LNG Bunker Snapshot: Rotterdam price falls on warm weather

Rotterdam’s LNG bunker price has dropped sharply due to relatively warm weather and stable supplies, while Singapore’s decline is mainly attributed to weak gas demand.

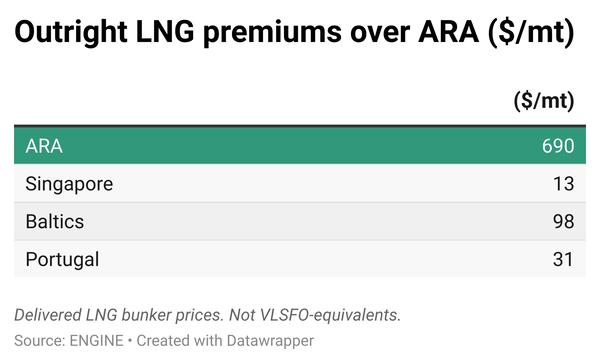

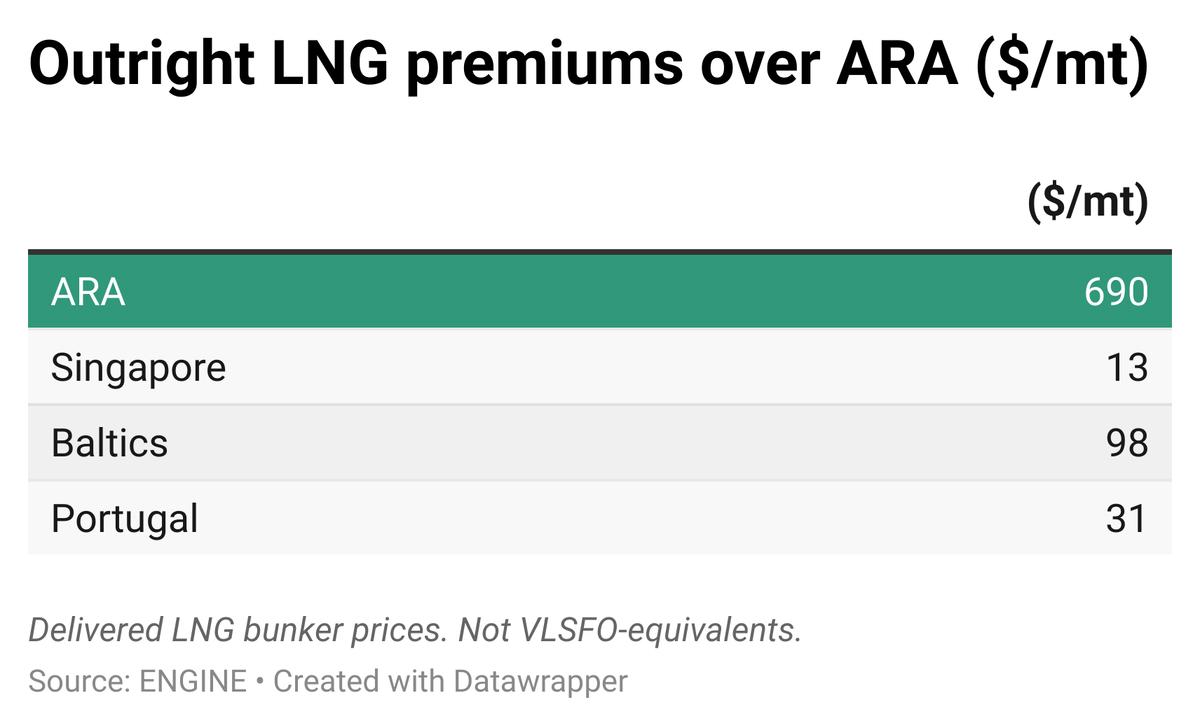

Changes in weekly LNG bunker prices:

- Rotterdam down by $22/mt to $690/mt

- Singapore down by $63/mt to $703/mt

Rotterdam

Rotterdam’s LNG bunker price has dropped by $22/mt to $690/mt. This weekly decline is mainly driven by a reduction of approximately 10% in the estimated LNG bunker premium, which has fallen from around $93/mt to $83/mt.

A roughly 2% decrease in the front-month Dutch TTF Natural Gas contract, a key European gas benchmark, has also contributed to the price drop.

The TTF decline is linked to “relatively warm weather and stable supplies,” according to the Japan Organization for Metals and Energy Security (JOGMEC).

“Forecasts for major demand hubs in Europe point to above-average temperatures until the first week of May,” Rystad Energy said.

The price has been on a downward trend “as the current supply picture is good and heating demand in Europe is falling as we now enter shoulder season,” Energi Danmark noted.

A shoulder month refers to the period between peak and off-peak seasons, typically marked by milder weather and lower energy demand.

As of 25 April, underground gas storage across the EU was at 38.1%, up from 36.5% the previous week but still 38.3% lower than the same period last year, according to Gas Infrastructure Europe, as cited by JOGMEC.

“EU steadily refilling storage, easing fears of a winter crunch. Plus, Europe is looking to relax refill targets,” Bloomberg News’ Energy Asia team leader Stephen Stapczynski commented.

“Prices came under pressure following the increased supply availability and lower demand in Asia,” two analysts from ING Bank added.

Singapore

Singapore’s LNG bunker price has dropped sharply by $63/mt over the past week, settling at $703/mt. Asian LNG bunker prices typically track the NYMEX Japan/Korea Marker (JKM), which declined by $0.82/MMBtu during the same period, pushing the front-month contract down to $11.27/MMBtu ($586/mt).

The fall was driven "by the fact that a price gap emerged between Asia and Europe amid stagnant demand in Asia, and the supply of US spot LNG to Asia increased due to arbitrage trading," according to JOGMEC.

Arbitrage trading refers to buying LNG in a lower-priced region and selling it in a higher-priced market to capitalise on regional price differences.

Weather forecasts have also contributed to the downward pressure. China is expecting above-average temperatures until 8 May, while Japan forecasts average or above-average temperatures across most regions on its main island and Hokkaido. South Korea forecasts above-average temperatures until 5 May, according to Rystad Energy.

As of 20 April, LNG inventories for power generation in Japan stood at 2.11 million mt, a slight decrease of 20,000 mt from the previous week, according to the Ministry of Economy, Trade and Industry (METI).

Meanwhile, the price premium over Rotterdam narrowed significantly during the week, falling from $54/mt to $13/mt.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.