Americas Market Update 24 Dec 2024

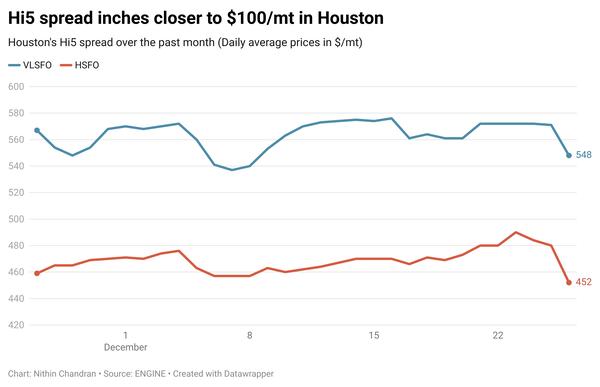

Bunker benchmarks in key Americas ports have moved in mixed directions, and prompt availability is tight across all grades in Houston.

Changes on the day, to 07.00 CST (13.00 GMT) today:

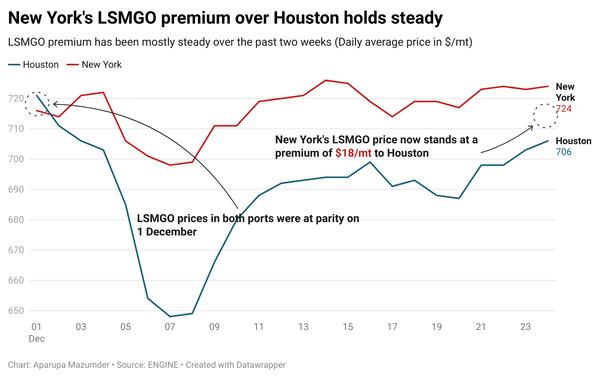

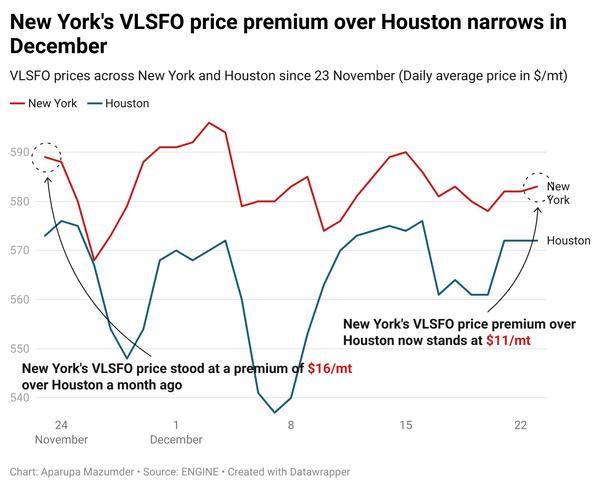

- VLSFO prices up in Los Angeles ($8/mt), Balboa ($6/mt), Zona Comun ($3/mt) and Houston ($1/mt), and unchanged in New York

- LSMGO prices up in Los Angeles ($15/mt), Houston and Balboa ($8/mt), and New York ($3/mt)

- HSFO prices up in Houston ($22/mt), Balboa ($11/mt) and New York ($2/mt), and down in Houston ($8/mt) and Los Angeles ($3/mt)

Houston's LSMGO price gain has been steeper than that of its VLSFO in the past day. Prompt availability remains tight across all grades in the port, a source said. Some suppliers require lead times of 7-9 days for VLSFO and LSMGO deliveries, while more than nine days are generally recommended for HSFO.

Heavy fog and reduced visibility along the US Gulf Coast could lead to intermittent closures of the Houston Ship Channel this week. These disruptions may halt vessel traffic, potentially leading to congestion and delays in bunkering operations.

Prompt LSMGO availability is tight in Vancouver, a source said. One supplier is unable to offer LSMGO for very prompt delivery dates because of tight delivery schedules.

Brazilian energy firm and bunker supplier Petrobras has informed its customers that it will not be accepting nominations or providing quotes on 24–25 December, as well as on 31 December and 1 January, due to the holidays.

Brent

The front-month ICE Brent contract has gained $0.64/bbl on the day, to trade at $73.22/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

Oil prices gained some upward thrust after the US Department of Commerce revised its GDP estimate upward for the third quarter.

The US gross domestic product (GDP), a key indicator of demand growth and consumer spending activity, increased at an annualised rate of 3.1% in the third quarter of this year, up from the initial estimate of 2.8%, the US Commerce Department’s Bureau of Economic Analysis (BEA) said.

The upward revision has shown resilience in the country's economic growth in the third quarter of this year, as it was better than previously estimated. It has supported demand growth expectations in the global oil market, according to analysts.

Oil market analysts and traders are now waiting to factor in the potential changes in the US economy when US President-elect Donald Trump takes office on 20 January 2025.

The oil market is in a “wait-and-watch mode for what 2025 brings,” VANDA Insights’ founder and analyst Vandana Hari said.

Downward pressure:

Brent’s price inched marginally lower in pre-Christmas trade as global financial markets held largely stable during the year-end holiday season.

Brent has felt some downward pressure due to concerns about the slowdown in Chinese oil demand, according to analysts.

Oil demand in the world’s second-largest consumer is expected to peak around 2027, market intelligence provider JLC reported citing Chinese state-owned oil company Sinopec.

Chinese officials have pledged to roll out a new stimulus package next year to revive the country’s economy. However, oil market analysts remain cautious, tempering expectations of a significant boost to oil demand from these measures.

The country will likely consume about 750 million mt and 770 million mt of crude oil this year and in 2025, respectively, Sinopec said in its report.

“Oil stays locked in a boring trading range a coming cold blast,” Price Futures Group’s senior market analyst Phil Flynn said.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.