Americas Market Update 20 Nov 2024

Bunker prices have mostly gained across Americas ports, and bad weather in Zona Comun disrupts bunkering.

Changes on the day, to 07.00 CST (13.00 GMT) today:

- VLSFO prices up in Houston ($8/mt), Balboa ($6/mt), Los Angeles ($5/mt) and New York ($4/mt), and down in Zona Comun ($5/mt)

- LSMGO prices up in Houston ($18/mt), Balboa ($8/mt), Los Angeles ($7/mt) and New York ($1/mt)

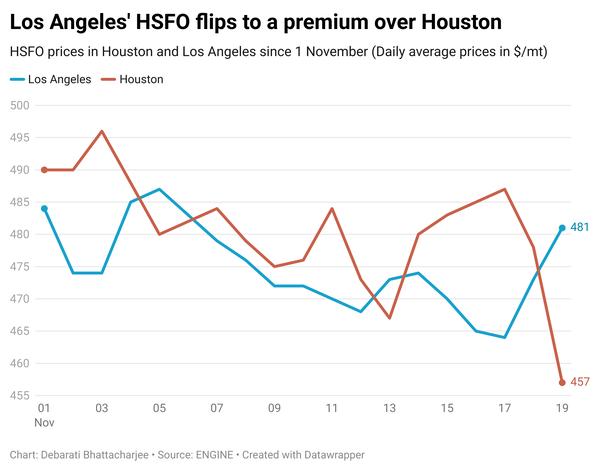

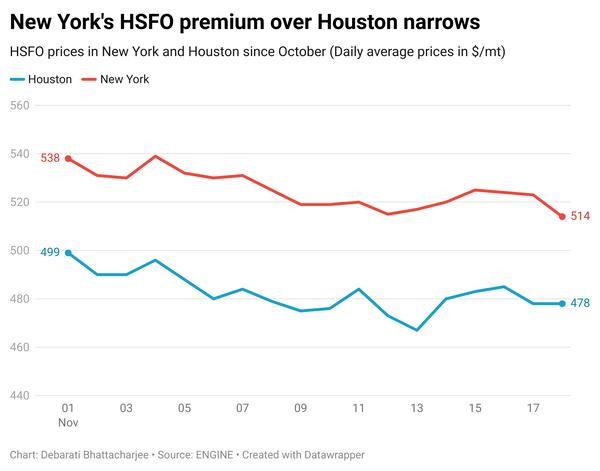

- HSFO prices up in Los Angeles, Houston and New York ($4/mt), and unchanged in Balboa

