Americas Market Update 27 Dec 2024

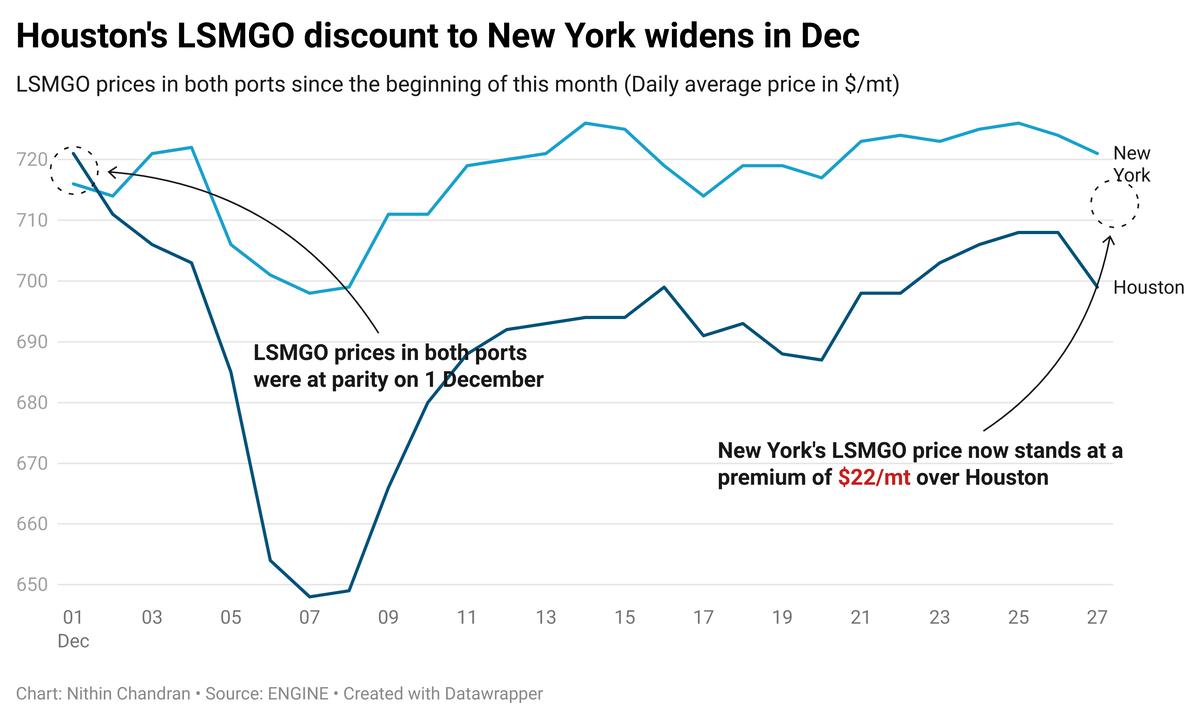

Most regional bunker benchmarks have come down, and Houston’s LSMGO discount to New York has widened.

Changes on the day to 07.00 CDT (13.00 GMT) today:

- VLSFO prices unchanged in New York and Balboa, and down in Houston ($7/mt)

- LSMGO prices unchanged in New York, and down in Houston ($25/mt) and Balboa ($1/mt)

- HSFO prices down in Houston ($8/mt) and Balboa ($1/mt)

Houston’s LSMGO price has come down sharply in the past day. One 50-150 mt non-prompt LSMGO stem fixed at $670/mt has contributed to pull the benchmark lower. The grade’s price in New York has remained steady. This has widened Houston’s LSMGO discount to New York, from parity levels seen at the beginning of this month.

A high risk of fog and reduced visibility is forecast in most Texas ports including Galveston and Freeport today. This may result in bunkering delays in these locations.

Moreover, scattered showers and thunderstorms in the Houston area may lead to Houston Ship Channel closures. The channel is a key waterway connecting Houston, Galveston, Texas City and Baytown to the Gulf of Mexico.

One supplier in Houston can offer VLSFO with lead times of 7-10 days.

Brent

The front-month ICE Brent contract has moved $0.16/bbl lower on the day, to trade at $73.84/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

Market optimism over economic stimulus efforts to drive China’s recovery has lent support to the price of Brent crude. Chinese authorities plan to issue 3 trillion yuan ($411 billion) in special treasury bonds next year to revive the economy, Reuters reported, citing sources.

“Oil is getting a boost from talk of a massive amount of economic stimulus from China,” noted Phil Flynn, senior market analyst at Price Futures Group.

The World Bank has revised its forecasts for China's economic growth in 2024 and 2025, Reuters reported. This economic growth could increase demand for oil and drive up Brent prices.

In the US, crude oil inventories dropped by 3.20 million bbls in the week ending December 27, following a larger decrease of 4.70 million bbls the previous week, according to American Petroleum Institute (API) estimates. A decline in US crude oil inventories indicates rising oil demand, which could support Brent prices.

“The American Petroleum Institute’s slightly bullish US oil stocks data may have spurred the buying interest through Thursday,” said Vandana Hari, founder and analyst at VANDA Insights.

The US Energy Information Administration (EIA) is expected to release its closely watched crude oil stockpile report later today.

Downward pressure:

A stronger US dollar pressured oil prices, limiting some of its gains.

The dollar has climbed approximately 7% this quarter and remains near a two-year high against major currencies after the Federal Reserve indicated slower rate cuts in 2025, according to Reuters.

A stronger dollar increases the cost of oil for buyers using other currencies. This can reduce oil demand and put downward pressure on prices.

By Nithin Chandran and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.