Europe & Africa Market Update 5 Mar 2025

Most bunker benchmarks in European and African ports have declined, and bunker operations have been suspended in Gibraltar and Ceuta amid rough weather.

Changes on the day to 09.00 GMT today:

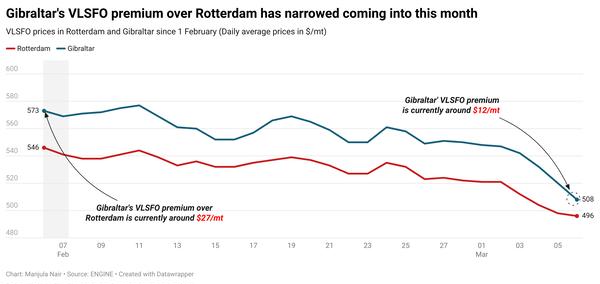

- VLSFO prices up in Durban ($1/mt), and down in Gibraltar ($3/mt) and Rotterdam ($2/mt)

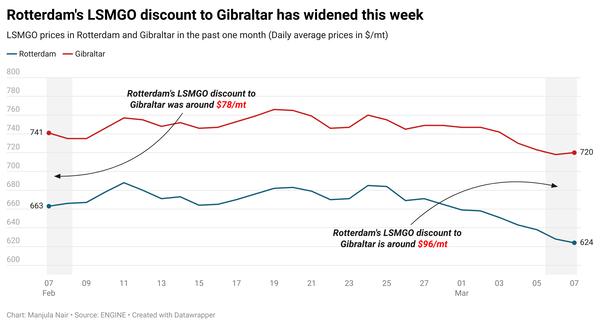

- LSMGO prices up in Rotterdam ($1/mt), and down in Gibraltar ($1/mt)

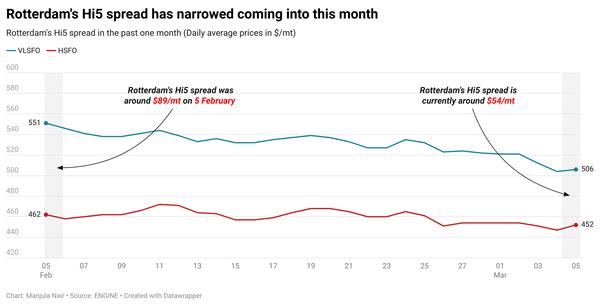

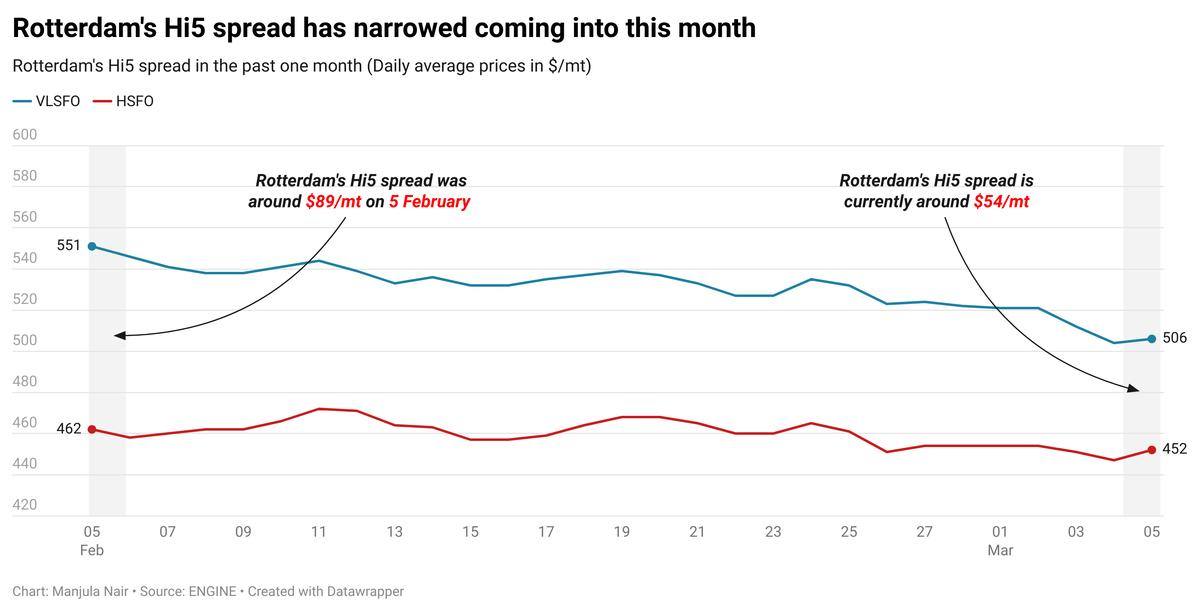

- HSFO prices up in Rotterdam ($10/mt), and down in Gibraltar ($2/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $23/mt to $232/mt

Rotterdam’s HSFO price has gained by a steep $10/mt in the past day, while its VLSFO price has mostly held steady. These diverging price moves have narrowed Rotterdam’s Hi5 spread from $66/mt to $54/mt now. Rotterdam’s HSFO discount to Gibraltar has also narrowed by $12/mt to $44/mt now.

Gibraltar's bunker operations have been suspended today amid rough weather, according to port agent MH Bland. Strong wind gusts of around 25 knots are forecast in Gibraltar today. Nine vessels are currently waiting for bunkers in the port, MH Bland said.

In nearby Ceuta, bunker operations have been suspended since yesterday evening due to rough weather, MH Bland said. Bunker operations both, in port and at anchorage, were suspended, shipping agent Jose Salama & Co. told ENGINE.

In South Africa’s Durban and Richards Bay, prompt VLSFO supply is tight, a trader said. Lead times of 7-10 days are advised. LSMGO availability is still dry in Durban, a trader said. Meanwhile, VLSFO and LSMGO supply in Angola’s Luanda are well stocked, a source told ENGINE. Lead times of 5-7 days are advised for both grades.

Brent

The front-month ICE Brent contract has gained $0.12/bbl on the day, to trade at $70.75/bbl at 09.00 GMT.

Upward pressure:

Brent’s price inched up after the American Petroleum Institute (API) reported a decline of 1.5 million bbls in US crude oil inventories for the week ending 28 February.

A drop in crude stocks is considered a positive indication for oil demand growth in the world’s largest oil consuming nation, according to market analysts. “It [API crude stock report] was a fairly neutral release,” two analysts from ING Bank said.

Besides, the US government has set a deadline of 3 April for oil company Chevron to cease operations in Venezuela. Despite the existing sanctions, Chevron had previously held a license allowing it to operate in the country and export crude oil to the US.

This news has spurred supply-related concerns in the market, analysts said.

“As production [in Venezuela] stops, 200k b/d [200,000 b/d] of supply is at risk,” ING Bank’s analysts said. “This will leave US refiners looking for alternative heavy grades of crude oil just as other suppliers — Canada and Mexico — face tariffs,” they further added.

Downward pressure:

Brent’s price gains were capped by the looming threat of a US trade war with Canada, Mexico and China, which has rattled financial markets and weighed on demand growth sentiment.

“[The oil market’s] sentiment wasn’t helped after US President Donald Trump announced that the tariffs on Canada and Mexico would start today [4 March] as planned, raising the prospect of a broader trade war,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Oil prices felt more downward pressure after eight members of the OPEC+ oil producers’ group participating in the 2.2 million b/d combined production cut reaffirmed their plans to proceed with a gradual unwinding starting 1 April.

“The prospect of rising OPEC+ supply, combined with intensifying uncertainty over tariffs, hit oil market sentiment,” ING Bank’s analysts added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.