Europe & Africa Market Update 25 Mar 2025

Bunker benchmarks have increased in key European and African hubs, and bunkering operations have been suspended off Malta.

Changes on the day to 09.00 GMT today:

- VLSFO up in Durban ($8/mt), Gibraltar ($5/mt) and Rotterdam ($2/mt)

- LSMGO prices up in Rotterdam ($20/mt) and Gibraltar ($14/mt)

- HSFO prices up in Rotterdam ($8/mt) and Gibraltar ($7/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $5/mt to $232/mt

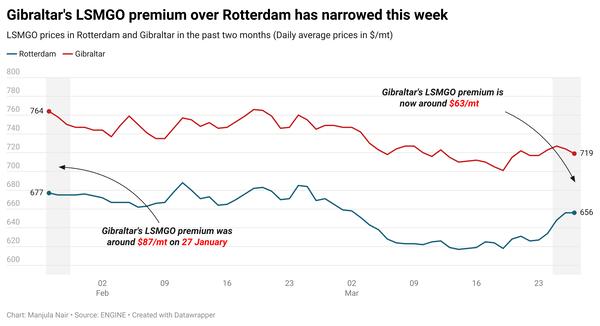

Rotterdam’s LSMGO price gain has outpaced Gibraltar’s in the past day. This has narrowed Rotterdam’s LSMGO discount to Gibraltar by $6/mt to $84/mt now.

Backlog due to bad weather has reduced in Gibraltar with congestion down to 12 vessels today from 22 on Monday, said port agent MH Bland. A supplier is reporting delays of up to 36 hours in the port. The Ceuta port authority has reported heightened bunker demand recently due to bunkering disruptions in the Gibraltar Strait ports.

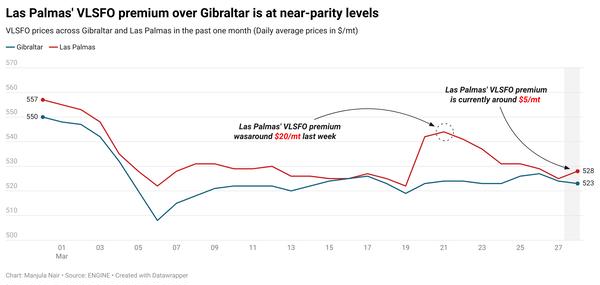

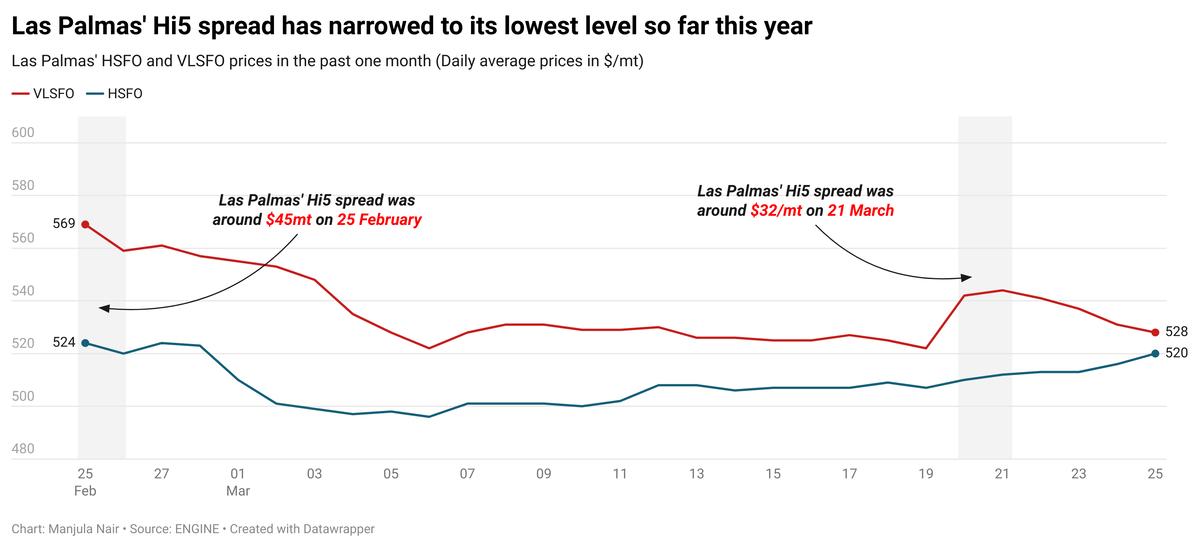

Meanwhile, strong wind gusts and heavy swells can hamper bunkering in the Canary Islands’ port of Las Palmas today, MH Bland said. Las Palmas’ Hi5 spread is currently at its lowest level so far this year at $8/mt. Last week, the port’s Hi5 spread had briefly widened to $32/mt. Las Palmas’ VLSFO prices are currently trading at near-parity levels with Gibraltar. The port’s HSFO premium over Gibraltar is around $18/mt today.

Off Malta, bunkering operations have been suspended amid rough weather, said port agent MH Bland, adding that all suppliers are currently facing delays.

Brent

The front-month ICE Brent contract has gained $1.31/bbl on the day, to trade at $73.30/bbl at 09.00 GMT.

Upward pressure:

Brent’s price gained over $1/bbl after US President Donald Trump threatened to impose 25% tariffs on imports from countries buying Venezuelan oil and gas.

The news comes amid growing tensions between Washington and the Nicolas Maduro-led Venezuelan government, with the former accusing the Latin American country of fueling illegal immigration and criminal gang activities in the US.

“Oil got an additional boost after the US announced secondary tariffs on buyers of Venezuelan oil,” two analysts from ING Bank noted.

China, India, Spain, Italy and Cuba are among the largest consumers of Venezuelan oil, Reuters reports.

“The levies would impact major economies from China and India and Western Europe,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked. “It may also complicate business for US Gulf Coast refiners, that rely heavily on Venezuela’s heavy crude to feed production lines,” he added.

Downward pressure:

Brent’s price gains were partially capped after the US treasury department extended oil company Chevron’s deadline to cease operations in Venezuela until 27 May.

Despite the existing sanctions, Chevron has held a license allowing it to operate in the country and export crude oil to the US since 2022.

“The withdrawal of Chevron’s licence to operate could reduce production in the country by about 200kb/d [200,000 b/d],” Hynes added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.