East of Suez Market Update 7 Mar 2025

Prices for B24-VLSFO are up in major Asian ports, but could they be about to be replaced by B30-VLSFO grades?

PHOTO: Fratelli Cosulich's IMO Type 2 chemical tanker Marta Cosulich has now been deployed in Singapore to offer biofuel blends up to B100. Fratelli Cosulich

PHOTO: Fratelli Cosulich's IMO Type 2 chemical tanker Marta Cosulich has now been deployed in Singapore to offer biofuel blends up to B100. Fratelli Cosulich

Changes on the day to 17.00 SGT (09.00 GMT) today:

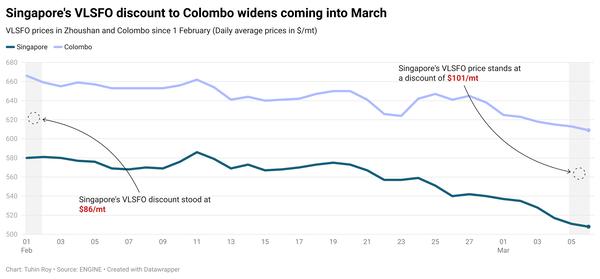

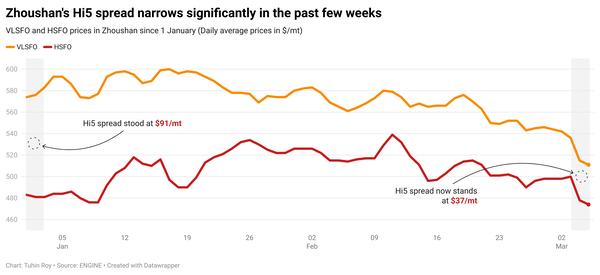

- VLSFO prices up in Fujairah and Zhoushan ($6/mt) and Singapore ($4/mt)

- LSMGO prices up in Fujairah ($16/mt), Zhoushan ($10/mt) and Singapore ($8/mt)

- HSFO prices up in Fujairah ($16/mt), Singapore ($14/mt) and Zhoushan ($2/mt)

- B24-VLSFO premium over VLSFO steady at $147/mt in Singapore

- B24-VLSFO premium over VLSFO up by $7/mt to $222/mt in Fujairah

B24-VLSFO has become even more expensive against pure VLSFO in Fujairah, now coming in at a $222/mt premium. That is considerably more than Singapore’s $147/mt.

Availability of various biofuel grades has grown in Singapore recently with the addition of Fratelli Cosulich’s chemical tanker Marta Cosulich. This allows Fratelli to supply stems containing more than the hitherto 25% biofuel limit and blends all the way up to pure biofuel (B100). Marta Cosulich is poised to give Vitol and the few others with access to chemical tankers a run for their money.

This week, though, we saw a regulatory development that is set to shake up the Singapore biofuel market. From today, the Maritime and Port Authority of Singapore (MPA) will follow IMO guidance to allow all Singapore-registered tankers – not just chemical tankers – to carry and deliver B30 to receiving ships.

The key question is whether suppliers will start offering B30 blends as standard in Singapore, having optimised their supply chains for B24 since the onset of bio-bunkering in the port. Additionally, could we soon see other ports follow suit?

Brent

The front-month ICE Brent contract has gained $0.95/bbl on the day, to trade at $70.23/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

The US government on Thursday exempted goods covered by its six-year-old trade policy with Canada and Mexico, from the 25% imposed tariffs for a one-month period, Reuters reports.

The US, Canada and Mexico are partners in a North American trade agreement known as USMCA. This news has eased some market concerns amid US threats of a wide-ranging trade war, thereby supporting oil prices today.

Brent has found support “as the market weighed up the impact of Trump’s move to delay tariffs on imports from Mexico,” ANZ Bank senior commodity strategist Daniel Hynes said.

Downward pressure:

Brent gains have been capped by a rise in US crude stocks. Commercial US crude oil inventories increased by 3.6 million bbls to touch 433.8 million bbls for the week ending 28 February, according to data from the US Energy Information Administration (EIA).

The build reported by the EIA was “slightly higher-than-expected,” VANDA Insights founder and analyst Vandana Hari said.

An increase in US crude stocks is seen as a negative indicator of oil demand growth and can put downward pressure on oil prices.

By Erik Hoffmann and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.