Europe & Africa Market Update 28 Mar 2025

Bunker benchmarks in European and African ports have mostly held steady, and prompt VLSFO supply is tight in Durban.

Changes on the day to 09.00 GMT today:

- VLSFO up in Durban ($5/mt) and Rotterdam ($2/mt), and down in Gibraltar ($1/mt)

- LSMGO prices up in Rotterdam ($3/mt) and Gibraltar ($2/mt)

- HSFO prices unchanged in Gibraltar, and down in Rotterdam ($1/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $3/mt to $228/mt

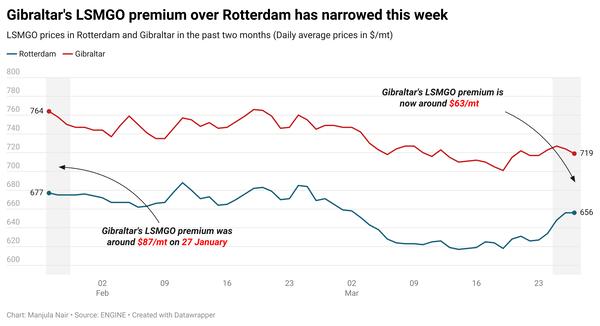

Rotterdam’s LSMGO price has gained moderately in the past day, but its discount to Gibraltar has held steady at around $64/mt. Prompt LSMGO supply is better in Rotterdam, with traders recommending lead times of 3-5 days, compared to Gibraltar’s 7-9 days.

Congestion has eased in Gibraltar in the past day, said port agent MH Bland. No vessels are waiting for bunkers in Gibraltar, down from seven yesterday, the port agent said. Calm weather is forecast in the Gibraltar Strait today, making it conducive for bunkering.

