East of Suez Market Update 22 Nov 2024

Most prices in East of Suez ports have moved up, and LSMGO availability remains good in several Omani ports.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($19/mt), Zhoushan ($8/mt) and Singapore ($2/mt)

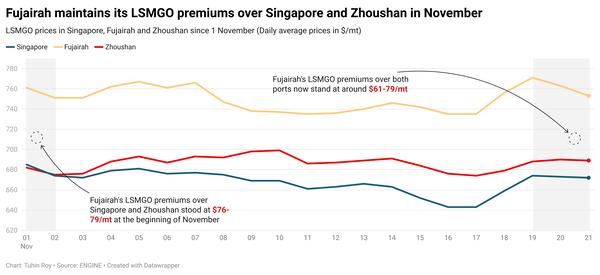

- LSMGO prices up in Zhoushan ($10/mt) and Singapore ($5/mt), and down in Fujairah ($6/mt)

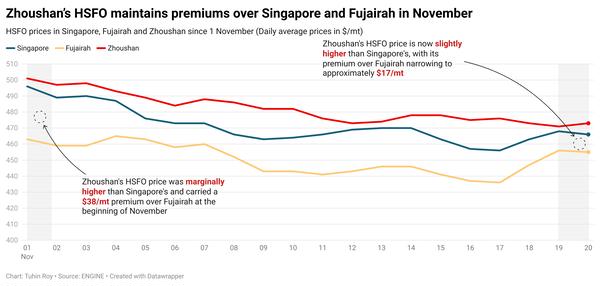

- HSFO prices up in Zhoushan ($7/mt) and Fujairah ($2/mt), and unchanged in Singapore

Fujairah's VLSFO price has risen by $19/mt, marking the steepest increase among the three major Asian bunker ports. This increase, influenced by a higher-priced VLSFO stem fixed in Fujairah, has eliminated its marginal VLSFO discount to Singapore, resulting in a $11/mt premium. Fujairah’s VLSFO discount to Zhoushan has also narrowed significantly, now standing at $9/mt.

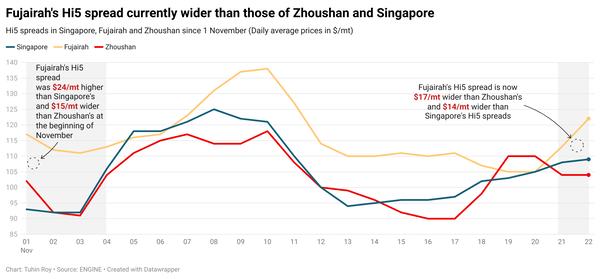

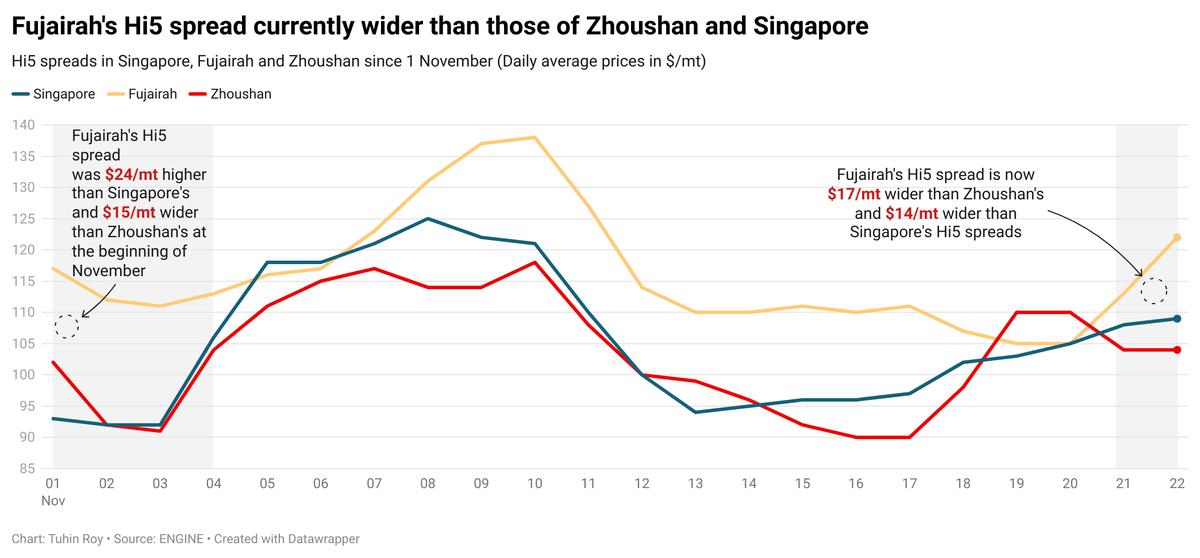

The rise in Fujairah’s VLSFO price has outpaced its HSFO benchmark increase, widening the Hi5 spread from $104/mt yesterday to $121/mt today—surpassing Singapore's $107/mt and Zhoushan's $104/mt.

Prompt VLSFO availability in Fujairah remains tight, with lead times of 5-7 days for all grades, consistent with last week. However, some suppliers can still manage prompt deliveries.

In contrast, Jeddah port in Saudi Arabia has sufficient supplies of both VLSFO and LSMGO. Djibouti continues to face VLSFO shortages, while LSMGO is more readily available. Omani ports, including Sohar, Salalah, Muscat and Duqm, have ample LSMGO supplies with options for prompt deliveries.

Brent

The front-month ICE Brent contract has gained $1.06/bbl on the day, to trade at $74.73/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

The escalating Russia-Ukraine war continues to drive up Brent crude prices.

Russia has intensified its offensive after Britain and the US permitted Ukraine to target Russia with their weapons.

On Thursday, Russian President Vladimir Putin announced that Russia had fired a ballistic missile at Ukraine and warned of a potential global conflict, increasing fears of oil supply disruptions, according to a Reuters report.

“This indicates the war has entered a new phase, raising concerns around disruptions to supply,” said Daniel Hynes, senior commodity strategist at ANZ Bank.

Oil prices are “awaiting further developments in the tit-for-tat escalation in warfare between Kyiv and Moscow since last weekend,” Vandana Hari, founder and analyst at VANDA Insights, added.

Downward pressure:

Rising US crude stocks have exerted some downward pressure on Brent futures.

The US Energy Information Administration (EIA) reported a 545,000-bbl increase in commercial crude oil inventories, bringing the total to 430 million bbls for the week ending 15 November.

Market analysts are expecting the EIA to report another rise in US crude stocks next week.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.