Europe & Africa Fuel Availability Outlook 19 Mar 2025

HSFO supply tightens in the ARA

Severe backlog in Gibraltar

LSMGO still dry in Durban

PHOTO: The Antwerp Euroterminal. Port of Antwerp

PHOTO: The Antwerp Euroterminal. Port of Antwerp

Northwest Europe

Prompt HSFO availability is tight in Rotterdam and the wider ARA hub. Lead times for HSFO have stretched to 8-10 days from 5-7 days last week due to barge loading delays, a trader said. VLSFO is comparatively better, but remains tight for very prompt delivery dates, with recommended lead times of 5-7 days. LSMGO supply is ample, with lead times of 3-5 days as advised.

The ARA’s independently held fuel oil stocks have declined by 9% so far this month compared to February, according to Insights Global data.

The region has imported 157,000 b/d of fuel oil so far this month, down from 298,000 b/d of fuel oil in February, according to data from cargo tracker Vortexa.

The United Kingdom (28% of the total) has become the region’s biggest fuel oil import source, followed by Mexico (20%), Germany (16%), Poland (15%), the Bahamas (14%) and Nigeria (7%).

The region’s independent gasoil inventories - which include diesel and heating oil – have averaged 9% lower so far this month. The ARA hub has imported 220,000 b/d of gasoil and diesel so far this month, registering a decline from 277,000 b/d imported in February, according to Vortexa data.

Prompt bunker supply in Germany’s Hamburg is well stocked, a trader told ENGINE. Lead times of 3-5 days for all three grades.

Mediterranean

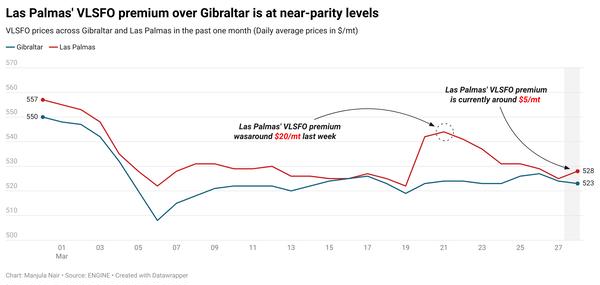

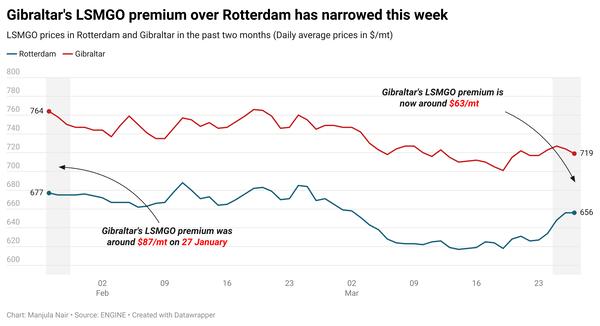

Lead times remain consistent with last week in Gibraltar, a trader said, recommending 5-7 days for optimal coverage from suppliers. Severe congestion was reported in Gibraltar port on Tuesday due to a backlog of 24 vessels triggered by rough weather conditions in the port area, according to port agent MH Bland. Congestion has persisted on Wednesday, but the backlog has reduced slightly to 16 vessels today, MH Bland said.

In the Canary Islands’ port of Las Palmas, prompt supply is still tight, a trader said. Lead times have remained unchanged over the last few weeks with suppliers able to offer within 5-7 days.

Meanwhile, in the other Mediterranean bunker hubs like Istanbul, Piraeus and Malta Offshore, supply is ample, a trader said.

In Turkey’s Istanbul, bunkers are well stocked and recommended lead times are 3-5 days. Weather is forecast to remain calm for the rest of the week, conducive to smooth bunkering in the port area.

The Greek port of Piraeus has good availability of VLSFO and LSMGO with lead times of 3-5 days. HSFO is subject to enquiry in the port.

Off Malta, supply is good, with lead times of 3-5 days advised. Rough weather may hamper bunkering off Malta this week, a source said. Strong easterly wind gusts around 19 knots are forecast off Malta today, said MH Bland. Rough weather is also forecast on Saturday with south-easterly wind gusts of around 27 knots.

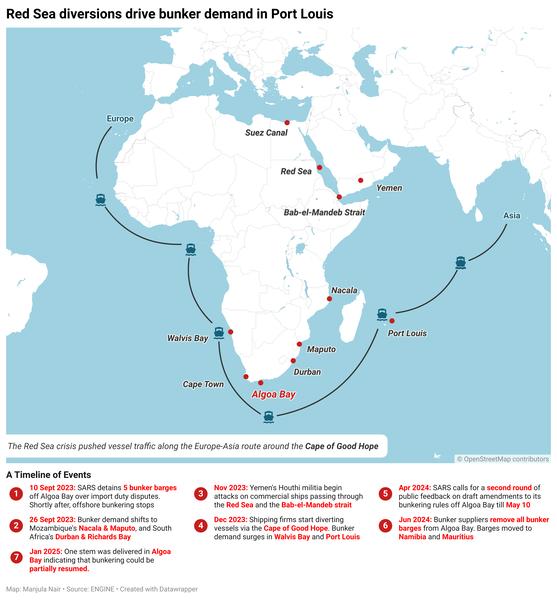

Africa

Prompt VLSFO supply is tight in the South African ports of Durban and Richards Bay, a trader told ENGINE. Lead times of 7-10 days are advised for the grade in both ports. LSMGO is still dry in Durban, the trader added.

VLSFO and LSMGO supply is good in Angola’s Luanda, a source said. Lead times of up to five days are advised for optimal coverage.

By Manjula Nair

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.