Europe & Africa Market Update 7 Mar 2025

Bunker benchmarks in European and African ports have mostly increased with Brent, and Rotterdam’s Hi5 spread has widened.

Changes on the day to 09.00 GMT today:

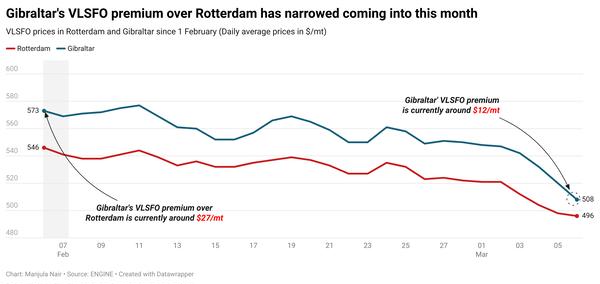

- VLSFO prices up in Durban ($9/mt), Gibraltar ($8/mt) and Rotterdam ($2/mt)

- LSMGO prices up in Gibraltar ($9/mt), and down in Rotterdam ($7/mt)

- HSFO prices up in Gibraltar ($3/mt), and down in Rotterdam ($8/mt)

- Rotterdam B30-VLSFO premium over VLSFO unchanged at $223/mt

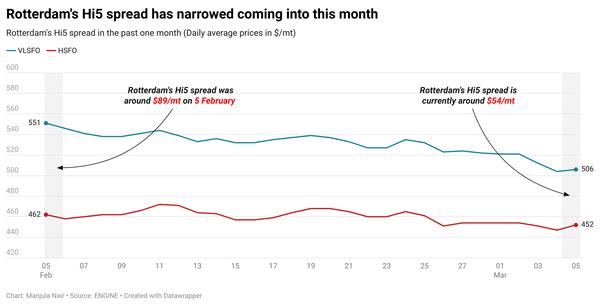

Rotterdam’s HSFO price has fallen in the past day due to downward pressure from a lower-priced stem, while the port’s VLSFO price has mostly held steady. These price movements have widened Rotterdam’s Hi5 spread from $59/mt to $69/mt now. HSFO and VLSFO supply remains a bit tight for very prompt delivery in Rotterdam and in the wider ARA hub, with recommended lead times of 5-7 days.

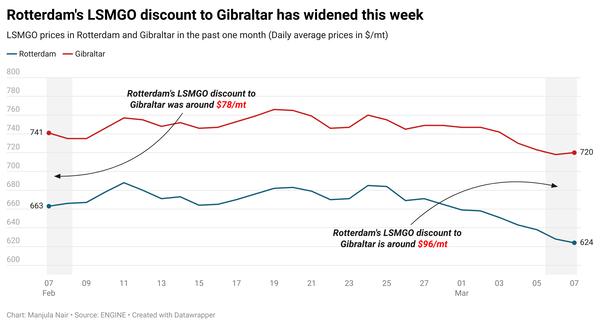

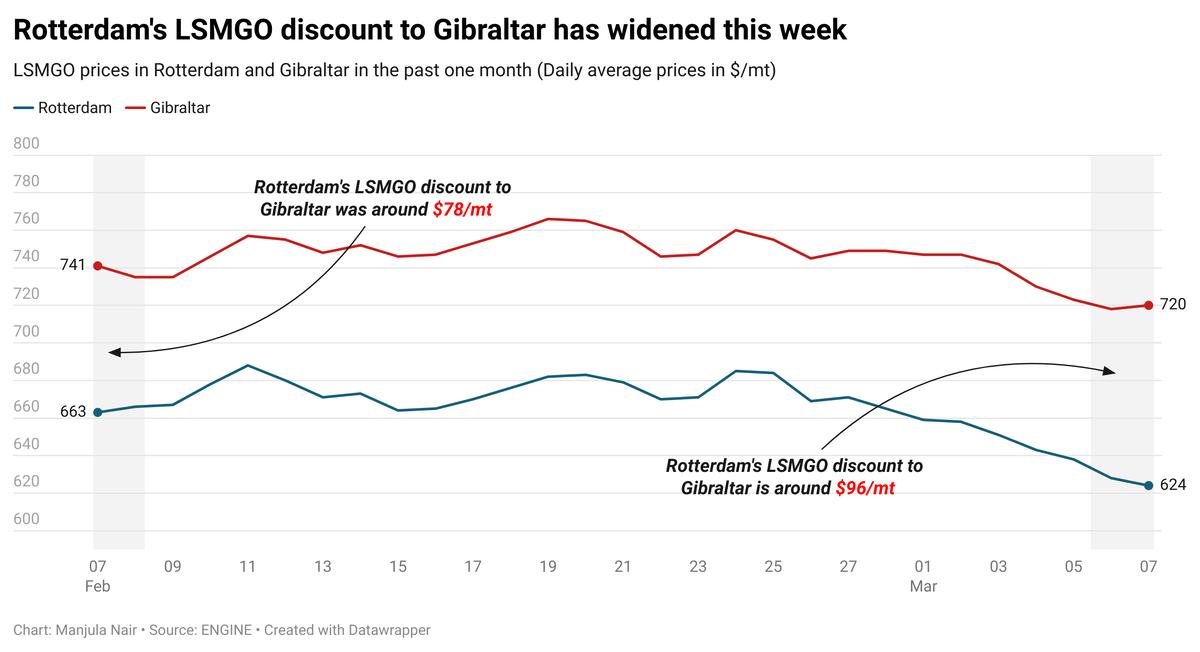

Rotterdam’s LSMGO price has countered Brent’s upward pull and has dipped in the past day. Gibraltar’s LSMGO price has gained. These price movements have widened Rotterdam’s LSMGO discount to Gibraltar by $16/mt to $97/mt now. LSMGO availability continues to be normal in Rotterdam and Gibraltar, with lead times of 3-5 days recommended.

Inbound vessel movement has resumed in Gibraltar amid calmer weather conditions today, according to port agent MH Bland. However, one supplier is still running 12-16 hours behind schedule. Vessel traffic movement was suspended in Gibraltar earlier this week due to bad weather. Bunkering disruptions may occur over the weekend with strong wind gusts of up to 32 knots forecast on Saturday.

In Ceuta, bunkering operations are running normally. 13 vessels are due to arrive for bunkers in Ceuta today, according to shipping agent Jose Salama & Co.

Brent

The front-month ICE Brent contract has gained $0.95/bbl on the day, to trade at $70.23/bbl at 09.00 GMT.

Upward pressure:

The US government on Thursday exempted goods covered by its six-year-old trade policy with Canada and Mexico, from the 25% imposed tariffs for a one-month period, Reuters reports.

The US, Canada and Mexico are partners in a North American trade agreement known as USMCA. This news has eased some market concerns amid the looming threat of a trade war, thereby supporting oil prices today.

Brent crude’s price found support “as the market weighed up the impact of Trump’s move to delay tariffs on imports from Mexico,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

Brent’s price gains were modestly capped by a rise in US crude stocks.

Commercial US crude oil inventories increased by 3.6 million bbls to touch 433.8 million bbls for the week ending 28 February, according to data from the US Energy Information Administration (EIA).

The build reported by the EIA was “slightly higher-than-expected,” VANDA Insights’ founder and analyst Vandana Hari said.

An increase in US crude stocks is seen as a negative indicator of oil demand growth and can put downward pressure on oil prices.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.