Europe & Africa Fuel Availability Outlook 4 Dec 2024

Supply improves in the ARA

HSFO tightness has eased in Las Palmas

Prompt VLSFO supply is tight in Richards Bay

PHOTO: Durban port at sunrise. Getty Images

PHOTO: Durban port at sunrise. Getty Images

Northwestern Europe

Supply pressures have eased across all three grades in the ARA this week, a trader told ENGINE. Bunker availability is back to normal and lead times of 3-5 days are advised for all three grades.

The ARA’s independently held fuel oil stocks dipped by 3% in November compared to October, according to Insights Global data.

The region imported 333,000 b/d of fuel oil in November, up from 262,000 b/d imported in October, according to data from cargo tracker Vortexa. The ARA imported low-sulphur fuel oil (LSFO) and HSFO in a 31/69 ratio in November, compared to a 45/55 ratio in October.

Kuwait (14% of the total) emerged as the region’s biggest fuel oil import source last month. The UK, Iraq and France (11% each) ranked second, while Sweden (10%) ranked third. Other import sources include the US (9%).

The ARA hub’s independent gasoil inventories - which include diesel and heating oil - decreased by 2% last month. The region imported 405,000 b/d of gasoil in November, a slight decline from 411,000 b/d of gasoil imported in October, according to Vortexa data.

Prompt bunker availability remains good in Germany’s Hamburg port, a trader told ENGINE. Lead times remain consistent with suppliers able to offer all three grades within 3-5 days.

Mediterranean

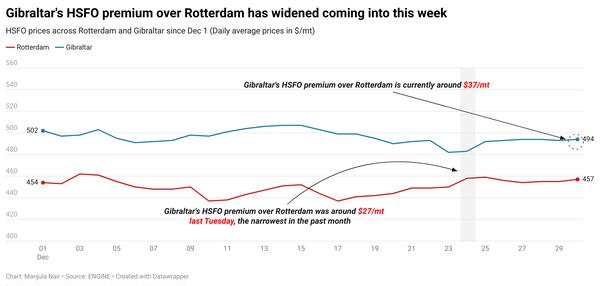

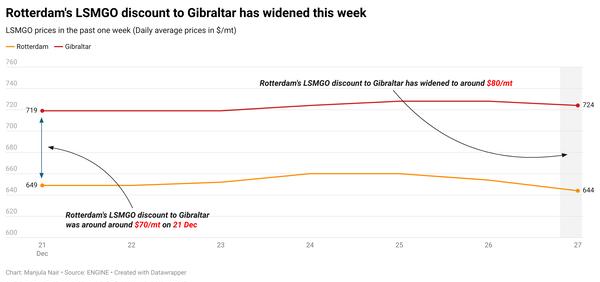

Bunker demand has spiked in the port in Gibraltar, according to a source. HSFO and LSMGO supply remains tight for prompt delivery. One trader recommends 5-7 days of lead time for HSFO, while another trader recommends lead times of up to 11 days for the grade. Lead times for LSMGO remain unchanged from last week with traders recommending around 7 days for the grade. VLSFO availability is normal with lead times of 3-5 days advised.

Gibraltar was witnessing adverse weather on Wednesday, with wind gusts of 23 knots in the port area. Five vessels were waiting to receive bunkers in Gibraltar on Wednesday, up from two on Tuesday, a source said. Wind gusts of 22 knots are forecast on Saturday and may complicate deliveries there.

In the Canary Islands’ port of Las Palmas, HSFO supply tightness has eased slightly, but the grade remains tight for prompt supply. Lead times for the grade have come down from last week's 7-10 days to 5-7 days. LSMGO availability remains tight for very prompt delivery dates, with lead times of 5-7 days advised. VLSFO availability is normal, with lead times unchanged at 3-5 days from last week.

Rough weather may trigger bunkering delays in Las Palmas on Wednesday and Thursday, a source said.

All grades remain tight for prompt supply in the Spanish port of Barcelona, a source said. Lead times of 5-7 days are advised for all grades in the port.

Portugal’s Lisbon has good availability across all grades, a trader said.

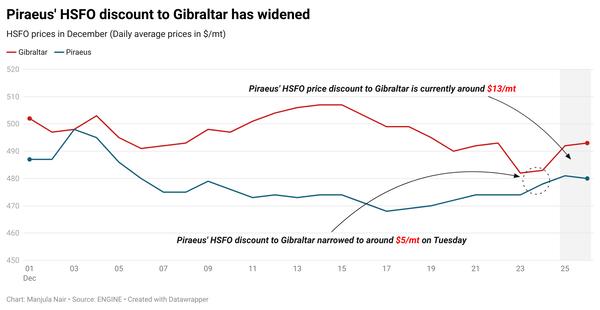

Bunker demand remains muted in Mediterranean bunker hubs like Piraeus, Malta Offshore and Istanbul, a trader told ENGINE. Availability has tightened in these ports as the year-end approaches.

In Greece’s Piraeus port, availability has tightened across all three grades, a trader said. Lead times of 7-10 days are recommended for all three grades, a source said. Calm weather is forecast in Piraeus for the rest of this week, making it conducive to bunkering.

Off Malta, supply tightness has persisted since last week, a trader said. Lead times of around 7-10 days are advised for all grades, one trader said. Another trader said HSFO and VLSFO require around five days of lead time, while LSMGO is plentiful, with 2-5 days recommended. Bad weather may impact bunkering intermittently from Wednesday and will likely continue into next week, a source said.

Turkey’s Istanbul port is also experiencing tightness across all grades with traders advising lead times of around 7-10 days for full coverage from suppliers.

Africa

VLSFO availability is still tight for prompt delivery dates in South Africa’s Durban and Richards Bay, a trader said. Lead times of 7-10 days are advised by traders for full coverage.

Securing LSMGO stems for prompt deliveries remains a challenge in Durban. Lead times of 7-10 days are recommended for the grade. While demand for LSMGO in Durban remains muted, demand for VLSFO is higher in the port.

Prompt availability is good for all three grades in Mauritius’ Port Louis, a trader said.

Namibia's Walvis Bay has ample bunker supply, according to a source. Lead times of around five days are advised for all three grades. Bunker demand has been strong, particularly for VLSFO and LSMGO. HSFO demand has been relatively less there. Bad weather may trigger bunkering disruptions from Wednesday to Friday, a source said.

By Manjula Nair

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.