East of Suez Fuel Availability Outlook 7 Jan 2025

HSFO availability improves in Singapore

VLSFO supply is good across several Japanese ports

Prompt supply is tight in Fujairah

PHOTO: Industrial cargo ships in Busan port area, South Korea. Getty Images

PHOTO: Industrial cargo ships in Busan port area, South Korea. Getty Images

Singapore and Malaysia

VLSFO availability remains tight in Singapore, with a standard lead time of around nine days. However, expedited deliveries within five days are possible at higher prices. HSFO supply has improved, with lead times reducing from 9-15 days last week to 5-9 days now. LSMGO lead times are around 3-11 days.

Singapore’s residual fuel oil stocks in December averaged 23% higher than in November, according to Enterprise Singapore. The port's fuel oil stocks remained above 22 million bbls in December, driven by a 93% increase in net fuel oil imports. Imports rose by a significant 2.10 million bbls, while exports dropped by 424,000 bbls. Meanwhile, the port's middle distillate stocks rose slightly, averaging 2% higher in December compared to November.

At Malaysia's Port Klang, VLSFO and LSMGO supplies remain abundant, with prompt small-quantity deliveries readily available. However, HSFO supply continues to be constrained.

East Asia

In Zhoushan, recommended lead times for VLSFO and HSFO have shortened to 4-6 days, down from 5-7 days last week. However, LSMGO lead times have risen to about six days, compared to 3-5 days previously.

Bunkering at Zhoushan's Tiaozhoumen and Xiazhimen outer anchorages could be suspended late Tuesday due to rough weather. Operations are expected to remain halted till Wednesday, according to a source.

In Northern China, Dalian and Qingdao ports have ample supplies of VLSFO and LSMGO, but Qingdao is facing limited HSFO availability. Tianjin is experiencing tight supplies of HSFO and VLSFO, while LSMGO supply is steady.

In Shanghai, LSMGO is readily available, but supplies of VLSFO and HSFO are constrained. Fuzhou has strong availability of both VLSFO and LSMGO, while Xiamen has good VLSFO supply but restricted LSMGO availability. Prompt supply of both grades remains limited at Yangpu and Guangzhou.

In Hong Kong, a lead time of around seven days is recommended for all fuel grades, consistent with recent weeks. The port is forecast to experience wind gusts of 20-21 knots and swells of more than one metre on 9-10 January. This could disrupt bunkering operations.

In Taiwan, ports such as Hualien, Taichung and Keelung have steady VLSFO and LSMGO supplies with lead times of around two days, unchanged from last week. At Kaohsiung, VLSFO lead times are around two days, but securing LSMGO delivery can be challenging due to barge maintenance since 26 December.

In South Korean ports, fuel availability across all grades has improved, with several suppliers recommending lead times of around 4-6 days. Last week, southern ports advised lead times of 3-11 days for VLSFO and LSMGO, while 6-11 days were recommended for western ports. HSFO required lead times of 6-7 days.

However, intermittent rough weather is expected this week, which could disrupt bunkering operations at Ulsan, Onsan, Busan, Daesan, Taean and Yeosu.

In Japan, VLSFO supply is strong across major ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya and Yokkaichi, but prompt availability remains tight in Mizushima. LSMGO availability is generally stable, though prompt deliveries are limited in Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi and Mizushima. Prompt HSFO availability is constrained at all ports, while all grades remain subject to availability in Oita.

In Vietnam, Hai Phong and Vung Tau ports have good supplies of VLSFO and LSMGO grades, with prompt deliveries available. However, bunker operations in Hai Phong may get affected due to bad weather expected on Wednesday.

Subic Bay in the Philippines may face inclement weather throughout this week, potentially disrupting bunkering operations. Similarly, adverse weather could affect bunkering at Thailand's Koh Sichang and Leam Chabang ports between 10 and 12 January.

Oceania

In Western Australia, the ports of Kwinana, Fremantle and Kembla have good supplies of VLSFO and LSMGO, with typical lead times of 7-8 days. In New South Wales, Sydney offers ample LSMGO availability, though HSFO may require longer lead times.

Victoria’s ports, Melbourne and Geelong, have abundant stocks of VLSFO and LSMGO, but securing prompt HSFO deliveries can be challenging. In Queensland, Brisbane and Gladstone maintain sufficient VLSFO and LSMGO supplies with lead times of 7-8 days, but HSFO availability in Brisbane remains limited.

In New Zealand, Tauranga and Auckland have adequate VLSFO stocks, with Auckland also offering sufficient LSMGO supplies.

South Asia

Availability of VLSFO and LSMGO remains limited in several Indian ports, including Kandla, Mumbai, Tuticorin, Chennai and Cochin, consistent with recent weeks. Both grades are subject to availability in Visakhapatnam, while a supplier in Paradip and Haldia is nearly out of stock.

Availability of all grades has tightened in Sri Lanka's Colombo port, with recommended lead times increasing to around eight days from four days last week. The port is forecast to face bad weather conditions on Thursday, which could complicate deliveries.

In contrast, Hambantota requires shorter lead times of around six days for all grades.

Middle East

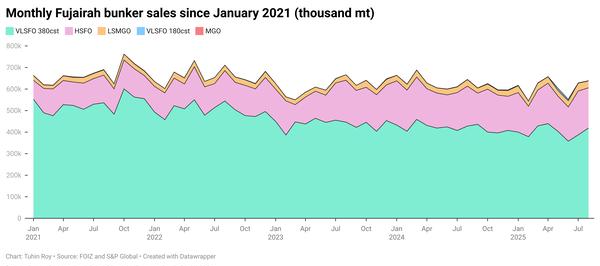

In Fujairah, prompt availability remains tight, with lead times for all grades steady at 5-7 days, unchanged from last week. Similarly, suppliers in Khor Fakkan are recommending lead times of 5-7 days for all grades.

In contrast, Saudi Arabia’s Jeddah port has sufficient supplies of both VLSFO and LSMGO. However, bunker deliveries in Jeddah may be disrupted due to inclement weather expected on Thursday. VLSFO supply is still under pressure in Djibouti, while LSMGO is more readily available.

Omani ports, including Sohar, Salalah, Muscat and Duqm, have ample LSMGO supplies with prompt deliveries available.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.