Europe & Africa Market Update 27 Mar 2025

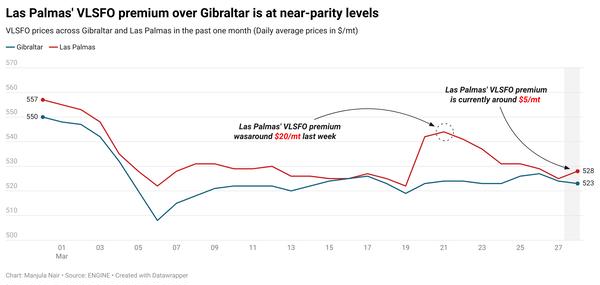

Bunker benchmarks have fallen in the past day, and bunker supply has tightened in Las Palmas.

Changes on the day to 09.00 GMT today:

- VLSFO down in Rotterdam, Durban ($6/mt) and Gibraltar ($4/mt)

- LSMGO prices down in Gibraltar ($10/mt) and Rotterdam ($3/mt)

- HSFO prices down in Rotterdam ($6/mt) and Gibraltar ($2/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $5/mt to $231/mt

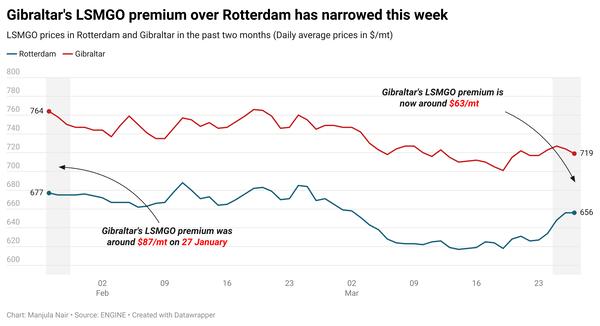

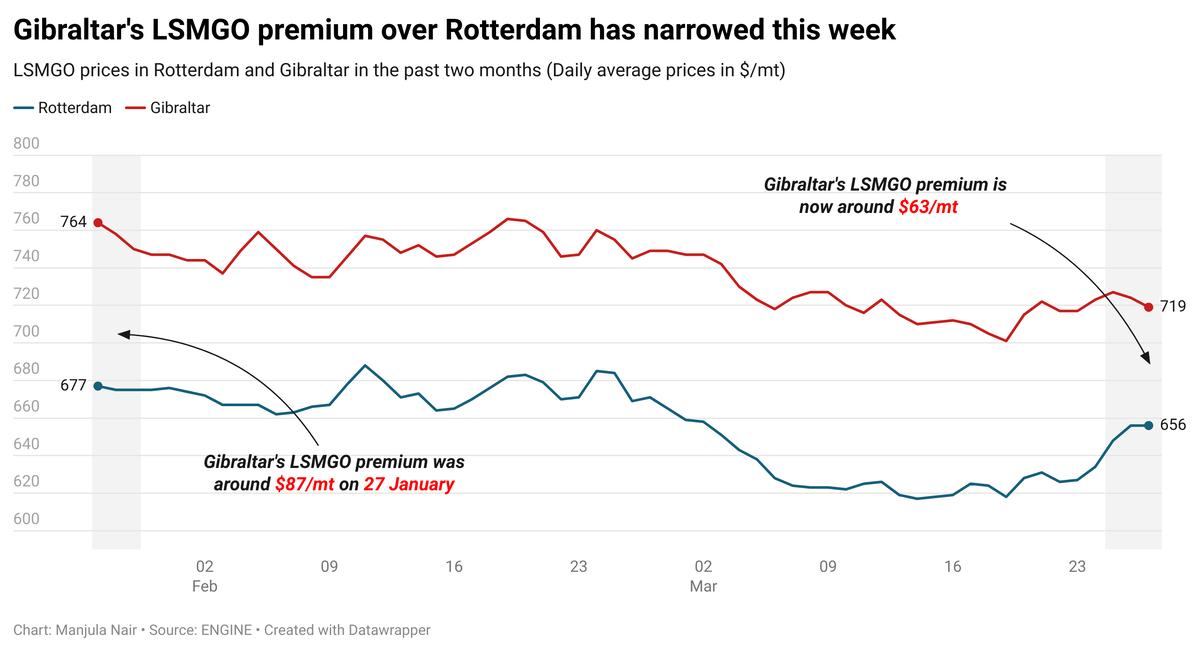

Gibraltar’s LSMGO price has continued to fall for a second consecutive day, erasing gains from Tuesday. Gibraltar’s LSMGO price drop has been steeper than Rotterdam’s in the past day, narrowing Gibraltar’s discount to Rotterdam by $7/mt to around $63/mt now.

Bunkering is proceeding normally in Gibraltar amid calmer weather. Seven vessels are currently waiting for bunkers in Gibraltar today, unchanged from yesterday, said port agent MH Bland. A supplier is experiencing around 24 hours of delay in the anchorage area. Supplier delays of up to 12 hours are also reported in Algeciras, MH Bland said.

Bunker supply has tightened in Las Palmas, with lead times up from 5-7 days last week to 8-10 days now, a trader said. The port has been facing moderately rough weather in the port area, which may complicate deliveries.

Off Malta, strong wind gusts of 24 knots are forecast today, which may disrupt bunkering, said MH Bland. All suppliers are reporting delays. Bunkering is currently taking place at the sheltered bunkering area four, MH Bland said.

Brent

The front-month ICE Brent contract has gained $0.13/bbl on the day, to trade at $73.51/bbl at 09.00 GMT.

Upward pressure:

Brent crude’s price moved higher after the US Energy Information Administration (EIA) reported a 3.3 million-bbl draw in commercial US crude oil inventories, to touch 434 million bbls for the week ending 21 March.

A decline in crude oil stocks typically signals strong oil demand, which can put upward pressure on Brent’s price. “Crude oil prices gained amid signs of strong demand,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Additionally, US President Donald Trump has threatened to impose 25% tariffs on imports from countries buying Venezuelan oil and gas.

China, India, Spain, Italy and Cuba are among the largest consumers of Venezuelan oil, Reuters reports.

Brent’s price gains were “fueled by a double shot of bullish catalysts: a larger-than-expected drawdown in U.S. crude and fuel inventories and mounting geopolitical tension as the U.S. threatens to impose tariffs on countries importing Venezuelan crude,” SPI Asset Management managing partner Stephen Innes remarked.

Downward pressure:

Uncertainty over tariffs imposed by the Trump-led US administration has kept global financial markets on edge, with analysts fearing a slowdown in demand growth.

Trump has announced import taxes of 25% on cars and light trucks coming into the US. These taxes are set to come into force from next week.

“[The market’s] attention may soon pivot back to demand worries amid the US’ chaotic blitzkrieg of import tariffs against major trade partners,” VANDA Insights’ founder and analyst Vandana Hari said.

Sluggish crude oil demand could lead to lower prices, according to market analysts.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.