East of Suez Market Update 19 Dec 2024

Prices in East of Suez ports have moved in mixed directions, and prompt availability of all grades remains under pressure in several Japanese ports.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore and Fujairah ($1/mt), and down in Zhoushan ($5/mt)

- LSMGO prices down in Zhoushan ($7/mt), Fujairah ($4/mt) and Singapore ($3/mt)

- HSFO prices down in Fujairah, Zhoushan ($3/mt) and Singapore ($2/mt)

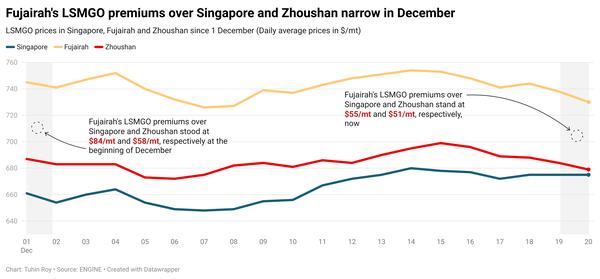

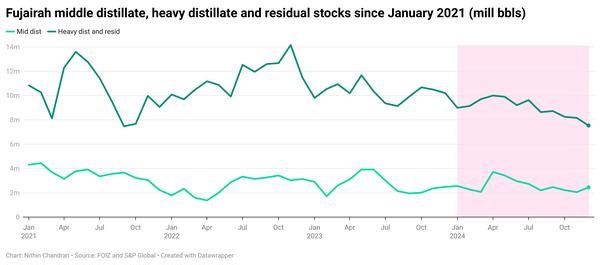

LSMGO prices in East of Suez ports have decreased some over the past day, with Zhoushan experiencing the largest drop. Fujairah's LSMGO price remains at a higher level, with premiums of $70/mt over Singapore and $60/mt over Zhoushan. Availability in Fujairah remains tight, with lead times for all grades steady at 5-7 days, unchanged from the previous week. Some suppliers can accommodate prompt orders, but these typically come at higher prices.

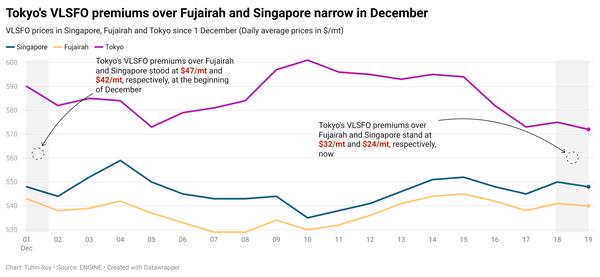

Meanwhile, VLSFO prices have remained broadly stable in the three major Asian bunker ports for the fourth consecutive day. Fujairah's VLSFO discounts to Zhoushan and Singapore are $29/mt and $8/mt, respectively.

In contrast, Japan's Tokyo continues to price its VLSFO at elevated levels, with premiums of $32/mt over Fujairah and $24/mt over Singapore.

In Japan, prompt availability of all fuel grades remains limited across major ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi, Mizushima and Oita. A slowdown in bunkering activity is expected ahead of the Year-end and New Year holidays from 29 December to 3 January. While bunker deliveries will continue during the holidays, the deadline for booking stems is Friday for December deliveries and Monday for January deliveries, according to a source.

Brent

The front-month ICE Brent contract has moved $0.56/bbl lower on the day, to trade at $73.11/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price gained as supply-related concerns escalated with Israel launching airstrikes on ports and energy infrastructures in Houthi-controlled areas of Yemen, Reuters reported.

The Israel Defense Forces (IDF) has threatened with more attacks against the Iran-aligned armed group, raising further concerns of a spillover of the conflict into neighbouring oil-rich areas, analysts said.

Meanwhile, oil demand growth found some support after the US Energy Information Administration (EIA) reported a slump in US crude stocks.

Commercial crude oil inventories in the US declined by 934,000 bbls to touch 421 million bbls for the week ending 13 December, according to data from EIA.

A drop in US crude stocks indicates oil demand growth in the world’s largest oil-consuming country.

Downward pressure:

Brent lost momentum after the US Federal Reserve (Fed) hinted at a softer approach to interest rate cuts next year.

Despite cutting interest rates for the final time in 2024, oil prices and the broader commodities market reacted negatively to the US central bank’s “hawkish” stance on economic and monetary policies next year, oil market analysts said.

“Crude futures were inching lower… as the US Federal Reserve’s signal of a slower and shallower path of interest rate cuts in 2025 dampened the mood in the financial markets,” VANDA Insights’ founder and analyst Vandana Hari said.

Higher interest rates in the US can make oil and other dollar-denominated commodities costlier for holders of other currencies and weigh on demand.

Brent continues to see headway from a slowdown in oil demand growth and a lack of efficient economic policies in China, the world’s second largest crude-consuming nation.

China's National Bureau of Statistics (NBS) reported that the country’s retail sales growth came in weaker than unexpected in November, rising by only 3% year-on-year, and noting a sharp drop from the 4.8% growth achieved in October.

“Weak economic data in China also sort of weighed on [oil market] sentiment,” Price Futures Group senior market analyst Phil Flynn said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.