Disconnectivity in HSFO and VLSFO supply drives Hi5 spreads narrower - Vortexa

An increase in low sulphur fuel oil exports and availability has placed downward pressure on VLSFO prices, Vortexa market analyst Xavier Tang told ENGINE.

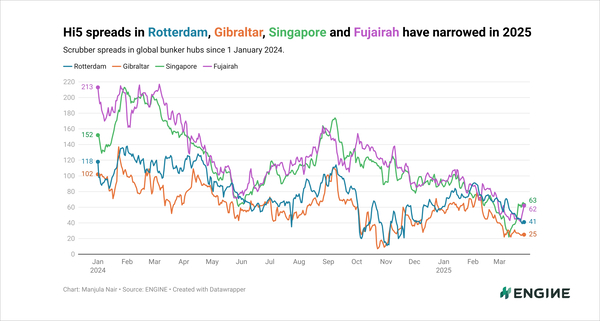

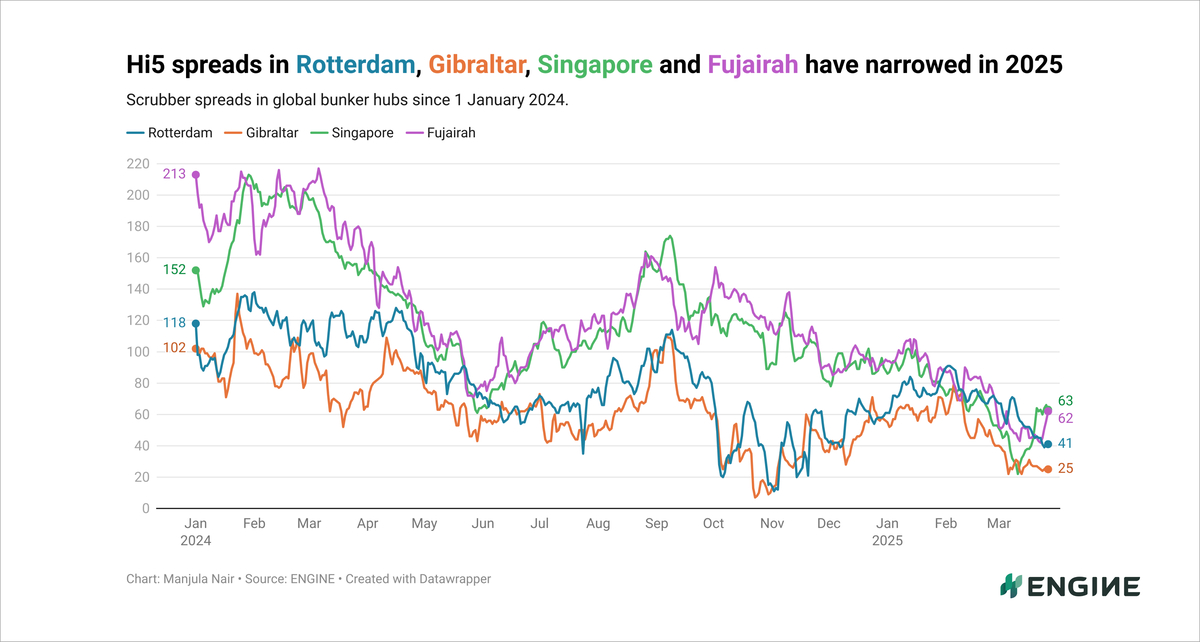

Changes in global Hi5 spreads since 1 January 2024:

- Singapore down from $152/mt to $63/mt

- Rotterdam down from $118/mt to $41/mt

- Fujairah down from $213/mt to $62/mt

- Gibraltar down from $102/mt to $25/mt

Tang attributes the rise in low sulphur fuel oil (LSFO) exports as a key factor in the growing availability of VLSFO in the market.

LSFO (less than 1% sulphur) is a wider fuel category than VLSFO (less than 0.50% sulphur). Its a residual output from refinery productiom, and can be an input to for further refining or desulpherisation to yield VLSFO, or be blended with other low-sulphur streams to become VLSFO.

Recent export increases from Nigeria’s Dangote refinery have contributed to this trend, Tang said. In Asia, two refineries have also ramped up LSFO exports.

“According to market sources, these refineries have likely shut their residual fluid catalytic cracking (RFCC) units, transforming LSFO into gasoline. Instead, they are exporting more LSFO instead of refining the supplies into gasoline.”

The resumption of Dar Blend crude exports from South Sudan has also supported higher LSFO export volumes, Tang noted. Dar Blend crude exports were suspended in January 2024 due to a pipeline rupture, before resuming this year.

Refining of Dar Blend - a heavy, low sulphur crude oil - yields substantial volumes of LSFO, which can be used to produce VLSFO. This has contributed to weaken VLSFO cracks, Tang argued.

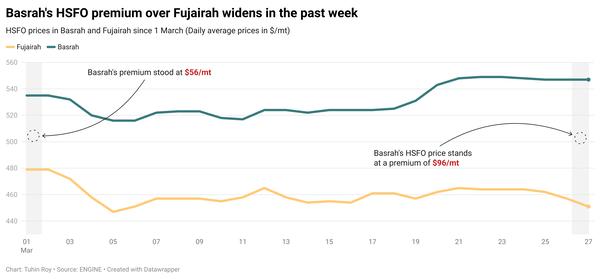

On the other hand, HSFO availability has tightened amid persistent constraints in Russian fuel oil exports.

“HSFO cracks have remained relatively robust, given the ongoing tightness in the Russian fuel oil exports. The disconnectivity in supplies for both grades has led to a narrowing of Hi5 spreads,” the Vortexa analyst said.

Hi5 spreads, or scrubber spreads, have narrowed to their lowest levels this year in key bunker hubs like the ARA, Gibraltar Strait, Singapore and Fujairah. The spreads have mostly followed a downward trajectory since February, according to ENGINE data.

Narrower Hi5 spreads indicate that HSFO has become more expensive for scrubber-equipped vessels. Scrubbers, or exhaust gas cleaning systems, allow ships to comply with the International Maritime Organization's 0.50% sulphur cap by capturing sulphur dioxide from exhaust gases.

If this trend with narrowing Hi5 spreads continues, it could discourage more shipowners from installing scrubbers onboard their vessels and instead opt for other fuels.

By Manjula Nair

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.