Americas Market Update 30 Dec 2024

Regional bunker benchmarks have moved in mixed directions, and Houston’s Hi5 spread has shrunk.

Changes on the day from Friday, to 07.00 CST (13.00 GMT) today:

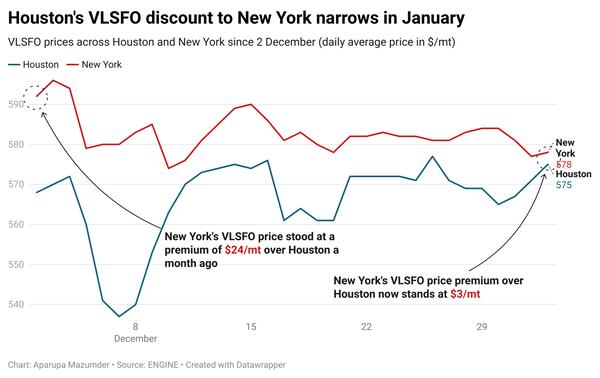

- VLSFO prices up in New York ($1/mt), unchanged in Balboa, and down in Houston ($2/mt)

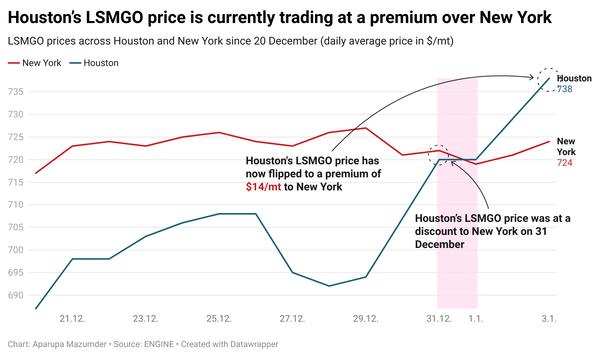

- LSMGO prices up in Houston ($18/mt), and down in New York ($7/mt) and Balboa ($1/mt)

