East of Suez Market Update 28 Mar 2025

Most prices in East of Suez ports have been rangebound, and availability of all grades is good in Zhoushan.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($13/mt), Singapore and Fujairah ($4/mt)

- LSMGO prices up in Singapore and Fujairah ($6/mt), and Zhoushan ($3/mt)

- HSFO prices up in Singapore ($5/mt) and Fujairah ($4/mt), and down in Zhoushan ($1/mt)

- B24-VLSFO at a $187/mt premium over VLSFO in Singapore

- B24-VLSFO at a $190/mt premium over VLSFO in Fujairah

Zhoushan’s VLSFO price has increased by $13/mt in the past day, the steepest rise among the three major Asian bunker ports. This was driven by two higher-priced VLSFO stems fixed within a $10/mt range, pushing the benchmark higher. As a result, Zhoushan’s VLSFO discount to Singapore has flipped to a marginal premium of $4/mt, while its premium over Fujairah has widened to $15/mt.

VLSFO availability in Zhoushan has improved amid weak demand, reducing lead times from 3–5 days last week to about three days now. Lead times for LSMGO and HSFO have also shortened from 3–5 days to three days.

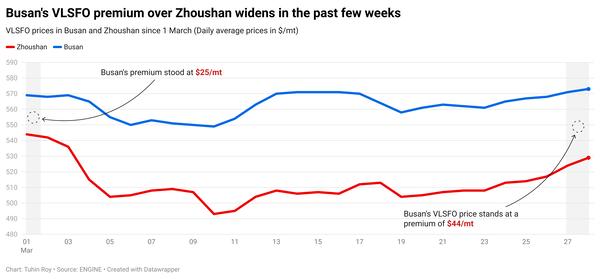

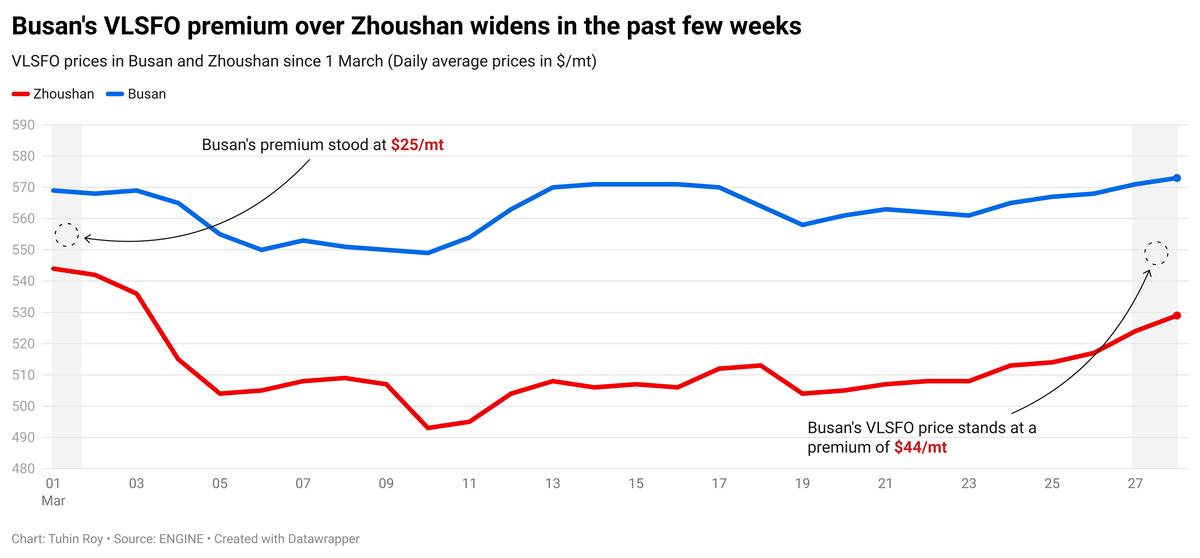

Meanwhile, South Korea’s Busan continues to price its VLSFO at elevated levels, maintaining a premium of $44/mt over Zhoushan. In several South Korean ports, recommended lead times for all fuel grades have increased to 3–8 days, up from around three days.

Bunker operations in Daesan, Taean, and Yeosu may face intermittent disruptions from 28–30 March due to adverse weather.

Brent

The front-month ICE Brent contract has moved $0.42/bbl higher on the day, to trade at $73.93/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Concerns over a shortage in global oil supply have supported Brent’s price gains this week, with the growing number of US sanctions on leading oil producers, including Iran and Venezuela.

“[Brent] crude oil prices extended gains amid signs of near-term tightness in the physical market,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

The Donald Trump-led US administration’s sanctions on Iran’s oil export have significantly slashed Iranian oil flows in the physical oil market, according to analysts.

At least 11 US-sanctioned oil tankers carrying Iranian oil are idling off the coast of Malaysia, Bloomberg reports. The news has highlighted the disruptions to trade flows, according to Hynes.

Additionally, revoking oil company Chevron’s licence to operate and export crude oil from Venezuela has put about 200,000 b/d at risk, Hynes said. “Venezuela is already looking to find alternative buyers,” he added.

Downward pressure:

Brent’s price felt some downward pressure from US tariffs-related demand growth concerns.

Earlier this week, Trump announced import tariffs of 25% on cars and light trucks coming into the US. These are set to come into force from next week.

“The scope, scale, and sequencing of the tariff package remain highly speculative,” SPI Asset Management managing partner Stephen Innes said.

However, the latest bout of Trump tariffs has pushed market analysts and investors over the edge, fearing a global trade-war and a subsequent slowdown in demand for commodities like oil.

“Traders are now reassessing whether the tariff reprieve narrative was a one-day wonder or something with real staying power,” Innes added.

Weak crude oil demand could lead to lower prices, according to market analysts.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.