East of Suez Market Update 21 Nov 2024

Prices in East of Suez ports have moved in mixed directions, and prompt availability remains tight for all grades in the UAE ports of Fujairah and Khor Fakkan.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices unchanged in Fujairah, and down in Singapore ($6/mt) and Zhoushan ($1/mt)

- LSMGO prices up in Zhoushan ($3/mt) and Singapore ($1/mt), and down in Fujairah ($17/mt)

- HSFO prices up in Zhoushan ($6/mt) and Fujairah ($2/mt), and down in Singapore ($4/mt)

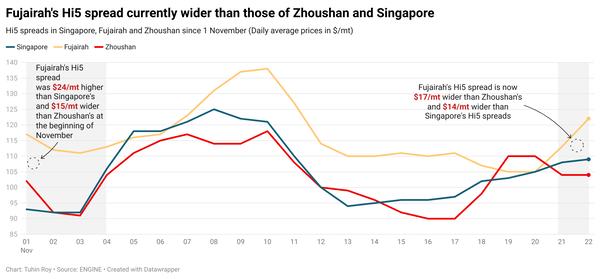

Singapore's VLSFO price has dropped by $6/mt over the past day, while prices in Fujairah and Zhoushan have remained mostly stable. A total of five VLSFO stems were fixed in Singapore yesterday in a wide range of $30/mt. Stems booked at the lower-end of the range have contributed to drag the benchmark down. As a result, Singapore's VLSFO is now at a $14/mt discount to Zhoushan, and its premium over Fujairah has halved to $6/mt.

VLSFO availability in Singapore has tightened, with lead times increasing from 2-8 days last week, to 6-11 days now. HSFO supply is also under pressure, with lead times of up to 13 days. Recommended lead times for LSMGO have also increased from 2-6 days last week, to 4-9 days now.

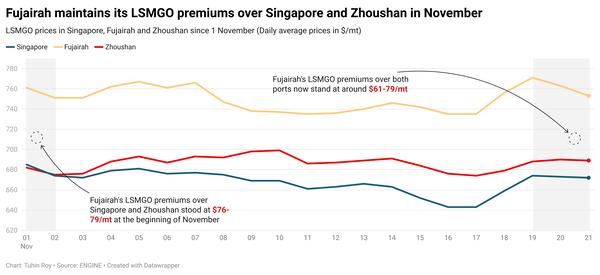

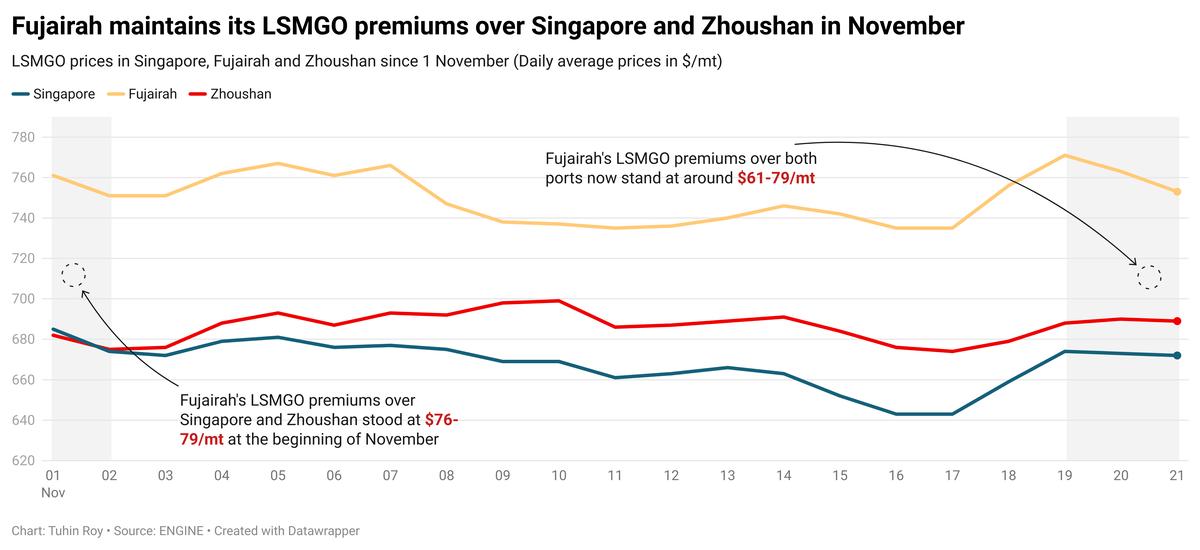

Fujairah’s LSMGO price has dropped sharply by $17/mt in the past day, while prices in Singapore and Zhoushan have remained stable. Despite the price drop, Fujairah's LSMGO premiums over Singapore and Zhoushan remain high at $79/mt and $61/mt, respectively.

Prompt availability in Fujairah is still tight, with recommended lead times of about 5-7 days for all grades, unchanged from last week. However, some suppliers can accommodate prompt deliveries, a source says. Suppliers in Khor Fakkan are able to offer deliveries with lead times of 5-7 days for all grades.

Brent

The front-month ICE Brent contract has dipped $0.13/bbl on the day, to trade at $73.67/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent's price has risen amid renewed supply concerns stemming from escalating tensions between Russia and Ukraine.

On Wednesday, Ukraine fired British cruise missiles into Russia, following the use of US missiles the previous day. Russia warned the use of Western weapons to strike targets deep within its territory would represent a significant escalation in the conflict, Reuters reported.

“An escalation in the conflict in Ukraine lifted Brent crude oil prices due to concern about disruptions to oil supply,” said Daniel Hynes, senior commodity strategist at ANZ Bank.

“For oil, the risk is if Ukraine targets Russian energy infrastructure, while the other risk is uncertainty over how Russia responds to these attacks,” analysts from ING Bank added.

Downward pressure:

Brent futures felt some downward pressure after the release of weekly oil data from the US Energy Information Administration (EIA), which showed an increase in US crude inventories.

According to the EIA, commercial crude oil inventories rose by 545,000 bbls, reaching 430 million bbls for the week ending 15 November.

Brent’s gains were “reversed after a bearish inventory report from the EIA,” Hynes noted.

Norway's Equinor announced on Wednesday that it fully restored output capacity at the Johan Sverdrup oilfield in the North Sea after a power outage earlier this week, Reuters reported. The news added more downward pressure on Brent futures.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.