Europe & Africa Market Update 6 Dec 2024

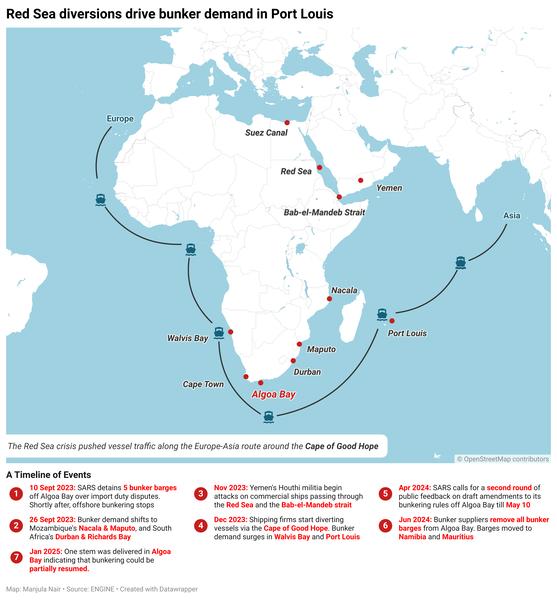

Regional bunker benchmarks have mostly come down with Brent, and HSFO availability has improved in Las Palmas.

Changes on the day to 09.00 GMT today:

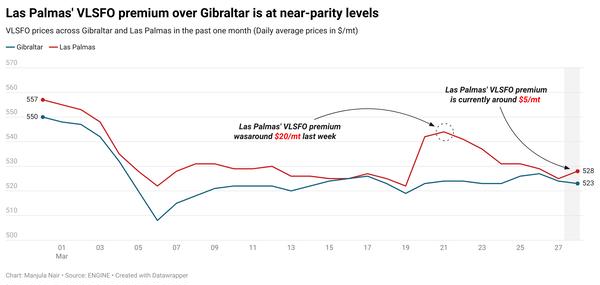

- VLSFO prices up in Gibraltar ($3/mt), and down in Durban ($3/mt) and Rotterdam ($1/mt)

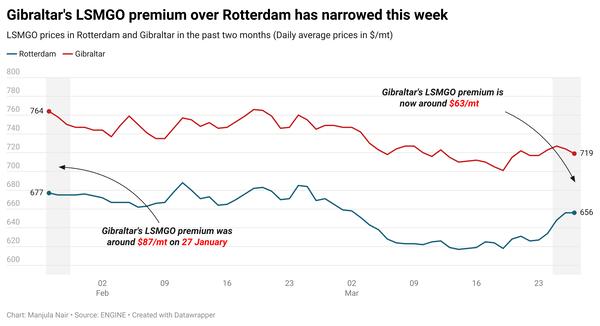

- LSMGO prices down in Rotterdam ($8/mt) and Gibraltar ($3/mt)

- HSFO prices down in Gibraltar ($4/mt) and Rotterdam ($3/mt)

- Rotterdam B30-VLSFO at a $178/mt premium over VLSFO

Rotterdam’s LSMGO price has fallen by a steep $8/mt in the past day due to downward pressure exerted by a lower-priced prompt delivery stem. The port’s LSMGO price drop has outpaced those of Gibraltar to widen its discount over Gibraltar's LSMGO by $5/mt to $77/mt now.

HSFO supply tightness has eased slightly in the Canary Islands’ Port of Las Palmas, but securing the grade for prompt supply remains a challenge. Lead times for the grade have come down from last week's 7-10 days to 5-7 days. LSMGO availability remains tight for very prompt delivery dates, with lead times of 5-7 days advised. VLSFO availability is normal, with lead times unchanged at 3-5 days from last week.

