East of Suez Market Update 8 Jan 2025

VLSFO prices in East of Suez ports have moved up, and availability of HSFO has improved in Singapore.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($13/mt), Zhoushan ($12/mt) and Fujairah ($2/mt)

- LSMGO prices up in Zhoushan ($16/mt) and Singapore ($15/mt), and unchanged in Fujairah

- HSFO prices up in Singapore ($12/mt) and Fujairah ($9/mt), and unchanged in Zhoushan

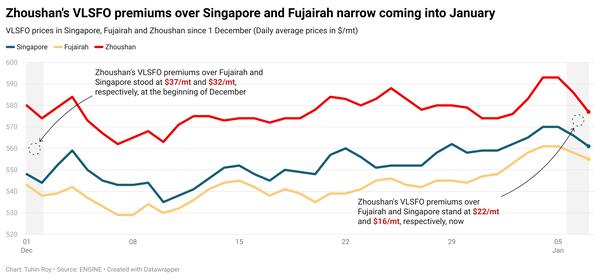

Singapore’s VLSFO price has increased by $13/mt in the past day, marking the steepest rise among the three major Asian bunker ports. Four VLSFO stems were fixed recently in Singapore within a $20/mt range. Stems booked at the higher end of the range have contributed to the price rise. As a result, Singapore’s VLSFO premium over Fujairah has widened to $16/mt, though it remains at a slight discount of $6/mt compared to Zhoushan.

VLSFO availability in Singapore remains tight, with a standard lead time of around nine days, though expedited deliveries within five days are possible at higher prices. HSFO supply has improved in the port, with lead times reducing from 9-15 days last week to 5-9 days now. LSMGO lead times are around 3-11 days.

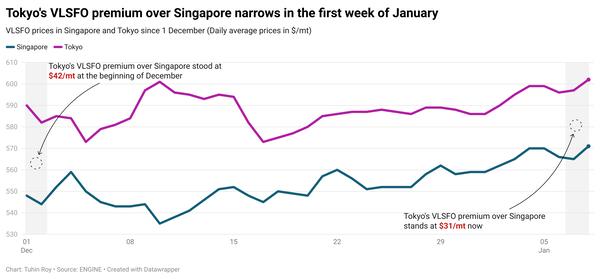

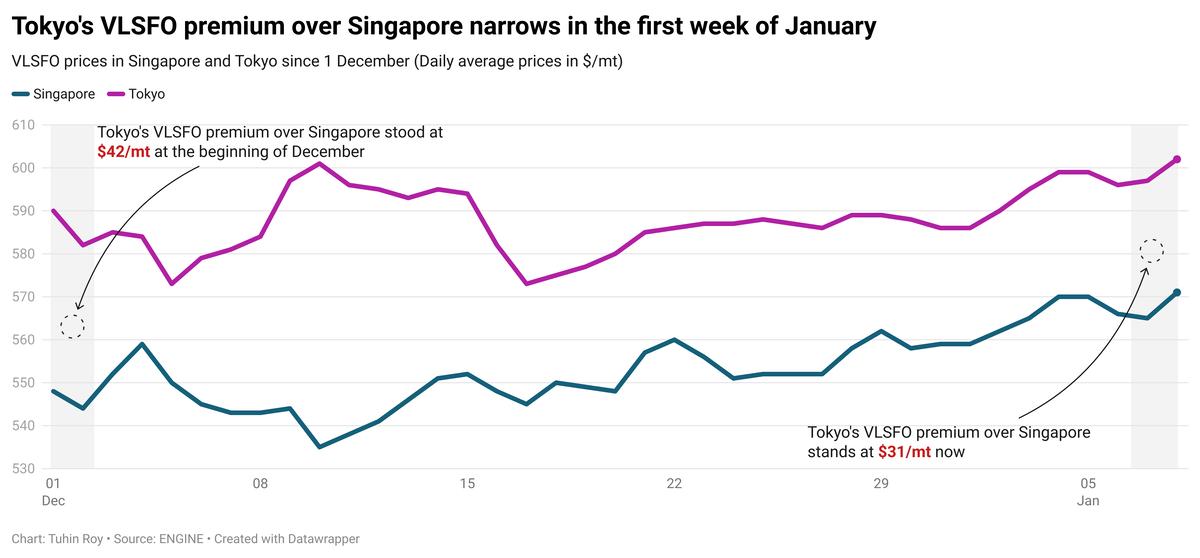

In Japan, Tokyo continues to price its VLSFO at a premium of $31/mt over Singapore.

VLSFO supply is strong across major Japanese ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya and Yokkaichi, but prompt availability remains tight in Mizushima. LSMGO availability is generally stable, but prompt deliveries are limited in several ports. Prompt HSFO availability is constrained across all ports, and all grades remain subject to availability in Oita.

Brent

The front-month ICE Brent contract has moved $1.91/bbl higher on the day, to trade at $77.84/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price found a strong upward thrust from positive US data that have supported demand growth expectations in the oil market.

Crude oil inventories in the US dropped by 4.0 million bbls in the week that ended 3 January, according to the American Petroleum Institute (API) estimates. A drop in US crude stocks indicates a growth in oil demand, which can support Brent's price.

Oil gained more support due to fresh supply concerns in eastern Europe after a Ukrainian drone struck a Russian oil depot yesterday, Ukraine's military said on the Telegram messaging app.

While the market awaits a Russian retaliation, it is also preparing for stricter sanctions against Russian and Iranian oil firms, expected to come into action once President-elect Donald Trump takes his official oath at the White House later this month.

“Given that oil from Russia and Iran typically flows into the inventories of China's teapot refineries and other storage facilities, this [potential] reduction [of Russian and Iranian oil supply] is seen as a significant driver of the current tight supply dynamics in Asia,” SPI Asset Management’s managing partner Stephen Innes said.

Downward pressure:

President-elect Donald Trump is ready to reverse the latest presidential order banning the majority of the offshore oil and natural gas leases in the eastern Gulf of Mexico, the Pacific Ocean, as well as portions of the Northern Bering Sea in Alaska, several media reports suggested.

With just two weeks in office, the Biden administration’s ban on most new oil and gas drilling off the Pacific and Atlantic coasts aims at drastically reducing US oil and gas production.

However, global markets are already on track to brace the “drill, baby, drill” agenda in Trump’s second term as the US President.

“Throughout his 2024 presidential campaign, Trump vowed that, if elected, he would expand oil and gas drilling to bolster American-made energy,” Price Futures Group’s senior market analyst Phil Flynn said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.