East of Suez Market Update 31 Mar 2025

Most prices in East of Suez ports have inched up, and availability of all grades has tightened in Zhoushan.

Changes on the day from Friday, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($6/mt), Zhoushan ($3/mt) and Singapore ($2/mt)

- LSMGO prices up in Fujairah ($9/mt), Singapore ($6/mt) and Zhoushan ($5/mt)

- HSFO prices up in Fujairah ($6/mt) and Singapore ($3/mt), and down in Zhoushan ($2/mt)

- B24-VLSFO at a $176/mt premium over VLSFO in Singapore

- B24-VLSFO at a $193/mt premium over VLSFO in Fujairah

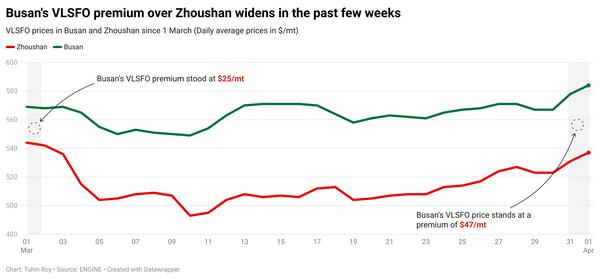

VLSFO prices in three major Asian bunker ports remained largely stable over the weekend, with no significant fluctuations. Zhoushan’s VLSFO price holds a premium of $12/mt over Fujairah and $5/mt over Singapore.

Lead times for VLSFO in Zhoushan have increased from around three days last week to 4-6 days due to some suppliers facing low stocks and delayed replenishments, according to a source. LSMGO lead times have also risen from around three days to 4-6 days. HSFO availability has tightened, with lead times surging from about three days last week to 7-10 days.

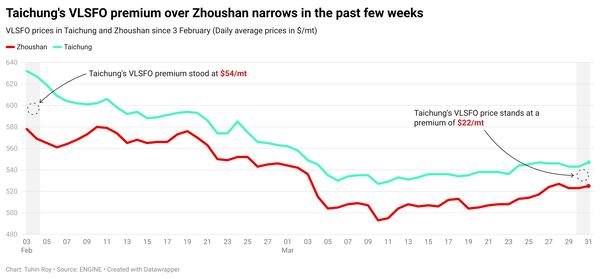

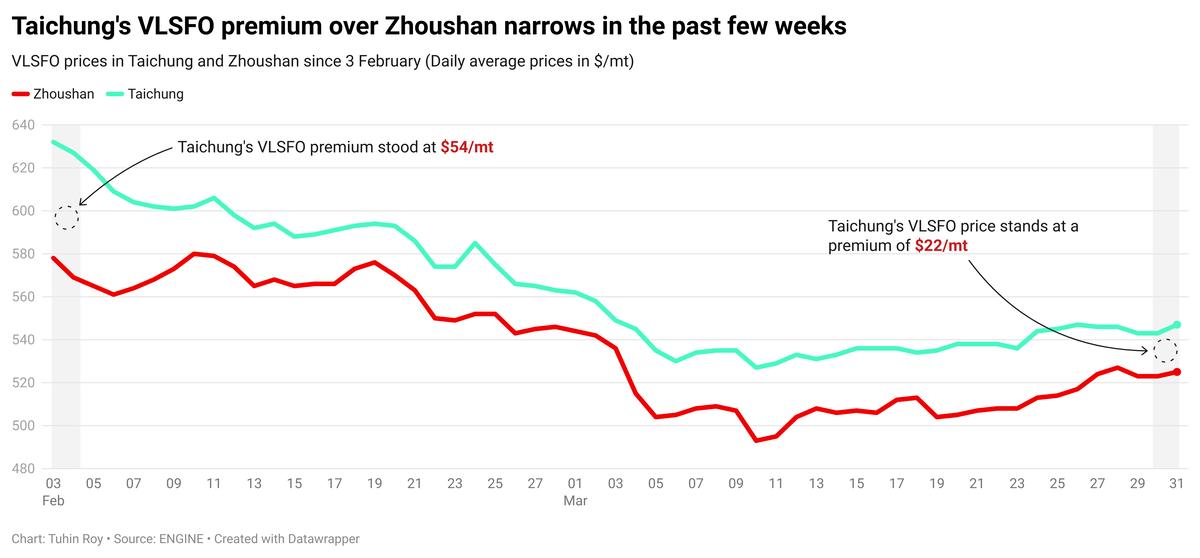

Meanwhile, Taiwan’s Taichung continues to price its VLSFO at an elevated level compared to Zhoushan, with a premium of $22/mt.

In Taiwan, VLSFO and LSMGO supplies remain steady in Hualien, Taichung, and Keelung, with lead times holding at approximately two days. In Kaohsiung, deliveries for both fuels require a lead time of four days.

Brent

The front-month ICE Brent contract has gained $0.20/bbl on the day from Friday, to trade at $74.13/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

The price of Brent crude has moved higher as growing supply disruption concerns have helped offset oversupply fears.

The US government’s latest sanctions on Iran’s oil exports have crimped Iranian oil flows in the physical oil market, according to analysts.

“US sanctions on Iran’s oil industry appear to be biting with at least 11 US sanctioned tankers containing Iranian oil reportedly sitting idled off the coast of Malaysia,” ANZ Bank senior commodity strategist Daniel Hynes said.

Some of the vessels, containing as much as 17 million bbls, “have been sitting there for over a month,” he added, noting that the news underscores the disruptions to trade flows.

Downward pressure:

Over the weekend, US President Donald Trump threatened to hit buyers of Russian crude oil with additional 25-50% tariffs, Reuters reports. This news has put some downward pressure on Brent’s price.

Trump’s administration has warned of potential tariffs on countries that continue purchasing Russian crude oil, if a ceasefire deal with Ukraine fails to materialise.

It is not the potential tariffs on Russian oil themselves that weigh on Brent, but their knock-on effect on oil trading and global economic growth.

The recent wave of Trump’s tariff threats has rattled market analysts and investors, sparking fears of a global trade war that could dampen demand for commodities like oil. Weak crude oil demand could lead to lower prices, according to market analysts.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.