Biofuel Bunker Snapshot: Bio feedstock prices surge across Singapore and the ARA

Rotterdam B30 HBE prices reach three-week highs

First biofuel stem in Zhoushan

New B100 supplier in Singapore

Rotterdam

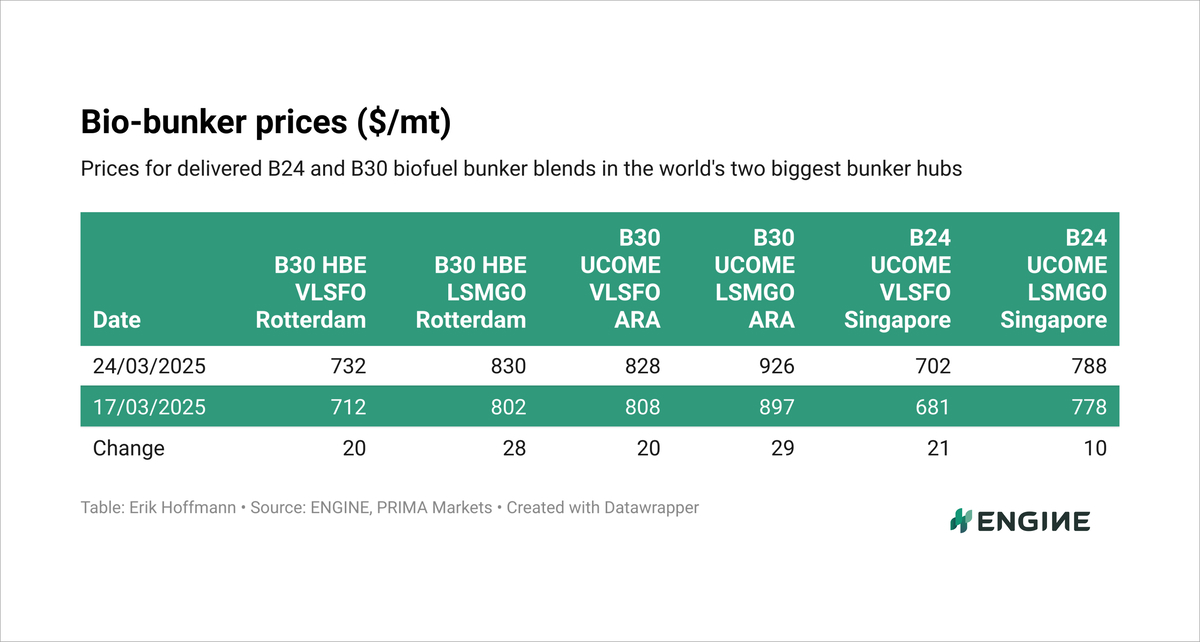

Rotterdam’s B30-VLSFO HBE at its highest level since 3 March, propelled up by a massive $56/mt rise in PRIMA Market’s POMEME ARA barge price, and a smaller $5/mt gain for ENGINE’s pure VLSFO price.

The HBE rebate for advanced B30 sold in the Netherlands was roughly steady on the week at $106/mt.

The port’s B30-LSMGO HBE price has fared even stronger over the past week, surging on the back of a $17/mt gain for pure LSMGO. It’s also at its highest level in three weeks.

The story is similar for B30 UCOME blends in the ARA, which have been propped up amid a $55/mt jump in PRIMA’s UCOME ARA barge price.

UCOME does not qualify for Dutch HBE rebates and is significantly more expensive than HBE-rebated biofuels based on feedstocks like palm oil mill effluent (POME) and cashew nut shell liquid (CNSL).

POME-based B30-VLSFO is currently at a $96/mt discount to UCO-based B30-VLSFO in the ARA.

Singapore

In Singapore, where UCO is the main feedstock, B24-VLSFO UCOME has jumped to a four-week high. Support has come from a $35/mt gain in PRIMA’s UCOME China cargo price and from a $13/mt rise in ENGINE’s VLSFO price.

Freight for UCOME on a mid-range tanker from China to Singapore has come off by $1.25/mt to $17.25/mt, which makes little material difference to its affordability.

B24-VLSFO has risen by $8/mt against VLSFO in Singapore in the past week and is now $182/mt more expensive.

The first biofuel stem was delivered to an internationally-sailing vessel in Zhoushan in the past week. A COSCO container ship picked up 1,600 mt of B24-HSFO supplied by Sinochem.

Bunker suppliers in Singapore sold 3,800 mt/day of bio-blended bunker fuels in February, up from 3,600 mt/day in January. B100 featured in the port’s sales figures for the first time, with 3,800 mt/year sold.

B100 was until recently only available in Singapore from a few suppliers, including Vitol and TotalEnergies. Fratelli Cosulich started supplying the grade last month, after it invested in a chemical tanker which is necessary for carrying bunker fuels with such high biofuel shares.

TFG Marine has announced that it will become the latest entrant to Singapore’s B100 market. Next month it will put a chemical tanker into operation.

These recent entries to the B100 market are poised to usher in more price competition for a grade that is currently priced around $500/mt higher than B24-VLSFO.

By Erik Hoffmann

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.