East of Suez Market Update 15 Apr 2025

Most prices in East of Suez ports have moved down, and availability of all grades is good in Zhoushan.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices unchanged in Fujairah, and down in Singapore ($12/mt) and Zhoushan ($10/mt)

- LSMGO prices down in Fujairah ($25/mt), Zhoushan ($16/mt) and Singapore ($7/mt)

- HSFO prices unchanged in Singapore, and down in Zhoushan ($7/mt) and Fujairah ($2/mt)

- B24-VLSFO at a $231/mt premium over VLSFO in Singapore

- B24-VLSFO at a $220/mt premium over VLSFO in Fujairah

Fujairah’s VLSFO price has remained steady over the past day, while prices in Singapore and Zhoushan have declined. As a result, Fujairah’s VLSFO discount to Singapore has narrowed to near parity level, and its discount to Zhoushan has reduced by almost half, now standing at $11/mt.

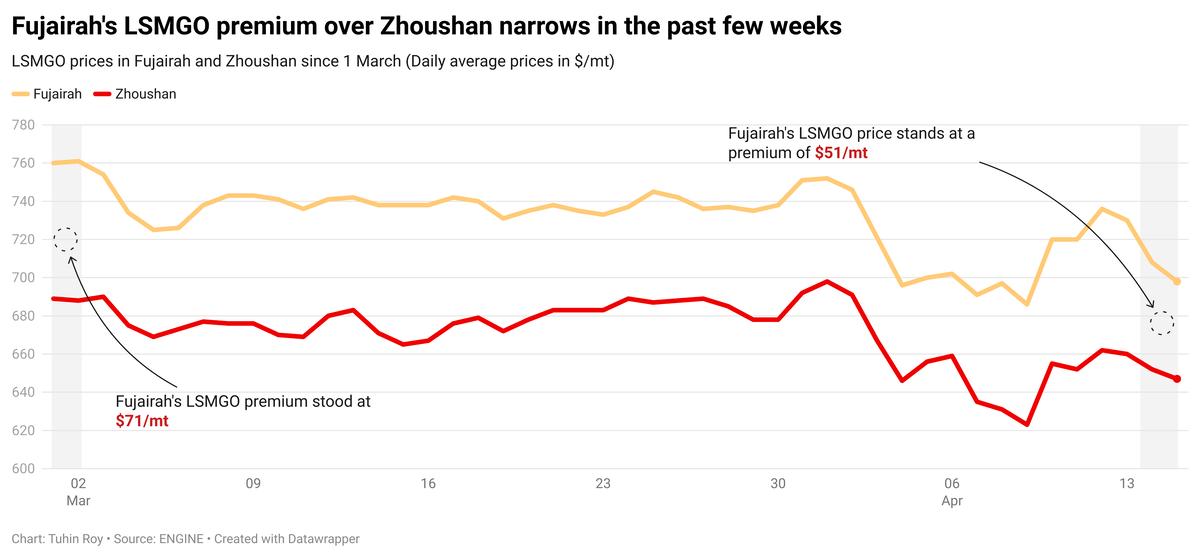

Meanwhile, Fujairah’s LSMGO price has dropped by $25/mt — the biggest decline among the three key Asian bunker ports. A lower-priced LSMGO stem fixed in the port has contributed to drag the benchmark lower. Despite the sharp drop, Fujairah's LSMGO still holds premiums of $107/mt over Singapore and $51/mt over Zhoushan.

Prompt availability in Fujairah remains tight, with lead times for all fuel grades at 5–7 days, unchanged from the previous week.

In contrast, availability has improved in Zhoushan, where most suppliers now recommend lead times of 4–6 days, down from 5–7 days previously.

Brent

The front-month ICE Brent contract has declined by $0.42/bbl on the day, to trade at $64.82/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

The US administration has decided to temporarily pause some country-specific tariff for most trade partners for 90 days. This news has provided some boost to Brent’s price.

Besides, US President Donald Trump on Friday granted exclusions from steep tariffs on smartphones, computers and other electronic devices imported largely from China, Reuters reports.

This development has eased some demand concerns, according to market analysts. “Crude oil found some support after Trump’s announcement of further exemptions to his reciprocal tariffs,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Downward pressure:

Brent’s price edged lower after the OPEC+ oil producers’ group released its monthly oil market report, which presented a subdued outlook for global oil demand.

Global oil consumption in 2025 is expected to average 105.05 million b/d, OPEC said. Previously, it expected consumption to average at around 105.2 million b/d this year.

“Uncertainty over how tense things could get is clouding the demand outlook,” two analysts from ING Bank noted.

Oil demand growth in 2026 is expected to decline further on account of the expected impact of US tariffs, OPEC said.

The report also stated that oil production in Saudi Arabia and Iran, two of the largest producers of the group, increased by 4,000 b/d to about 9 million b/d and 12,000 b/d to about 3.3 million b/d, respectively, in March.

Output in Kazakhstan surged by 37,000 b/d, the Vienna-headquartered group said.

“OPEC’s monthly oil market report also shed some light on its decision to accelerate its planned production hikes,” Hynes added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.