Europe & Africa Fuel Availability Outlook 26 Mar 2025

Prompt HSFO & VLSFO tight in the ARA

Lead times stretched in Gibraltar

Prompt supply good in Port Louis

PHOTO: Cape Town Harbour in South Africa. Getty Images

PHOTO: Cape Town Harbour in South Africa. Getty Images

Northwest Europe

HSFO continues to be very tight in the ARA hub, with recommended lead times of 8-10 days amid product loading delays, a trader said. VLSFO supply is relatively better, and lead times of 5-7 days are recommended. LSMGO availability is normal with prompt lead times of 3-5 days.

Ample VLSFO availability, coupled with tighter HSFO supplies, has shrunk Hi5 spreads globally. HSFO has been generally tight around the world amid constraints in fuel oil exports. “HSFO cracks have remained relatively robust, given the ongoing tightness in Russian fuel oil exports. The disconnectivity in supplies for both grades has led to a narrowing of Hi5 spreads,” Xavier Tang, a Vortexa analyst, told ENGINE.

Meanwhile, the ARA’s independently held fuel oil stocks are down by 11% so far this month compared to February, according to Insights Global data.

At 7.46 million barrels, the region’s fuel oil stocks are at their lowest so far this year. The region has imported 196,000 b/d of fuel oil so far this month, down from 298,000 b/d of fuel oil in February, according to data from cargo tracker Vortexa.

Mexico (18% of the total) has emerged as the region’s topmost import source. Other import sources include the UK (17%), Poland and Lithuania (11% each), Germany (10%) and France (9%).

The region’s independent gasoil inventories - which include diesel and heating oil – have averaged 11% lower so far this month. The ARA hub has imported 224,000 b/d of gasoil and diesel so far this month, marking a slight decline from 277,000 b/d imported in February, according to Vortexa data.

Germany’s Hamburg has normal availability across all three grades, a trader said. Lead times of 3-5 days are recommended.

Mediterranean

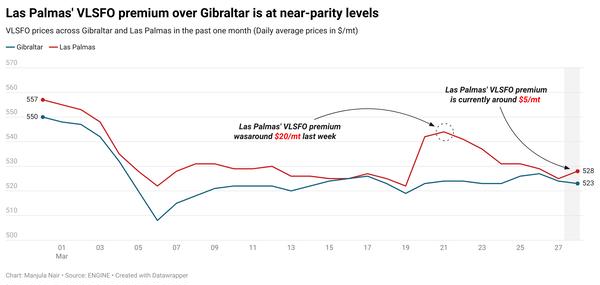

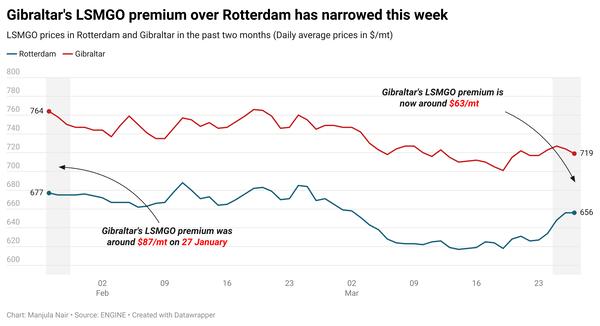

In Gibraltar, all three grades are tight for prompt delivery. Lead times have stretched since last week, with 7-9 days recommended for all three grades, a trader said. Bad weather from last week triggered a backlog of 30 vessels waiting for bunkers in Gibraltar on Sunday. Congestion has since eased and is down to seven vessels from 12 vessels yesterday, according to port agent MH Bland.

Supplies have tightened in Las Palmas, with lead times up from 5-7 days last week to 8-10 days now, a trader said. The port has been facing rough weather and strong swells in the port area, MH Bland said.

Meanwhile, in the other Mediterranean ports of Istanbul, Piraeus and Malta Offshore, bunker availability is currently good, a trader said.

Lead times of 3-5 days are advised for bunkers in Istanbul, a trader said, while similar lead times are also recommended in Greece’s Piraeus.

Malta Offshore has restarted bunkering operations on Wednesday after being suspended since Monday due to bad weather, MH Bland said. Adverse weather may complicate bunkering off Malta as rough weather is forecast till Saturday, a trader said.

Africa

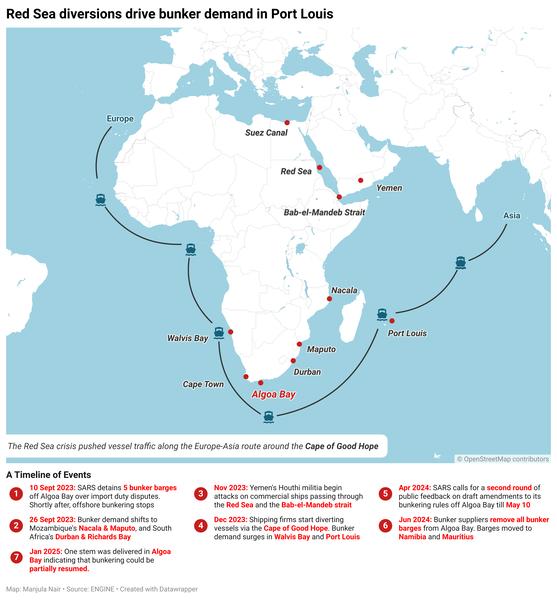

VLSFO is still tight in the South African ports of Durban and Richards Bay, with recommended lead times of 7-10 days, a trader said. LSMGO remains dry in Durban.

In Mauritius’ Port Louis, prompt availability is good, with suppliers able to offer all three grades within lead times of 5-7 days, a trader said.

Availability is fine off Luanda, a source told ENGINE. Lead times of around 3-5 days are advised for both grades.

Mozambique’s Nacala and Maputo ports also have good supplies of all grades, a source told ENGINE. HSFO, VLSFO and LSMGO availability is good in Nacala, while VLSFO and LSMGO supply is normal in Maputo.

By Manjula Nair

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.