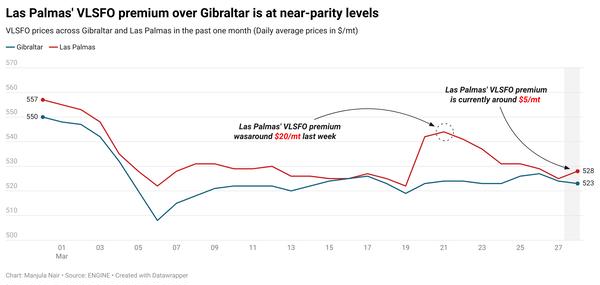

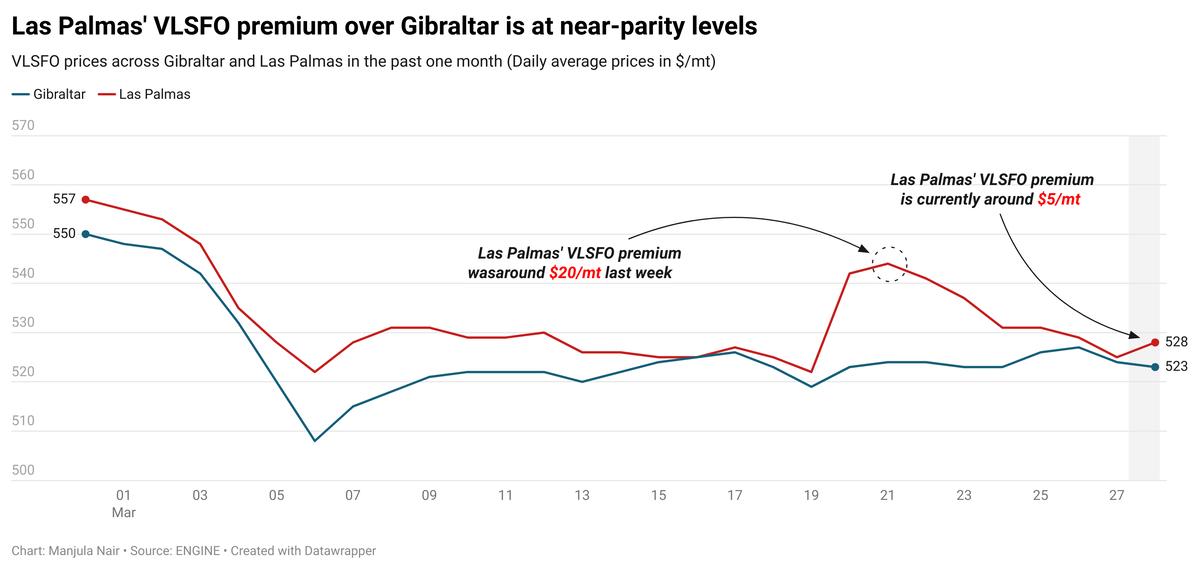

Las Palmas is also witnessing calm weather today, MH Bland said, allowing bunkering to proceed smoothly. The port's VLSFO price is at a $5/mt premium over Gibraltar, much narrower than last week when the premium was at $20/mt.

Meanwhile, in the Mediterranean ports of Istanbul and Piraeus, bunker availability is currently good, a trader said, with recommended lead times of 3-5 days in both ports.

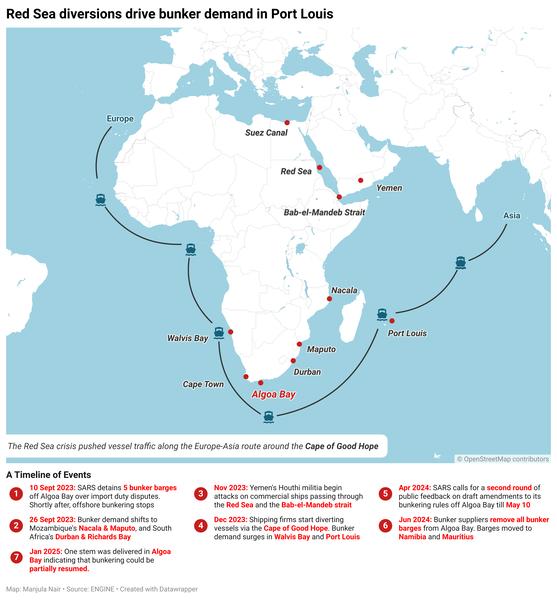

Prompt VLSFO is still tight in the South African ports of Durban and Richards Bay, with recommended lead times of 7-10 days, a trader said. LSMGO remains dry in Durban.

Brent

The front-month ICE Brent contract has moved $0.42/bbl higher on the day, to trade at $73.93/bbl at 09.00 GMT.

Upward pressure:

Concerns over a shortage in global oil supply have supported Brent’s price gains this week, with the growing number of US sanctions on leading oil producers, including Iran and Venezuela.

“[Brent] crude oil prices extended gains amid signs of near-term tightness in the physical market,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

The Donald Trump-led US administration’s sanctions on Iran’s oil export have significantly slashed Iranian oil flows in the physical oil market, according to analysts.

At least 11 US-sanctioned oil tankers carrying Iranian oil are idling off the coast of Malaysia, Bloomberg reports. The news has highlighted the disruptions to trade flows, according to Hynes.

Additionally, revoking oil company Chevron’s licence to operate and export crude oil from Venezuela has put about 200,000 b/d at risk, Hynes said. “Venezuela is already looking to find alternative buyers,” he added.

Downward pressure:

Brent’s price felt some downward pressure from US tariffs-related demand growth concerns.

Earlier this week, Trump announced import tariffs of 25% on cars and light trucks coming into the US. These are set to come into force from next week.

“The scope, scale, and sequencing of the tariff package remain highly speculative,” SPI Asset Management managing partner Stephen Innes said.

However, the latest bout of Trump tariffs has pushed market analysts and investors over the edge, fearing a global trade-war and a subsequent slowdown in demand for commodities like oil.

“Traders are now reassessing whether the tariff reprieve narrative was a one-day wonder or something with real staying power,” Innes added.

Weak crude oil demand could lead to lower prices, according to market analysts.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.