Americas Market Update 3 Jan 2025

Bunker benchmarks in key Americas ports have moved in mixed directions, and high wind gusts are expected to disrupt bunkering operations in Montreal.

Changes on the day, to 07.00 CST (13.00 GMT) today:

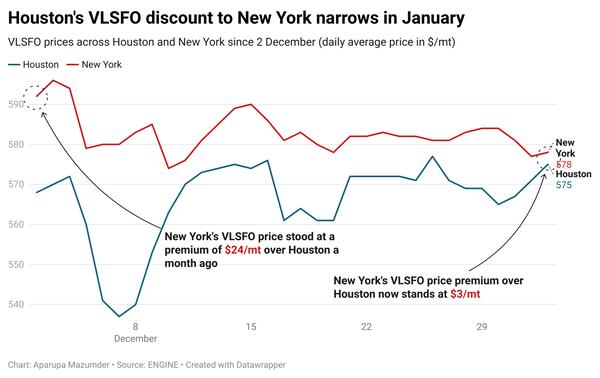

- VLSFO prices up in Houston ($6/mt), Balboa ($2/mt), unchanged in Los Angeles, and down in Zona Comun ($19/mt) and New York ($3/mt)

- LSMGO prices up in Houston ($10/mt), Balboa ($4/mt) and Los Angeles ($1/mt), and down in New York ($3/mt)

- HSFO prices up in Balboa ($2/mt), unchanged in Los Angeles, and down in Houston ($5/mt) and New York ($2/mt)

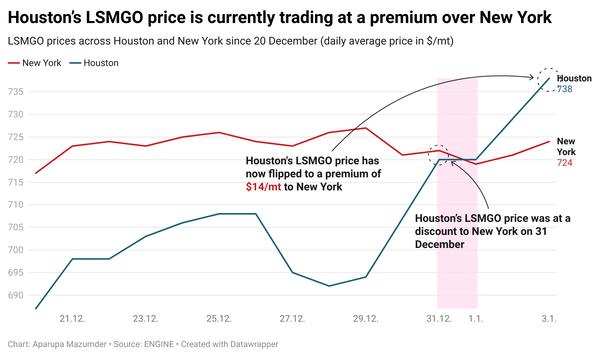

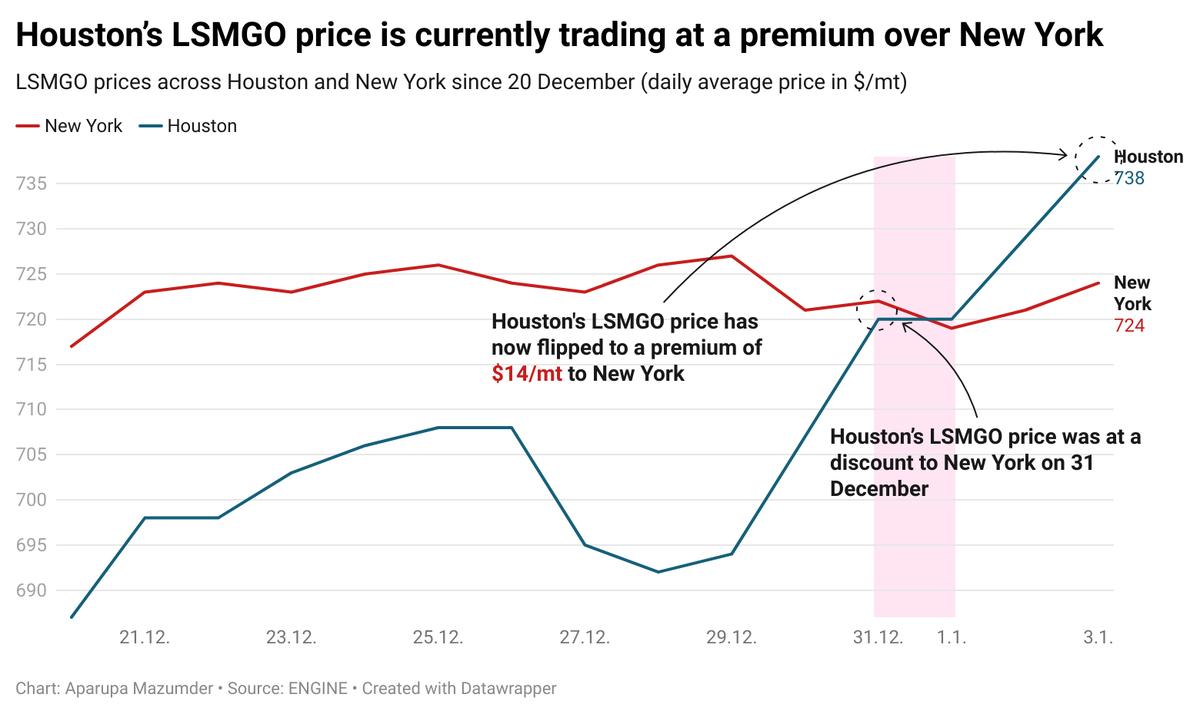

Houston’s LSMGO price has moved higher in the past day, while the grade’s price has declined in New York. These diverging price movements have flipped Houston’s LSMGO discount to New York, to a $14/mt premium now.

LSMGO is tight for very prompt delivery in Houston, where a trader recommends lead times of at least seven days for optimal coverage.

Heavy fog has reduced visibility in the US Gulf Coast, causing possible delays in bunker deliveries.

Bad weather conditions forecast over the weekend and into the next week may complicate barge deliveries and delay some bunker operations in the Galveston Offshore Lightering Area (GOLA).

There is a risk of high wind gusts in Montreal tomorrow, which may complicate deliveries there.

VLSFO availability for prompt dates is good in Argentina’s Zona Comun, with expected lead times of less than seven days.

Brent

The front-month ICE Brent contract has inched $0.03/bbl higher on the day, to trade at $75.69/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

Brent’s price has increased by around $1/bbl on strong hopes of oil demand growth in 2025, as US President-elect Donald Trump, a vocal advocate for expanding domestic oil production, prepares to take office later this month.

Commercial crude oil inventories in the US declined by 1.2 million bbls to touch 415 million bbls for the week ending 27 December, according to data from the US Energy Information Administration (EIA).

A drop in US crude stocks indicates oil demand growth, which could support Brent's price.

Brent’s price has gained “amid expectations of a surge in energy use,” VANDA Insights’ founder and analyst Vandana Hari said.

Downward pressure:

Brent futures felt some downward pressure due to resurfacing demand growth concerns from China.

China's manufacturing purchasing managers' index (PMI) came in at 50.1% in December, noting a decline from 50.3% achieved in November, data from the National Bureau of Statistics (NBS) showed.

A decline in the PMI reading has raised concerns about demand growth in the country, ultimately weighing down on prices of commodities like oil.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.