Europe & Africa Market Update 6 Mar 2025

Bunker benchmarks in European and African ports have declined with Brent, and bunkering disruptions continue in Gibraltar Strait ports amid bad weather.

Changes on the day to 09.00 GMT today:

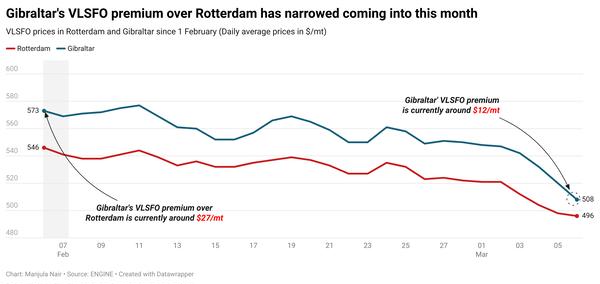

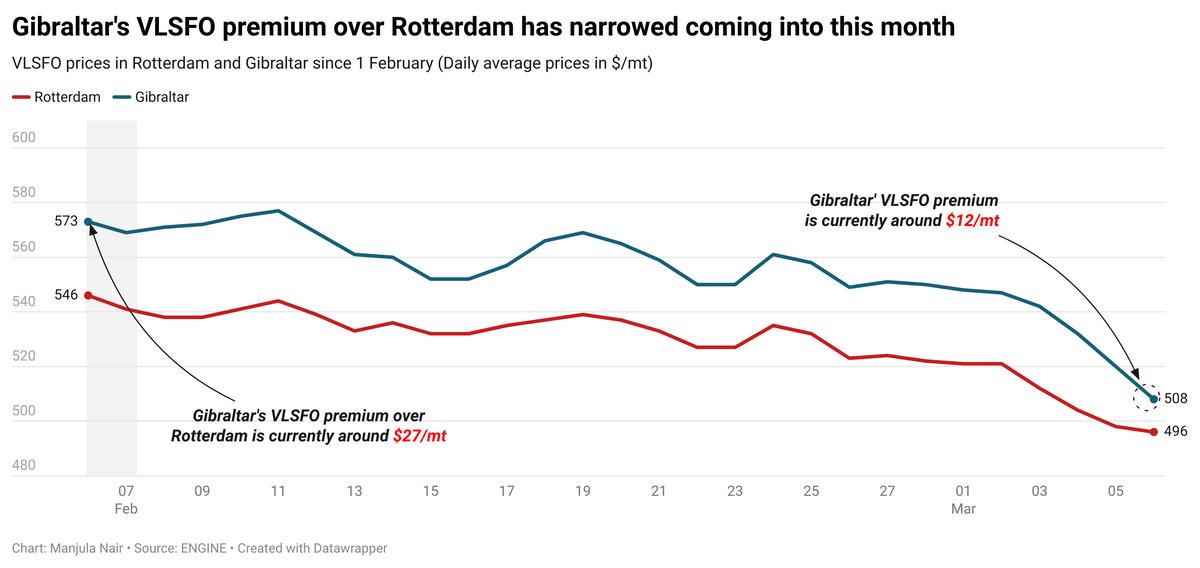

- VLSFO down in Gibraltar ($23/mt), Durban ($13/mt) and Rotterdam ($6/mt)

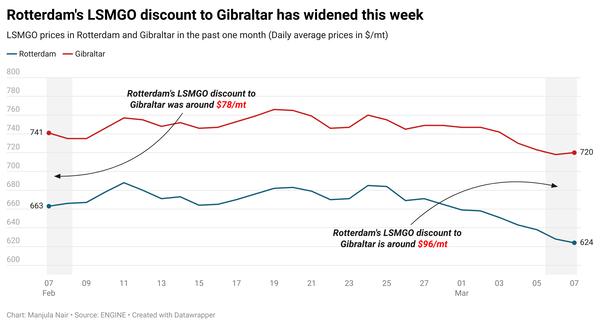

- LSMGO prices down in Gibraltar ($13/mt) and Rotterdam ($10/mt)

