Americas Market Update 26 Dec 2024

Regional bunker benchmarks have gained some, and trading has been muted in the Americas.

Changes on the day to 07.00 CDT (13.00 GMT) today:

- VLSFO prices up in Houston($5/mt), Los Angeles ($4/mt), New York ($3/mt) and Balboa ($2/mt)

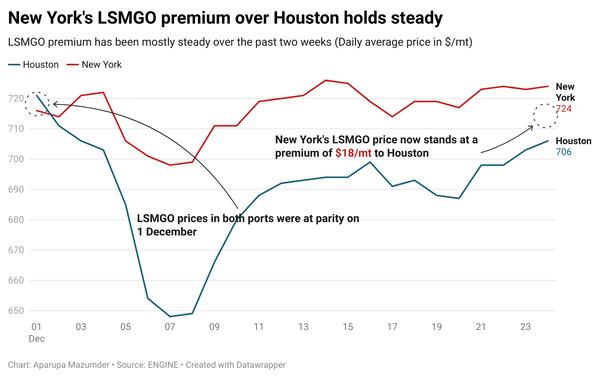

- LSMGO prices up in Los Angeles ($4/mt), Houston and New York ($2/mt), and unchanged in Balboa

- HSFO prices up in Houston ($4/mt), New York and Los Angeles ($2/mt), and unchanged in Balboa

Trading activity has been muted across the region due to the holiday season. All bunker benchmarks in key ports in the Americas have made modest gains in the past day.

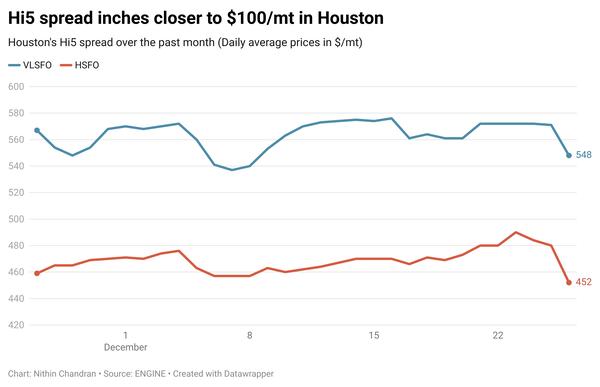

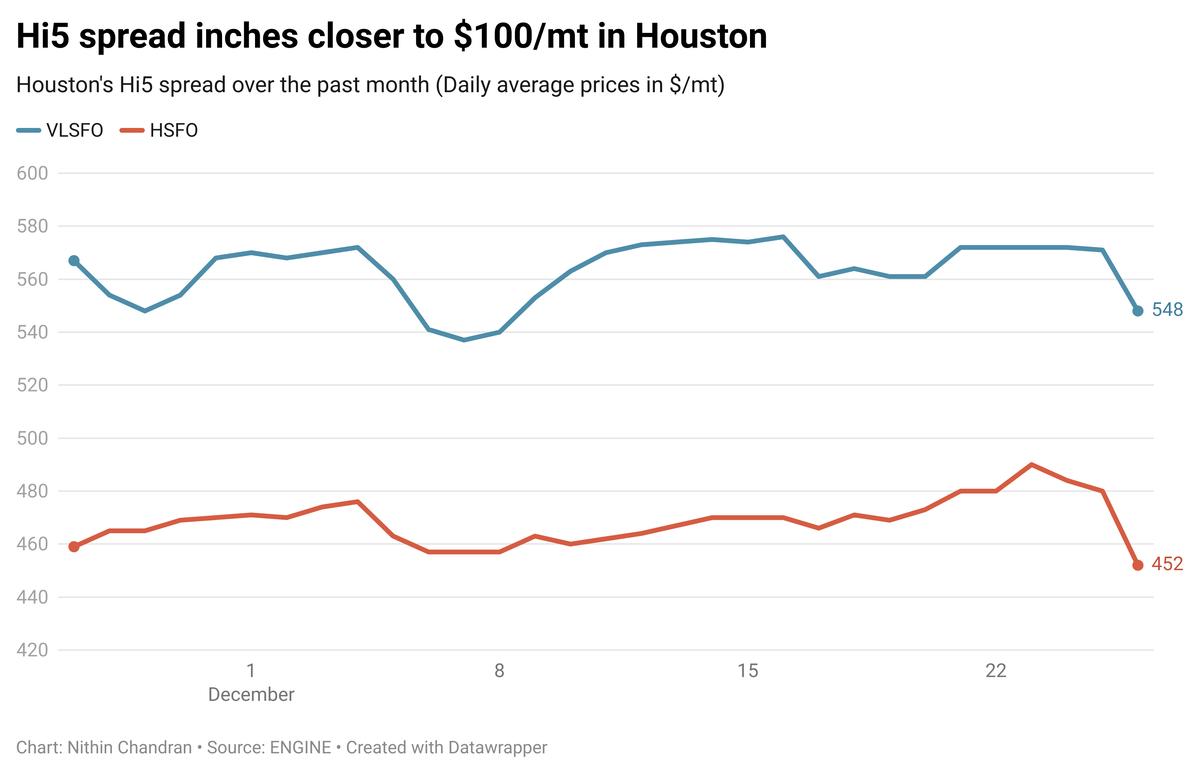

The Hi5 spread in Houston is around $96/mt, almost a double compared to $55/mt in New York, but still narrower than $119/mt in Los Angeles.

There is a moderate to high risk of fog and reduced visibility forecast throughout this week, which could lead to intermittent closures of the Houston Ship Channel.

The US Coast Guard restricts or suspends barge movements during dense fog conditions, thereby impacting bunkering and causing loading delays in the Gulf Coast. Dense fog and reduced visibility are common during this time of the year and usually runs until early spring. This causes bunkering delays and congestion in Houston.

Brent

The front-month ICE Brent contract has jumped $0.78/bbl from Tuesday, to trade at $74/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

Oil prices rose on optimism about additional fiscal stimulus in China, the world's largest oil importer.

China plans to enhance fiscal support for consumption next year by increasing pensions, medical insurance subsidies, and expanding trade-in programs for consumer goods, according to a finance ministry announcement reported by Reuters.

China's trade-in programs for consumer goods refer to a series of measures to boost domestic sales.

Expectations of a decline in US crude inventories also supported Brent futures, analysts said.

Downward pressure:

Libya's National Oil Corporation (NOC) announced on Wednesday that the country's average crude production in 2024 surpassed its target of approximately 1.4 million b/d, Reuters reported. This exerted some downward pressure on Brent futures.

By Nithin Chandran and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.