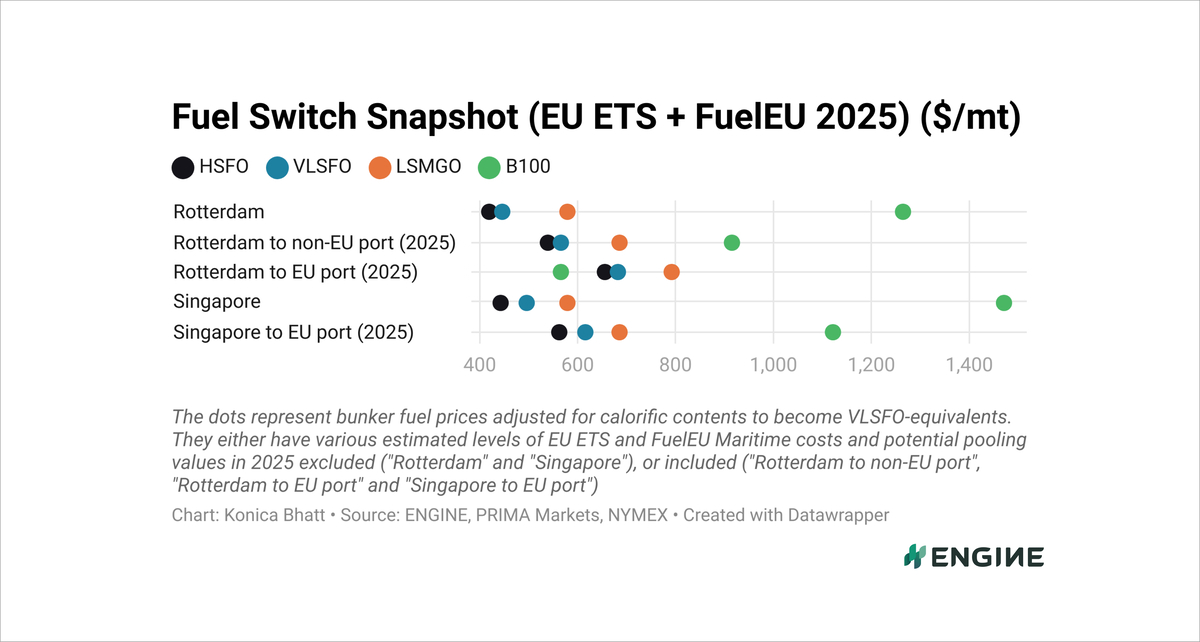

Fuel Switch Snapshot: Rotterdam's B100 becomes more cost-effective for EU voyages

B100 now $90/mt cheaper than HSFO in Rotterdam

LNG delivery premium down $10/mt in Rotterdam

Singapore’s LNG flips to discount to LSMGO

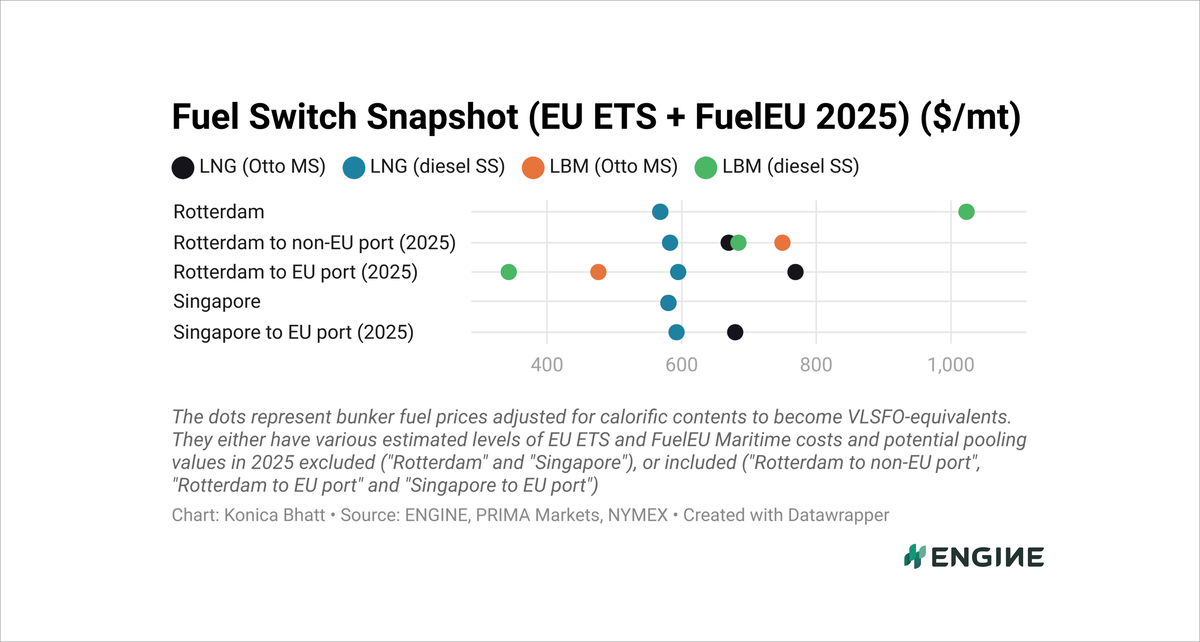

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU compliance costs for EU–EU voyages included. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