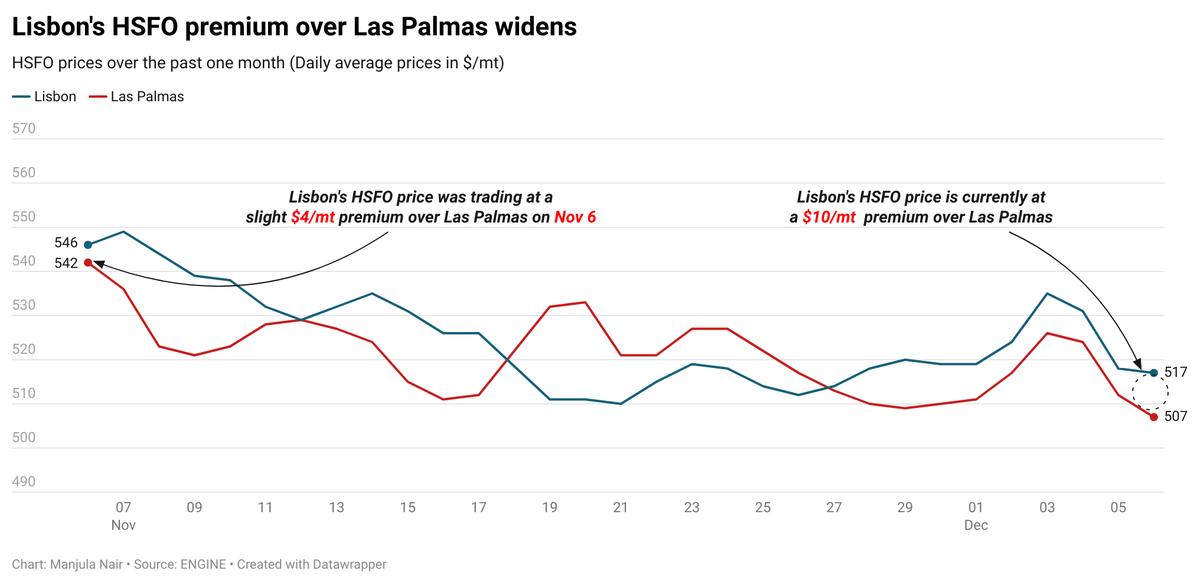

Portugal’s Lisbon has good availability across all grades, a trader said. Lisbon’s HSFO price is currently trading at a $10/mt premium over Las Palmas’ HSFO.

All grades remain tight for prompt supply in the Spanish port of Barcelona, a source said. Lead times of 5-7 days are advised for all grades in the port.

Brent

The front-month ICE Brent contract has declined by $0.76/bbl on the day, to trade at $71.75/bbl at 09.00 GMT.

Upward pressure:

OPEC’s latest decision to extend oil output cuts by another three months until the end of March 2025 has lent support to Brent price.

The Saudi-led coalition had previously planned to gradually unwind the 2.2 million b/d cuts starting January 2025, with monthly production increases of 180,000 b/d.

“OPEC+, as expected, decided to delay, for a third time until April, a planned gradual increase in production,” market analysts at Saxo Bank said.

In addition to a further delay in unwinding supply cuts, OPEC+ members will bring this supply back at a slower pace. The unwinding of the voluntary production cut will take place on a monthly basis until the end of September 2026.

“The gradual increase by pack probably comes along with some promises from OPEC over producers to continue to make compensation cuts,” Price Futures Group’s senior market analyst Phil Flynn remarked.

OPEC+ is responsible for about half of the world's oil output, Reuters reports.

Downward pressure:

Despite its alignment with market fundamentals, OPEC's decision to extend cuts has weighed on Brent crude’s price.

This move reflects OPEC's cautious outlook on 2025 demand growth and concerns over increased output from non-OPEC producers.

“Once again, major oil producers have deferred plans to ramp up production, reacting to a stagnant market grappling with sluggish global demand and heightened output from other regions,” SPI Asset Management’s managing partner Stephen Innes said.

The oil market is grappling with a demand slowdown in China, the world’s second-largest oil consumer.

Chinese state-owned refineries including Sinopec, PetroChina, and Sinochem, plan to lower crude throughput in December to produce about 39.28 million mt. The daily crude throughput is expected to be roughly around 1.3 million mt (9.33 million b/d), a drop of nearly 3% from November, according to market intelligence provider JLC.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.