Bio-bunker sales drop to 5% of Rotterdam's demand

Rotterdam sales lag further behind Singapore's

No bio-LNG demand

Bio-methanol and bio-MGO demand increases

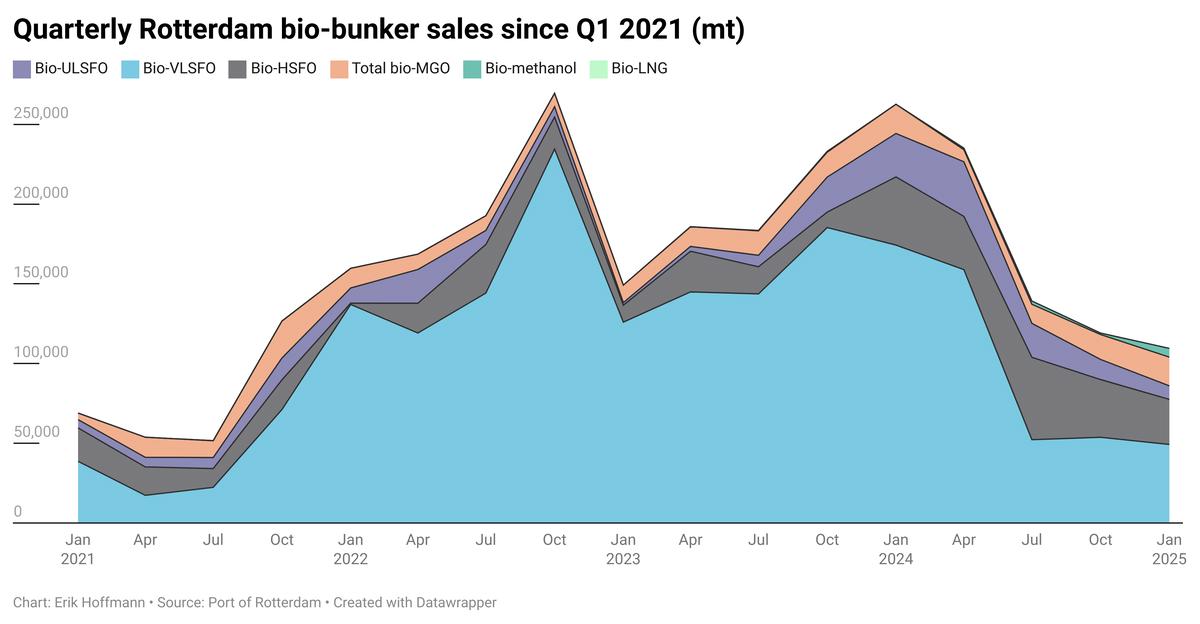

Changes in Rotterdam's bio-bunker sales between the fourth quarter 2024 and the first quarter 2025:

- Bio-VLSFO sales down by 4,000 mt to 49,000 mt

- Bio-HSFO sales down by 8,000 mt to 28,000 mt

- Total bio-MGO sales up by 2,000 mt to 18,000 mt

- Bio-ULSFO sales down by 4,000 mt to 8,000 mt

- Bio-methanol sales up by 4,000 mt to 5,000 mt

- Bio-LNG sales down from 500 mt to nil

The first quarter of 2025 saw a significant decrease in demand for biofuels sold in the Dutch Port of Rotterdam. The port's bio-bunker sales have more than halved from a peak of 262,000 mt in the first quarter of 2024 and coincided with massive growth in Singapore's sales.

Singapore suppliers sold more than three times more bio-bunkers in the first quarter with 361,000 mt.

Bio-bunker sales are made up of liquid biofuels blended into any of the conventional bunker grades (VLSFO, HSFO, MGO and ULSFO), as well as bio-methanol and bio-LNG. They can be pure bio products like B100 biofuel, or bio-fossil blends like B30-VLSFO.

Rotterdam supplied a total of 110,000 mt bio-bunkers in the first quarter, making up 5% of the total sales at the Dutch port. However, this marks the quarter with the lowest demand since the third quarter of 2021, when the port sold 52,000 mt of bio bunkers.

The share of bio-bunker sales of Rotterdam's total bunker sales has come down from 10-11% between the third quarter of 2023 to the second quarter of 2024, to 5-6% in the quarters since then.

The most notable decline in demand in the last quarter was for bio-LNG, which saw no sales. Bio-LNG has featured irregularly in the port's sales figures, with only a few test stems and no regular sales from quarter to quarter.

Sales of bio-ULSFO, bio-HSFO and bio-VLSFO saw 33%, 22% and 8% declines, respectively, while bio-MGO sales rose by 15%.

Competition from new and other growing bio-bunker locations like Lisbon, Istanbul and Gibraltar could be part of the explanation for the overall sales drop, in addition to Singapore's continuous rise.

Bio-methanol demand rose by nearly six times to a new all-time high of over 5,000 mt. More methanol-capable vessels have come into operation this year. Right now there are 55 in operation, up from 46 at the end of last year, according to DNV data.

By Samantha Shaji

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.