Europe & Africa Market Update 24 Mar 2025

Bunker benchmarks have shown mixed market directions, and congestion persists in Gibraltar.

Changes on the day, from Friday to 09.00 GMT today:

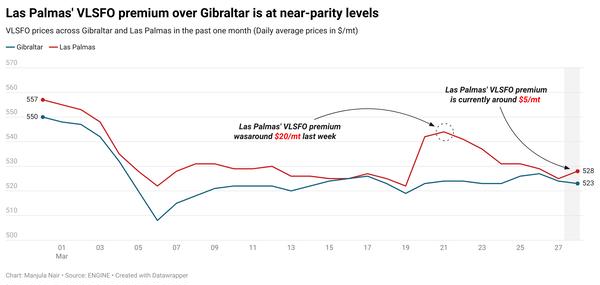

- VLSFO up in Durban ($2/mt) and Rotterdam ($1/mt), and down in Gibraltar ($1/mt)

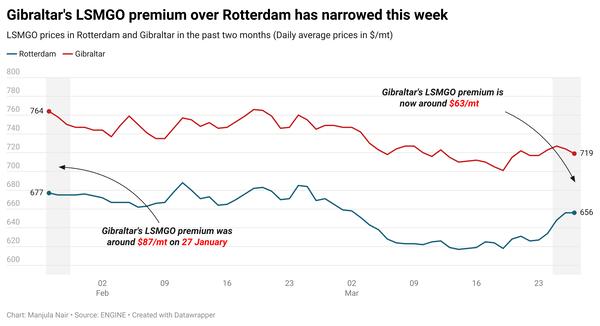

- LSMGO prices down in Rotterdam ($8/mt) and Gibraltar ($7/mt)

- HSFO prices up in Rotterdam ($3/mt), and unchanged in Gibraltar

- Rotterdam B30-VLSFO premium over VLSFO down by $7/mt to $227/mt

Rotterdam’s LSMGO price has fallen sharply over the weekend due to downward pressure from a lower-priced prompt delivery stem booked on Friday. LSMGO availability is good in the ARA hub, a trader told ENGINE, with the grade available within lead times of 3-5 days.

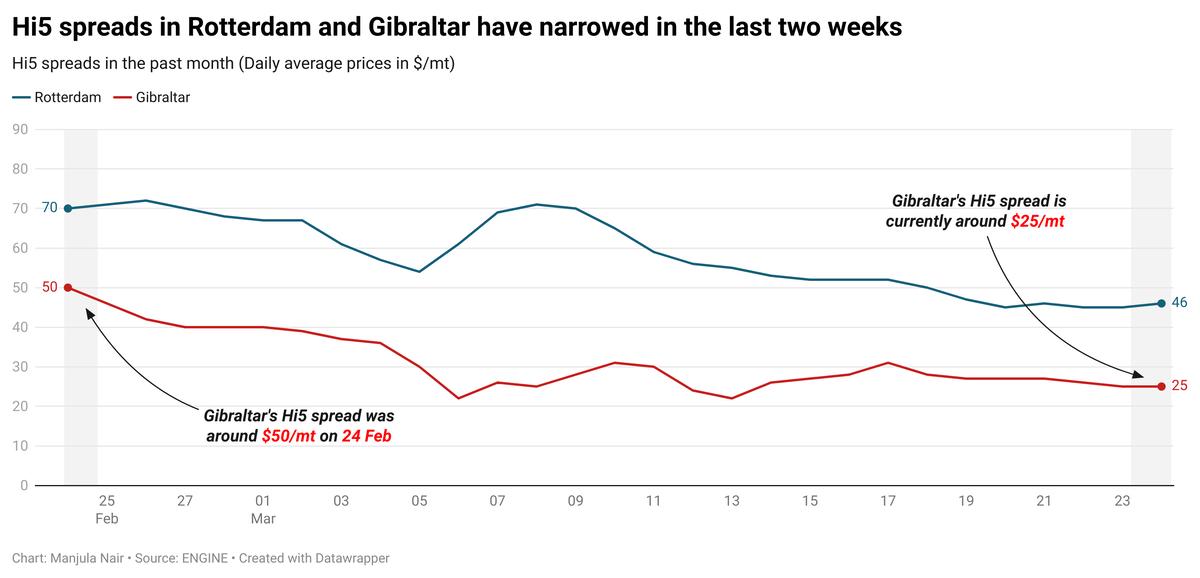

Gibraltar’s Hi5 spread has recovered slightly and is currently around $26/mt, much narrower than Rotterdam’s Hi5 spread which is around $46/mt today. Gibraltar’s Hi5 spread has been at its lowest level in the last two weeks.

Meanwhile, the backlog of vessels due to bad weather in Gibraltar has once again caused severe congestion in the port. A total of 22 vessels have been waiting for bunkers today, down from 30 vessels on Sunday, said port agent MH Bland. A supplier is reporting delays of up to 36 hours at the anchorage area, MH Bland said. Inbound traffic was suspended in Gibraltar on Friday amid bad weather and was restarted over the weekend.

In Algeciras, operations are currently allowed at the inner anchorage but delays of around 48 hours are reported for vessels to enter, MH Bland said. Bunkering operations have been suspended at the Delta anchorage and outer port limits, the port agent added. In nearby Ceuta, bunkering operations are on, but operations have been suspended for Ceuta port’s sole bunker barge, SPABunker Cuarenta, said shipping agent Jose Salama & Co.

Brent

The front-month ICE Brent contract has inched $0.09/bbl lower on the day from Friday, to trade at $71.99/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has remained steady over the weekend.

Last week, the US Department of Treasury sanctioned a Chinese oil refinery and its chief executive officer for allegedly buying sanctioned Iranian oil, and several other vessels linked to Tehran’s shadow fleet of ships. This news has supported Brent’s price, according to market analysts.

“The move is having an impact on the physical market, with spot and near-term futures gaining for oil from the Middle East,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Additionally, OPEC+ members that have repeatedly breached output quotas announced plans for further cutbacks to compensate for overproduction. This move could offset the planned production hikes set to begin in April.

“However, questions remain about whether members will actually stick to the compensation plan and cut output,” two analysts from ING Bank noted.

Downward pressure:

Oil demand growth concerns have put downward pressure on Brent’s price in recent days, following a 1.7 million-bbl rise in commercial US crude oil inventories last week.

A build in inventories typically signals weaker oil demand, which can cap Brent’s price gains.

Moreover, officials from the US and Russia have commenced talks in Saudi Arabia today, Reuters reports. The talks aim to advance towards a broader ceasefire deal in Ukraine, the report adds.

US President Donald Trump is also pushing for a separate Black Sea maritime ceasefire deal as a precursor to a wider agreement. The talks follow Washington’s negotiations with Kyiv yesterday, as it continues to ramp up efforts to end the three-year conflict in eastern Europe.

A ceasefire deal between Russia and Ukraine could see the US lifting its sanctions on Russian oil exports, which in turn could increase global oil supply, according to market analysts.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.