East of Suez Market Update 5 Mar 2025

Prices in East of Suez ports have moved in mixed directions, and bunkering operations at inner anchorages of Zhoushan have resumed following a five-day suspension due to adverse weather.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($7/mt), Singapore ($5/mt) and Fujairah ($4/mt)

- LSMGO prices up in Zhoushan ($5/mt) and Singapore ($4/mt), and down in Fujairah ($6/mt)

- HSFO prices up in Zhoushan ($1/mt), and down in Fujairah ($17/mt) and Singapore ($12/mt)

- B24-VLSFO at a $147/mt premium over VLSFO in Singapore

Zhoushan’s VLSFO price has declined by $7/mt in the past day, marking the steepest drop among the three major Asian bunker ports. The price now stands at near-parity with both Fujairah and Singapore and has fallen by $63/mt since the start of the year.

This decline has been driven by an injection of short-term supply from domestic refiners after the Chinese government issued a new batch of export quotas for the new year. The government has allocated 8 million mt of VLSFO export quotas for bonded bunkering in 2025, according to market intelligence provider JLC. Additionally, sluggish bunker demand for the grade has further pressured prices.

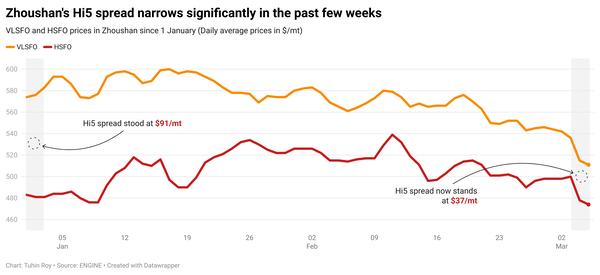

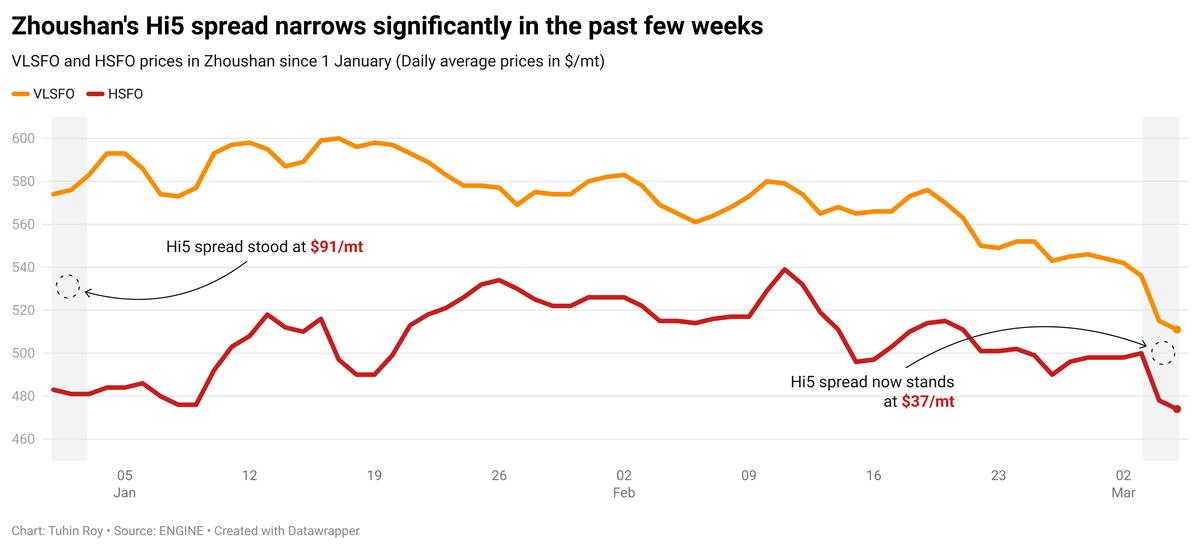

Meanwhile, HSFO prices have remained broadly steady. This stability is partially due to tightening supply caused by fresh Western sanctions on Russian oil flows, which have reduced Chinese imports of the grade, a source said. As a result, Zhoushan’s Hi5 spread has narrowed by $54/mt to $37/mt since the start of the year. This is significantly lower than the Hi5 spreads in Fujairah ($62/mt) and Singapore ($48/mt).

VLSFO availability in Zhoushan has tightened, with lead times extending from 4–6 days last week to around eight days now. In contrast, LSMGO and HSFO availability has improved, with lead times shortening from 4–6 days and 5–8 days, respectively, to about two days.

Bunker deliveries have resumed today at Zhoushan’s more sheltered Xiushandong anchorage and inner Mazhi anchorage after being suspended since Friday due to adverse weather. However, bunker operations at the outer Tiaozhoumen and Xiazhimen anchorages remain suspended. Operations are expected to fully resume on Friday, when calmer weather conditions are anticipated, a source said.

Brent

The front-month ICE Brent contract has gained $0.12/bbl on the day, to trade at $70.75/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price inched up after the American Petroleum Institute (API) reported a decline of 1.5 million bbls in US crude oil inventories for the week ending 28 February.

A drop in crude stocks is considered a positive indication for oil demand growth in the world’s largest oil consuming nation, according to market analysts. “It [API crude stock report] was a fairly neutral release,” two analysts from ING Bank said.

Besides, the US government has set a deadline of 3 April for oil company Chevron to cease operations in Venezuela. Despite the existing sanctions, Chevron had previously held a license allowing it to operate in the country and export crude oil to the US.

This news has spurred supply-related concerns in the market, analysts said.

“As production [in Venezuela] stops, 200k b/d [200,000 b/d] of supply is at risk,” ING Bank’s analysts said. “This will leave US refiners looking for alternative heavy grades of crude oil just as other suppliers — Canada and Mexico — face tariffs,” they further added.

Downward pressure:

Brent’s price gains were capped by the looming threat of a US trade war with Canada, Mexico and China, which has rattled financial markets and weighed on demand growth sentiment.

“[The oil market’s] sentiment wasn’t helped after US President Donald Trump announced that the tariffs on Canada and Mexico would start today [4 March] as planned, raising the prospect of a broader trade war,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Oil prices felt more downward pressure after eight members of the OPEC+ oil producers’ group participating in the 2.2 million b/d combined production cut reaffirmed their plans to proceed with a gradual unwinding starting 1 April.

“The prospect of rising OPEC+ supply, combined with intensifying uncertainty over tariffs, hit oil market sentiment,” ING Bank’s analysts added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.