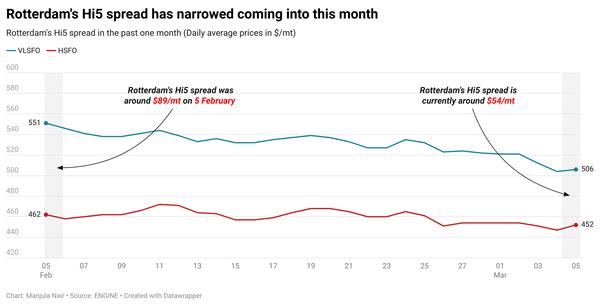

- HSFO prices down in Rotterdam ($11/mt) and Gibraltar ($9/mt)

- Rotterdam B30-VLSFO premium over VLSFO down by $9/mt to $223/mt

Gibraltar’s VLSFO price has fallen by a steep $23/mt in the past day, registering a higher decline than its HSFO price drop. These price moves have narrowed Gibraltar’s Hi5 spread from $36/mt yesterday to $22/mt now. Gibraltar’s VLSFO premium over Rotterdam has also narrowed by $17/mt in the past day and is now around $12/mt.

Barge delays have stretched lead times for all grades in Gibraltar Strait, a trader said. The earliest delivery date suppliers can offer is 12 March. Strong easterly winds are triggering bunker disruptions in the Gibraltar Strait.

Inbound vessel traffic remains suspended in Gibraltar due to rough weather, according to port agent MH Bland. Inbound vessel movement was halted on Wednesday amid adverse weather conditions. Slight congestion is reported in Gibraltar, with seven vessels waiting for bunkers, down from nine yesterday, MH Bland said.

Bunkering in Algeciras’ Delta anchorage and OPL areas have remained suspended since Monday due to bad weather, MH Bland said. Bunkering is currently taking place at the inner anchorage. The bunker barge Spabunker Cuarenta is still suspended due to bad weather, said shipping agent Jose Salama & Co. 16 vessels are due to arrive for bunkers in Ceuta today, with two vessels waiting for bunkers in the anchorage. A supplier is experiencing 4-6 hours of delay.

Brent

The front-month ICE Brent contract has declined by $1.47/bbl on the day, to trade at $69.28/bbl at 09.00 GMT.

Upward pressure:

Brent has found modest support from improving sentiments in the broader financial markets, after the US government granted a one-month exemption to automakers in Canada and Mexico from 25% import tariffs, the Associated Press (AP) reported.

The news comes as a relief after the US struck the first blow in trade wars with Canada, Mexico and China, which has rattled financial markets and weighed on demand growth sentiment.

“...sentiment in the financial markets began to recover as the US exempted Canadian and Mexican automakers from import tariffs and indicated it was weighing exclusions for some other sectors,” VANDA Insights’ founder and analyst Vandana Hari remarked.

Downward pressure:

Brent has dropped below the $70/bbl threshold for the first time since September 2024, driven by concerns over slowing oil demand in an oversupplied global market and impending tariffs.

Eight members of the Saudi Arabia-led OPEC+ oil producers’ group have reaffirmed plans to proceed with a gradual unwinding of cuts from 1 April. They have 2.2 million b/d in combined production cuts.

This development is expected to add about 138,000 b/d of crude oil to the market, which could dampen demand and exert downward pressure on Brent, according to market analysts.

“Sentiment remains weak following OPEC’s decision to go ahead with its planned production hikes in April,” ANZ Bank senior commodity strategist Daniel Hynes said.

Brent came under further downward pressure after the US Energy Information Administration (EIA) reported a 3.6 million-bbl rise in commercial US crude inventories. The EIA data was “fairly bearish,” two analysts from ING Bank said.

“Rising OPEC supply and prospects for further increases, combined with ever-present tariff uncertainty, pushed the market lower,” ING Bank analysts added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.