Europe & Africa Market Update 12 Dec 2024

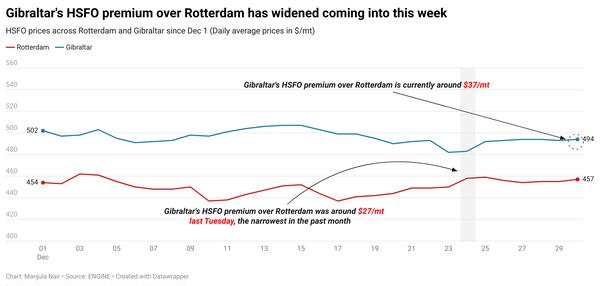

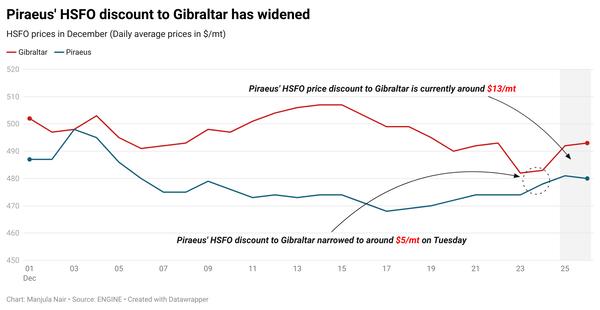

Regional bunker benchmarks have tracked Brent’s upward movement, and prompt HSFO availability is tight in Rotterdam.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($15/mt), Gibraltar ($11/mt) and Rotterdam ($9/mt)

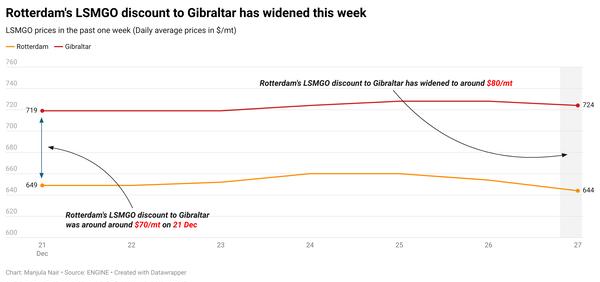

- LSMGO prices up in Rotterdam and Gibraltar ($14/mt)

- HSFO prices up in Gibraltar ($10/mt) and Rotterdam ($9/mt)

- Rotterdam B30-VLSFO at a $193/mt premium over VLSFO

HSFO supply is a bit tight for prompt delivery in Rotterdam and in the rest of the ARA, with lead times of 5-7 days recommended for the grade. VLSFO and LSMGO availability continues to be normal with lead times of 3-5 days.

In Gibraltar, HSFO and LSMGO tightness has eased this week, a trader said. Lead times have come down to 3-5 days for both grades. VLSFO lead time has remained consistent since last week with suppliers offering prompt delivery dates of 3-5 days across all three grades.

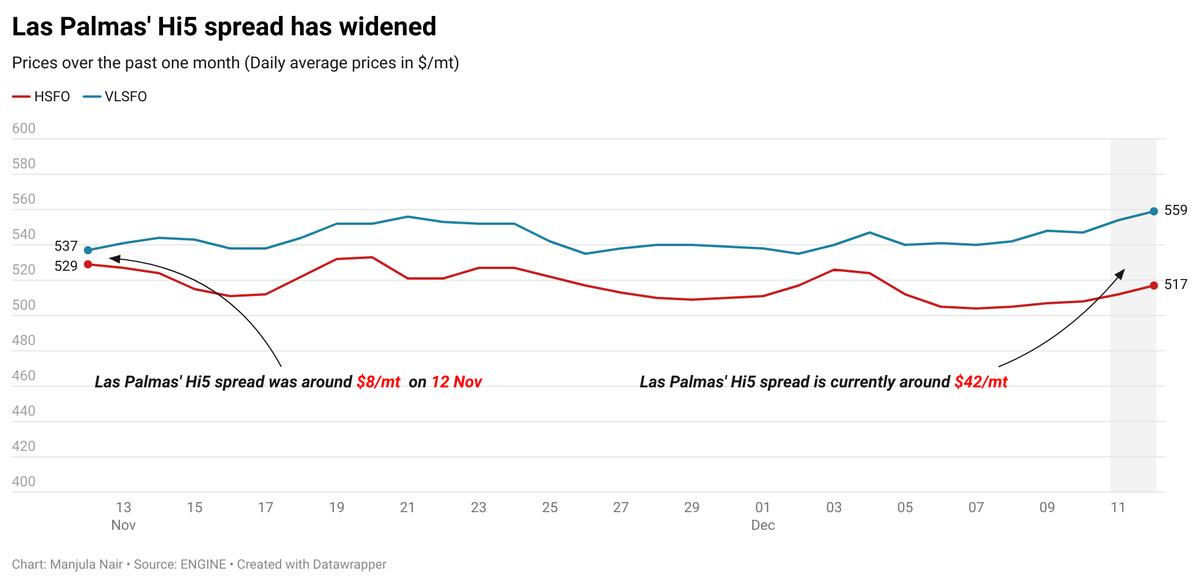

In the Canary Islands’ Port of Las Palmas, VLSFO availability has tightened and a trader advises 5-7 days of lead time for the grade. Recent weather issues have caused some backlog, a trader said adding that VLSFO availability was tight for a couple of suppliers last week. This supply tightness has pushed the port's VLSFO price up by $15/mt in the past day. Las Palmas' Hi5 spread has widened to around $42/mt compared to $8/mt last month.

HSFO availability has been tight in Las Palmas since last week, with suppliers unable to offer very prompt delivery dates. Lead times of 5-7 days are advised for both HSFO and VLSFO in Las Palmas.

Brent

The front-month ICE Brent contract has gained $1.48/bbl on the day, to trade at $73.98/bbl at 09.00 GMT.

Upward pressure:

Brent crude price has moved higher on the day following the latest US inflation data, which came in “hot”.

The US inflation rate, based on the Consumer Price Index (CPI), rose by 0.3% in November, edging up from the 0.2% increase recorded in the previous month, according to the US Bureau of Labor Statistics (BLS).

On an annual basis, the CPI increased to 2.7% in November, up from 2.6% in October and matching market expectations.

Oil prices have reacted positively to the data as it opened the window for a final interest rate cut by the US Federal Reserve (Fed) this year, as it tries to bring inflation under its 2% target.

“US CPI numbers yesterday would have only reinforced the view that the Fed will likely cut interest rates by 25bp [basis points] at its meeting this month,” two analysts from ING Bank said.

Meanwhile, Washington is considering fresh sanctions on Russia’s crude oil, according to media reports. The new sanctions could move Brent’s price higher, according to market analysts.

“Oil prices have been better supported recently on the back of reports that the US is potentially looking to impose further sanctions against Russia, which could target oil,” ING Bank’s analysts said.

Downward pressure

Oil prices felt some downward pressure after Saudi Arabia and its partners at OPEC+ reduced demand growth for the fifth consecutive month.

The Organization of the Petroleum Exporting Countries (OPEC) reduced its world oil demand growth forecast to 1.6 million b/d, about 210,000 b/d lower than its previous month's projection.

Total oil consumption in 2024 is expected to average 103.8 million b/d, OPEC said.

Looking ahead to 2025, OPEC forecasts global oil demand growth at 900,000 b/d, with total consumption reaching 105.27 million b/d. This represents a downward adjustment of 600,000 b/d compared to its prior estimate.

“These revisions do not come as a surprise as OPEC has been more aggressive than the rest of the market when it comes to demand,” ING Bank’s analysts said.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.