B100’s discounts to fossil fuels have widened even further in Rotterdam. It is now $116/mt cheaper than VLSFO and a substantial $228/mt cheaper than LSMGO in the port.

Even for scrubber-fitted vessels bunkering in Rotterdam, B100 remains the most cost-effective alternative, standing at a significant $90/mt discount against HSFO.

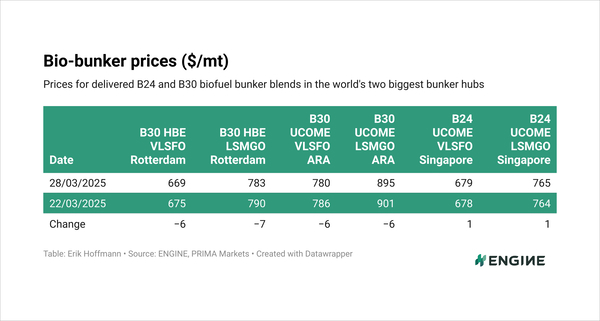

Rotterdam's biofuel bunker sales fell to 110,000 mt in the first quarter of the year and made up 5% of the port’s total bunker sales, down from peaks of 10-11% between the third quarter of 2023 and the second quarter of 2024.

Rotterdam’s sales have been trailing further and further behind Singapore’s 361,000 mt in the first quarter this year.

LBM continues to be Rotterdam’s cheapest bunkering option for dual-fuel vessel owners. Its discount to LNG has widened by a slight $2/mt, to $253–293/mt, depending on a vessel’s methane slip.

LBM's discount to VLSFO has also increased, now standing at $204–339/mt.

LBM’s discount to Rotterdam’s B100, meanwhile, has narrowed by $9/mt to $88–223/mt over the past week.

Liquid fuels

Rotterdam’s VLSFO benchmark has declined by $8/mt over the past week, mirroring an $8/mt decrease in front-month ICE Brent futures. Prompt supply of the grade remains tight in the wider ARA region, with lead times of 5–7 days recommended.

The port’s B100 price has declined by a greater $27/mt in the past week. PRIMA Markets last assessed the Dutch HBE rebate for B100 at $406/mt, up $16/mt from a week earlier.

Singapore’s VLSFO benchmark has remained unchanged over the past week. Lead times for the grade have grown longer, now standing at 6–18 days compared to 8–12 days the week before.

Liquid gases

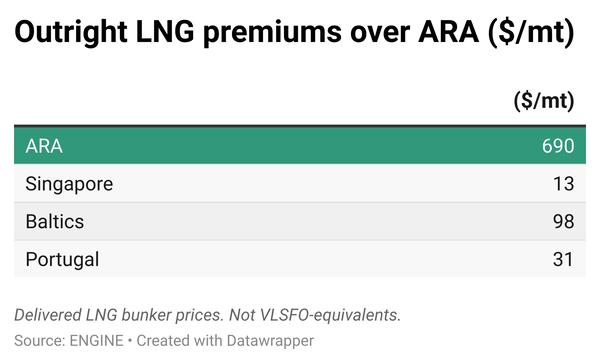

Rotterdam's LNG bunker price has declined by $17/mt over the past week. The drop has largely been driven by a $10/mt drop in the bunker delivery premium over the Dutch TTF gas benchmark, which has fallen by $10/mt on the week to $83/mt.

LNG's discount to LSMGO has widened by a further $8/mt to $23/mt.

Singapore’s LNG bunker price has dropped by $51/mt in the past week. Asian LNG bunker prices typically track the NYMEX Japan/Korea Marker (JKM), which has declined by $0.82/MMBtu during the same period, pushing the front-month contract down to $11.27/MMBtu ($586/mt).

A price gap has "emerged between Asia and Europe amid stagnant demand in Asia, and the supply of US spot LNG to Asia increased due to arbitrage trading," according to JOGMEC.

Singapore’s LNG price has shifted to a $5/mt discount against LSMGO over the past week, down from a $41/mt premium. These prices include estimated EU compliance costs for Singapore–EU voyages.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.