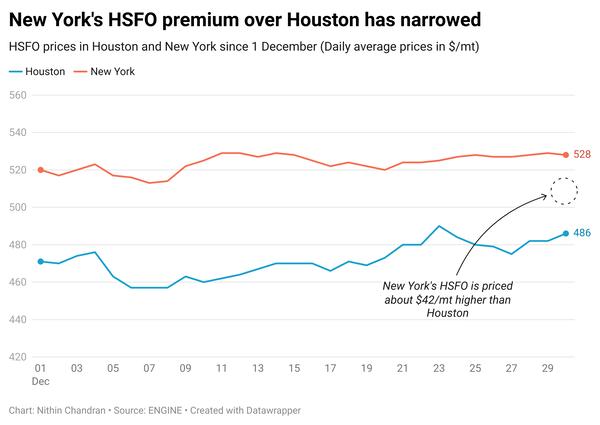

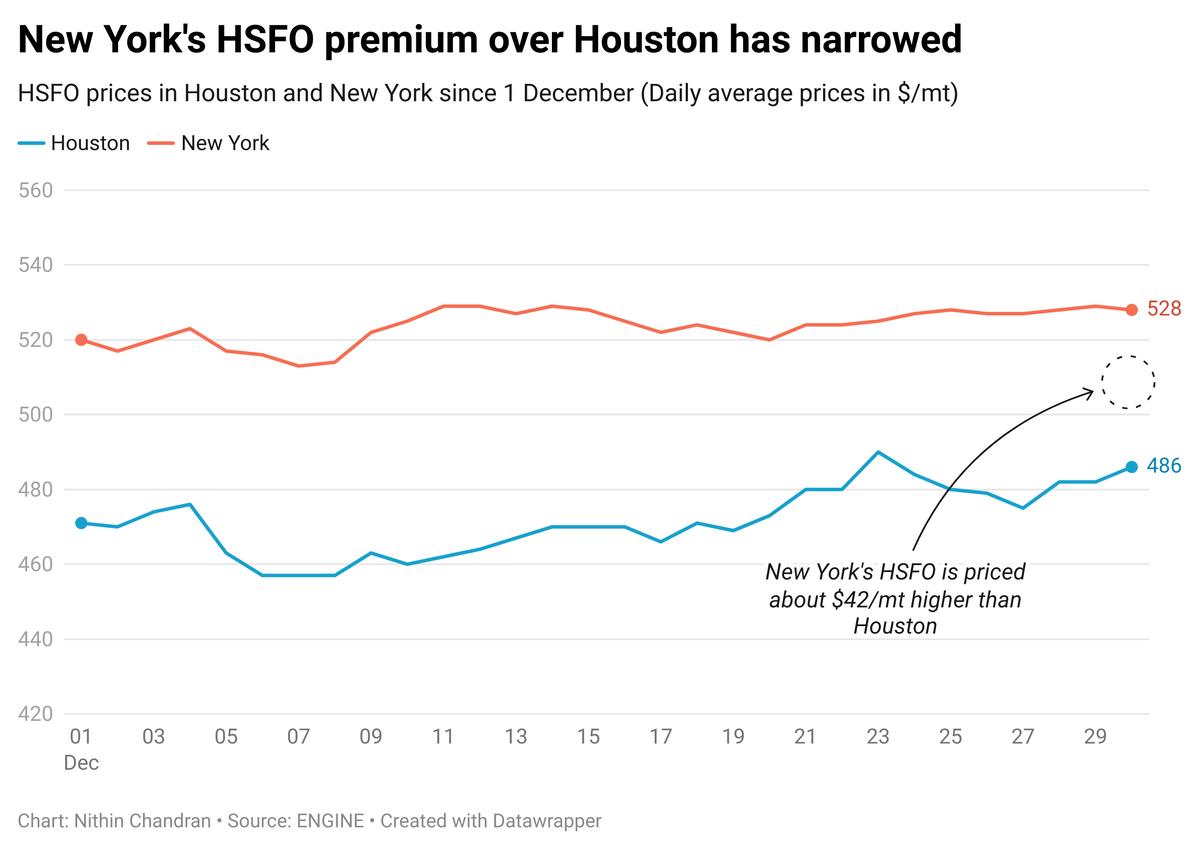

- HSFO prices up in Houston ($17/mt), New York and Balboa ($2/mt), and down in Los Angeles ($1/mt)

Houston’s HSFO price has shot up by $17/mt over the weekend, while the port’s VLSFO price shed $2/mt. A lower-priced 500-1,500 mt VLSFO stem fixed at $561/mt has prevented the benchmark from gaining.

The diverging price moves have narrowed Houston’s Hi5 spread from $93/mt to $74/mt. Houston’s HSFO premium over New York has narrowed from $55/mt on Friday to $42/mt today.

Dense fog has been reported in the upper Houston Ship Channel. This may cause delays in bunkering at locations such as the Barbours Cut and Bayport terminals, located in the upper part of the channel.

The US Coast Guard has advised ships to exercise caution before beginning or continuing their transits through these areas. During dense fog conditions, the Coast Guard can restrict or suspend barge movements, which affects both bunkering and oil product loadings.

LSMGO availability is normal in New Orleans. One supplier can deliver the grade with a lead time of 5-6 days. Yesterday, a tugboat collided with a tanker and caused a near day-long partial closure of the Mississippi River between mile markers 120-124.

The affected section reopened this morning, according to shipping agent Moran Shipping Agencies. While New Orleans, located near mile marker 95 in the Mississippi River, was not directly impacted, vessel schedules could get delayed.

Brent

The front-month ICE Brent contract has gained $0.48/bbl on the day from Friday, to trade at $74.32/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

Oil prices have been supported by optimism for Chinese economic growth in the coming year, which could increase demand from the world’s largest crude oil importer.

Chinese authorities plan to issue 3 trillion yuan ($411 billion) in special treasury bonds next year to stimulate the economy. The World Bank has also raised its growth forecasts for China in 2024 and 2025, Reuters reported. This could boost oil demand in the country and support Brent's price.

Additionally, data from the US Energy Information Administration (EIA) revealed a larger-than-expected drawdown in US crude inventories for the week ending 20 December. US crude stocks fell by 4.2 million bbls as refiners increased activity and the holiday season led to an increase in fuel demand, Reuters reported.

Prices were further supported by “bigger-than-expected weekly slumps in US crude and distillate fuel stocks reported by the Energy Information Administration for the week ended December 20,” according to Vandana Hari, founder and analyst at VANDA Insights.

Downward pressure

Meanwhile, market participants remain cautious and are awaiting economic data from China and the US later this week to evaluate growth in the world’s two largest oil consuming nations.

The market is focused on China’s PMI factory surveys, set for release on Tuesday, and the US ISM survey for December, which will be published on Friday. This uncertainty has contributed to put some downward pressure on Brent futures.

By Nithin Chandran and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.