Europe & Africa Fuel Availability Outlook 26 Feb 2025

Prompt VLSFO still tight in the ARA

Bunker supply good in Lisbon and Sines

LSMGO remains dry in Durban

PHOTO: Aerial view of a container ship in Istanbul. Getty Images

PHOTO: Aerial view of a container ship in Istanbul. Getty Images

Northwest Europe

HSFO and VLSFO supply is still tight for very prompt delivery dates in the ARA hub. Lead times of 5-7 days are advised for both grades. LSMGO availability is better in comparison with suppliers able to offer lead times of 3-5 days.

The ARA’s independently held fuel oil stocks have decreased by 7% so far this month compared to January, according to Insights Global data.

The region has imported 257,000 b/d of fuel oil so far this month, a dip from 298,000 b/d imported in January, according to data from cargo tracker Vortexa.

Saudi Arabia (25% of the total) has emerged as the region’s biggest fuel oil cargo source, followed by the UK (18%), Sweden (15%), Poland (14%) and Lithuania (8%).

The ARA hub’s independent gasoil inventories - which include diesel and heating oil – have averaged 3% higher so far this month.

Mediterranean

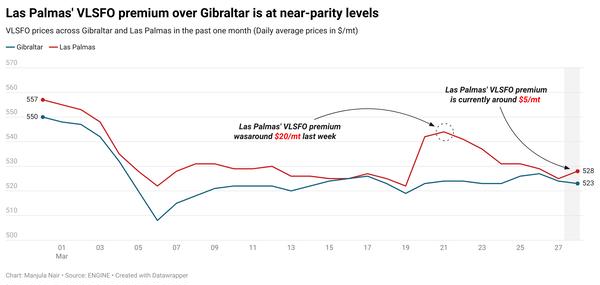

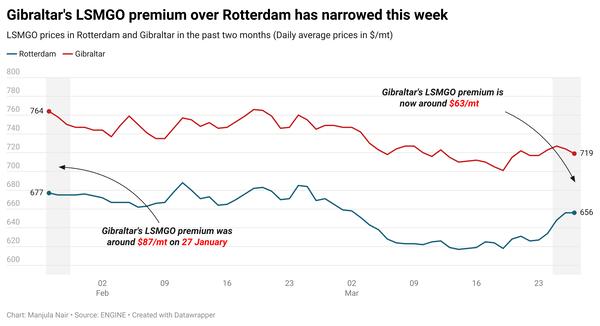

HSFO is still very tight in Gibraltar, a trader said, recommending lead times of 8-10 days for full coverage. VLSFO and LSMGO availability is normal with suppliers able to offer prompt delivery dates. Lead times of 3-5 days are recommended for both. Bunkering is proceeding smoothly in Gibraltar amid conducive weather conditions.

The Canary Islands’ port of Las Palmas has good availability across all three grades. Lead times of 3-5 days are advised.

Bunker supply is well stocked in the Spanish port of Barcelona. Suppliers can offer prompt delivery dates, with a trader advising lead times of 3-5 days.

Meanwhile, availability is normal in the Portuguese ports of Lisbon and Sines, a source told ENGINE.

Suppliers in Mediterranean bunker locations like Piraeus, Istanbul and off Malta have reported muted demand, a trader said.

The Greek port of Piraeus has good supply of VLSFO and LSMGO. Both require lead times of 3-5 days, while HSFO is subject to enquiry. Off Malta, bunker availability is normal with lead times of 3-5 days on offer, a trader said.

Securing prompt delivery dates is not a challenge in Turkey’s Istanbul. Suppliers in the port are well stocked and recommended lead times are 3-5 days.

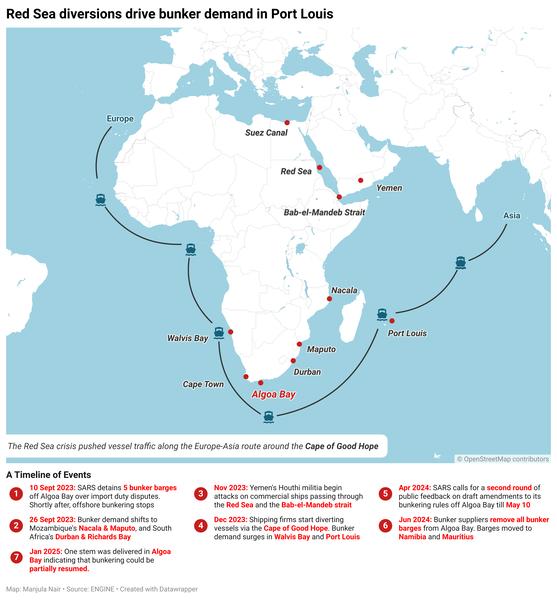

Africa

Prompt VLSFO supply is very tight in the South African ports of Durban and Richards Bay, a trader said. Recommended lead times are 7-10 days.

LSMGO continues to be dry in Durban, a trader said. Suppliers ran out of LSMGO in the last week of January.

By Manjula Nair

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.