East of Suez Market Update 11 Apr 2025

LSMGO and HSFO prices in East of Suez ports have moved down, and VLSFO and LSMGO supply is good in several Taiwanese ports.

Changes on the day, to 15.00 SGT (07.00 GMT) today:

- VLSFO prices up in Singapore ($3/mt) and Fujairah ($2/mt), and down in Zhoushan ($7/mt)

- LSMGO prices down in Zhoushan ($9/mt), Fujairah ($8/mt) and Singapore ($6/mt)

- HSFO prices down in Singapore ($12/mt), Fujairah ($8/mt) and Zhoushan ($7/mt)

- B24-VLSFO at a $217/mt premium over VLSFO in Singapore

- B24-VLSFO at a $214/mt premium over VLSFO in Fujairah

Zhoushan’s VLSFO price has dropped by $7/mt over the past day, while prices in Singapore and Fujairah have remained unchanged. Despite the decline, Zhoushan’s VLSFO still carries a premium of $25/mt over Fujairah and $11/mt over Singapore.

Lead times for VLSFO and LSMGO in Zhoushan continue to be around 5–7 days. HSFO availability at the port has improved amid weak demand, with lead times now reduced to 5–7 days from last week’s 7–10 days.

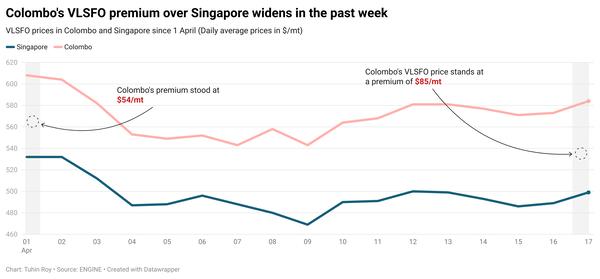

In Taiwan, Kaohsiung’s VLSFO stands at a premium of $8/mt over Hong Kong. Supply of VLSFO and LSMGO remains good across major Taiwanese ports, including Hualien, Taichung, Kaohsiung and Keelung, with typical lead times of about two days.

In Hong Kong, lead times for all fuel grades remain steady at around seven days, consistent with recent weeks. However, bunker operations could be disrupted over the weekend due to expected adverse weather conditions.

Brent

The front-month ICE Brent contract has inched $0.02/bbl up on the day, to trade at $63.43/bbl at 15.00 SGT (07.00 GMT).

Upward pressure:

Brent’s price felt some upward pressure after US President Donald Trump signed an executive, implementing a 90-day pause on country-specific tariffs for most trade partners.

This development has eased some demand-related fears, with global markets now focused on how trade talks between Washington and its allies will unfold.

“President Trump surprised markets with a 90-day pause in reciprocal tariffs for most trading partners,” two analysts from ING Bank said. “This provided a boost to risk assets, including commodities,” they added.

Downward pressure:

The simmering trade tensions between two leading oil consumers of the world – the US and China – have dragged Brent’s price lower this week.

The US-China tariff battle intensified this week, after Beijing announced 125% tariff on US goods, effective from Saturday, according to a Reuters report. China's latest tariff announcement follows Trump's decision to hike duties on Chinese products to 145%, the report said.

“A prolonged trade war would drag on consumer confidence, weaken appetite for risk and weigh on demand [for commodities like oil],” ING Bank’s analysts added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.