East of Suez Fuel Availability Outlook 17 Dec 2024

VLSFO and LSMGO availability is good in Taiwanese ports

Bunker demand is low in western South Korean ports

Prompt supply is tight across several Japanese ports

PHOTO: Cargo ships docked at Tauranga Harbour Port with Mount Maunganui in the background. Getty Images

PHOTO: Cargo ships docked at Tauranga Harbour Port with Mount Maunganui in the background. Getty Images

Singapore and Malaysia

In Singapore, VLSFO availability has tightened, with lead times increasing from seven days last week to around 10 days now. Some suppliers can fulfil orders in as little as two days, but these expedited deliveries are usually priced higher than those for delivery dates further out.

HSFO supply remains tight, with recommended lead times holding steady at 9-12 days. Meanwhile, lead times for LSMGO deliveries have increased from 2-3 days last week to 2-8 days now.

Singapore’s residual fuel oil stocks have averaged 2% lower so far in December compared to November, according to Enterprise Singapore. Stocks have fallen below 18 million bbls despite a significant 61% increase in net fuel imports this month. Fuel oil imports have risen by 1.05 million bbls, while exports have dropped by 599,000 bbls. In contrast, middle distillate stocks in Singapore have grown, averaging 13% higher than last month.

At Malaysia's Port Klang, VLSFO and LSMGO supplies remain abundant, with some suppliers offering prompt deliveries for smaller quantities. However, HSFO availability continues to be largely limited.

East Asia

VLSFO and HSFO availability in Zhoushan remains robust, with some suppliers able to deliver with lead times of 4-6 days. LSMGO supply has improved, with lead times reducing from 4-6 days last week to 2-4 days.

In Northern China, Dalian and Qingdao ports have ample supplies of VLSFO and LSMGO, though Qingdao faces limited HSFO availability. Tianjin is experiencing a tight supply across all fuel grades.

In Shanghai, LSMGO is readily available, but VLSFO and HSFO supplies are constrained. Fuzhou reports strong availability of both VLSFO and LSMGO, while Xiamen has good VLSFO supply but restricted LSMGO availability. Prompt availability of both grades remains limited at Yangpu and Guangzhou.

In Hong Kong, a lead time of around seven days is advised for all fuel grades, unchanged from last week. However, bunker operations may face disruptions on Wednesday due to a forecast of wind gusts of 20-21 knots and swells close to a meter.

In Taiwan, VLSFO and LSMGO supplies are stable at the Hualien, Kaohsiung, and Keelung ports, with lead times of 2-3 days, similar to last week. Taichung requires slightly longer lead times of about four days for both grades.

From 26 December to 24 January, the LSMGO bunker barge Chung Yu No. 16 in Kaohsiung will undergo annual maintenance, tightening the LSMGO supply and causing longer waiting times. Supply at other ports, including Hualien, Taichung, and Keelung, will remain unaffected, according to state-owned oil company CPC Corporation.

In South Korea, western ports such as Daesan are experiencing subdued demand and have reduced VLSFO prices compared to southern ports like Busan to attract buyers. Daesan’s VLSFO discount to Busan is around $29/mt on Tuesday.

Availability remains steady across all South Korean ports, with lead times for all grades ranging from 4-9 days, consistent with last week. However, intermittent rough weather is expected this week, potentially disrupting bunkering operations at Ulsan, Onsan, Busan, Daesan, Taean and Yeosu.

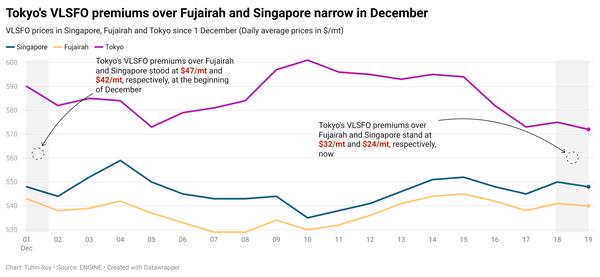

In Japan, prompt availability of all fuel grades is limited across major ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi, Mizushima, and Oita. A slowdown in bunkering activity is expected ahead of the Year-end and New Year holidays from 29 December to 3 January. While bunker deliveries will continue during the holiday, the deadline for booking stems is Friday for December delivery dates and Monday for January dates, according to a source.

Subic Bay in the Philippines may experience inclement weather from 21-23 December, potentially disrupting bunkering operations. Similarly, adverse weather could impact bunkering at Vietnam’s Ho Chi Minh port on 19 December.

Oceania

In Western Australia, the ports of Kwinana, Fremantle, and Kembla have a good supply of VLSFO and LSMGO with typical lead times of 7-8 days. In New South Wales, Sydney has ample LSMGO availability, but HSFO may require longer lead times.

Victoria’s ports, Melbourne and Geelong, have abundant VLSFO and LSMGO stocks, though securing prompt HSFO deliveries can be challenging. In Queensland, Brisbane and Gladstone also maintain sufficient VLSFO and LSMGO supplies with lead times of 7-8 days, though HSFO availability in Brisbane remains limited.

In New Zealand, Tauranga and Auckland have adequate VLSFO stocks, with Auckland also offering sufficient LSMGO supplies. However, rough weather is expected in Tauranga on 18 and 21 December, which could disrupt bunker operations.

South Asia

Supplies of VLSFO and LSMGO at Indian ports, including Mumbai, Kandla, Tuticorin, Cochin, and Chennai, remain constrained. Bunker deliveries at Visakhapatnam and Kandla may be disrupted by inclement weather expected on 18 and 20 December, respectively.

Sri Lanka’s ports of Colombo and Hambantota have good availability of VLSFO, LSMGO, and HSFO, with lead times remaining steady at around five days.

Middle East

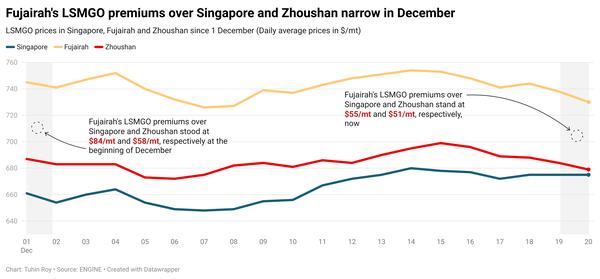

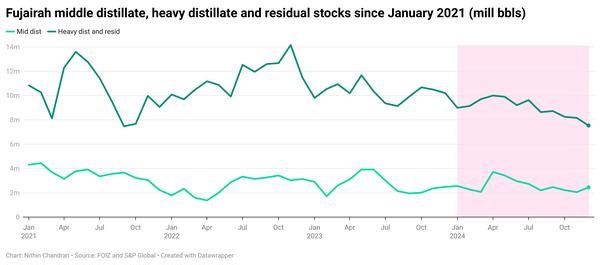

In Fujairah, availability remains tight, with lead times for all grades steady at 5-7 days, unchanged from last week. Some suppliers can accommodate prompt stems, though these typically come at higher prices. Khor Fakkan has similar lead time recommendations for all grades.

In Basrah, Iraq, both VLSFO and LSMGO are readily available. However, supplies of both grades are nearly depleted in Ras Laffan, Qatar, and Suez, Egypt.

In Jeddah, Saudi Arabia, LSMGO is sufficiently supplied, but VLSFO availability is limited. Djibouti faces severe supply constraints, with VLSFO and HSFO nearly exhausted and LSMGO also running low.

Omani ports, including Sohar, Salalah, Muscat, and Duqm, have ample LSMGO supply.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.