Biofuel Bunker Snapshot: Prices drop in Rotterdam, steady in Singapore

Rotterdam B30 prices move lower with oil products

Rotterdam’s biofuel sales slide further behind Singapore’s

FincoEnergies expands bunker operations

Rotterdam

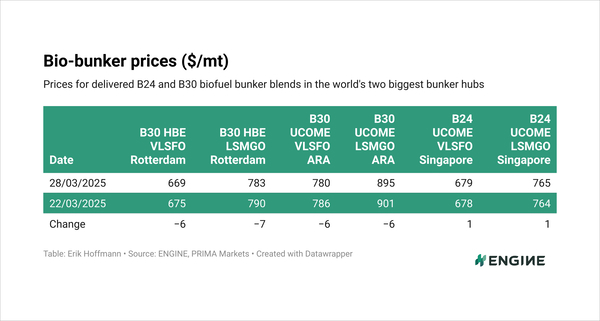

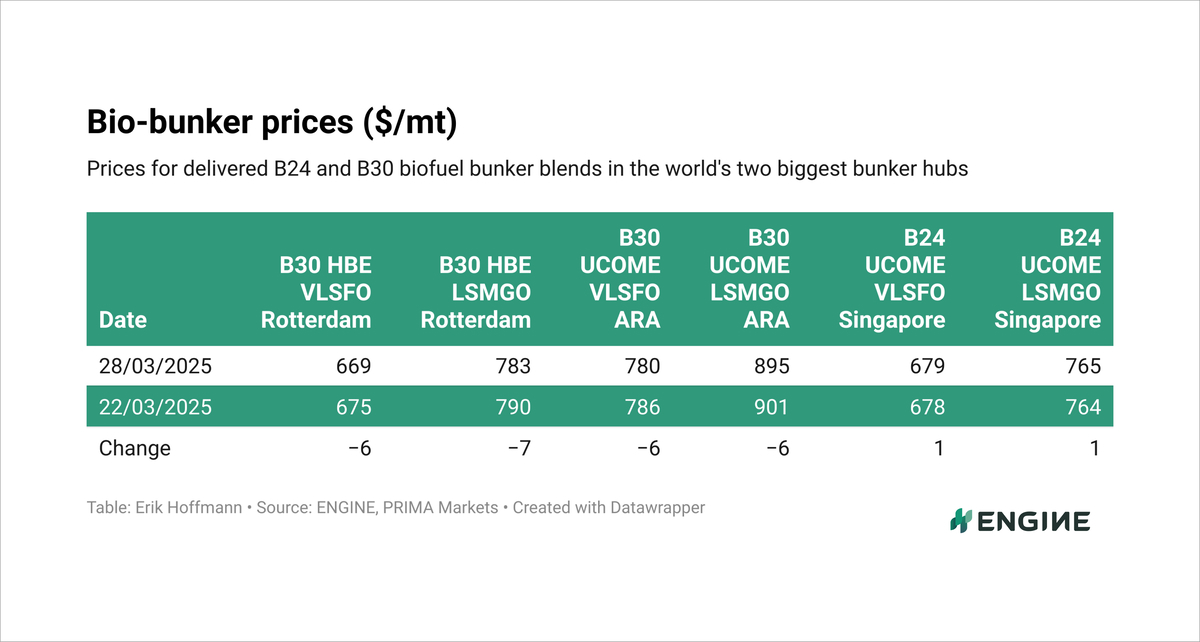

The price of B30-VLSFO with an HBE rebate in Rotterdam has dropped $6/mt lower in the past week amid an $11/mt decline in the port’s pure VLSFO price. POMEME CIF ARA barges are up by $4/mt to $1,494/mt, while the HBE rebate for B30s has held steady at $122/mt.

Both the POMEME barge and HBE rebate prices have been assessed by ENGINE’s partner PRIMA Markets, while the VLSFO price comes from ENGINE.

POMEME has come down by $97/mt from $1,591/mt at the beginning of April and put downward pressure on the POMEME-based B30-VLSFO blend price, which has dropped by $78/mt over the same period.

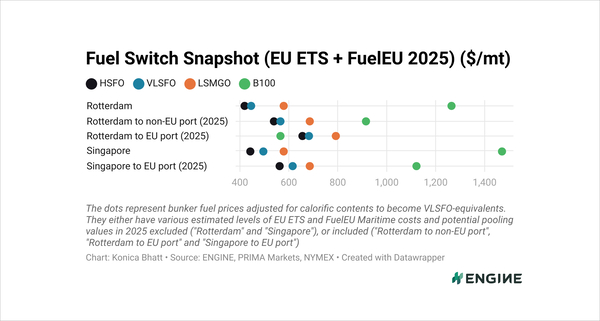

B30-VLSFO HBE’s premium over pure VLSFO has widened by $5/mt in the past week to $223/mt on an outright basis. These prices are without EU ETS and FuelEU Maritime costs, which can tilt the balance in B30-VLSFO’s favour.

ARA B30-VLSFO UCOME, which does not qualify for the $122/mt HBE rebate, has also dropped by $6/mt on the week. PRIMA’s UCOME FOB ARA barge price has climbed $4/mt higher, similar to POMEME.

Singapore

Singapore’s B24-VLSFO UCOME price has edged $1/mt higher amid broadly unchanged UCOME FOB China cargo and pure VLSFO prices, and a steady China-Singapore freight rate of $15.25/mt.

Demand for Chinese UCOME has been weak, reports PRIMA. The price reporting agency has seen a bid-ask spread of $1,130-1,140/mt and assessed the price to $1,137.50/mt.

The arbitrage for Chinese UCOME exports into the EU is closed because of the EU’s anti-dumping duties on Chinese UCOME, leaving fewer outlets for Chinese exporters.

Singapore’s B24-VLSFO is at a $182/mt premium over VLSFO, up from $176/mt at the start of the month.

Other bio-bunker news

Rotterdam’s biofuel bunker sales fell to 110,000 mt in the first quarter of the year and made up 5% of the port’s total bunker sales, down from peaks of 10-11% between the third quarter of 2023 and the second quarter of 2024. Rotterdam’s sales have been trailing further and further behind Singapore’s 361,000 mt in the first quarter this year.

Dutch biofuel bunker supplier FincoEnergies has bought a stake in bunker supplier Oliehandel Klaas de Boer, which supplies LSMGO in Amsterdam and several other Dutch ports, as well as in Germany’s Emden. Finco said the acquisition will expand its storage capacity.

Swire Shipping will run three of its ships on B24 biofuel blends supplied by BP in Singapore, and said it looks to transition to B30 blends eventually. These ships will sail between Southeast Asia and the Pacific Islands.

Finnish ferry operator Eckerö Line said it will use hydrotreated vegetable oil (HVO) biofuels supplied by refiner Neste in its fuel mix to comply with FuelEU Maritime. Its ferries operate between Helsinki and Tallinn.

By Erik Hoffmann

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.