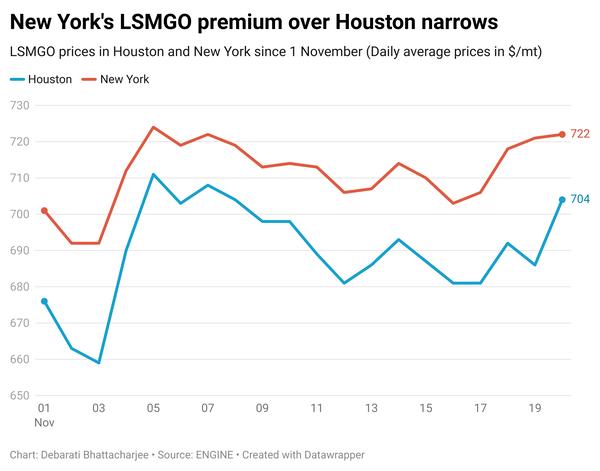

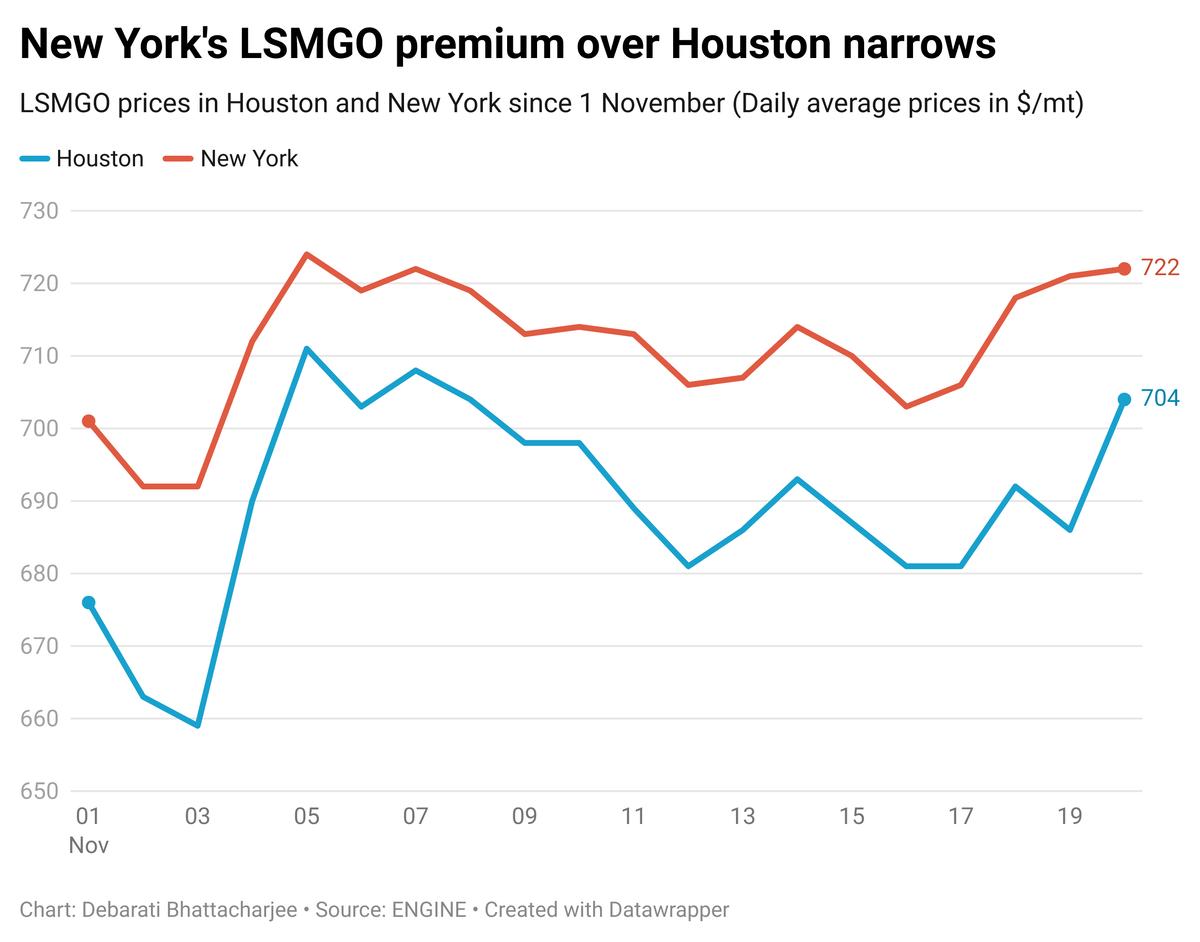

Houston’s LSMGO price has gained by $18/mt in the past day with support from a higher-priced LSMGO stem. Meanwhile, New York’s LSMGO price has gained marginally. This has narrowed New York’s LSMGO price premium over Houston from $35/mt yesterday, to $18/mt now.

LSMGO price at the New Orleans Outer Anchorage (NOLA) has made a smaller gain in the past day compared to Houston. Despite the smaller increase, NOLA’s LSMGO price continues to hold a premium of $13/mt over Houston.

Market sources attribute the higher prices at NOLA to delays in replenishments, which have created supply-side constraints.

Bad weather in Argentina’s Zona Comun has disrupted operations today, delaying bunker deliveries. Suppliers in Zona Comun are now indicating that the earliest possible delivery will be on November 29.

Brent

The front-month ICE Brent contract has gained $0.82/bbl on the day, to trade at $73.81/bbl at 07.00 CST (13.00 GMT) today.

Upward pressure:

Oil prices have moved higher on renewed supply jitters in the global oil market after Russia’s Foreign Minister Sergei Lavrov said that Moscow will now enter into a "new phase of Western war" after Ukraine used US-built long-range missiles on targets deep inside the Russian territory over the weekend.

With the onset of a new phase in the Ukraine-Russia conflict, oil prices are expected to gain momentum as supply concerns will keep traders on their toes.

Moreover, Russian President Vladimir Putin updated the country’s nuclear doctrine on Tuesday, establishing conditions under which Russia could strike from the world's biggest nuclear arsenal, Reuters reported.

Brent’s price moved higher after Putin approved an “updated nuclear doctrine expanding conditions for using atomic weapons,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Downward pressure:

Brent’s price felt some downward pressure after the American Petroleum Institute (API) reported a bigger-than-expected rise in US crude stocks.

Crude oil inventories in the US surged by 4.7 million bbls in the week that ended 15 November, according to API. The weekly inventory build was much higher than market expectations of an 800,000-bbl rise during the week.

A rise in US crude stocks indicates weakness in oil demand, which can put downward pressure on Brent’s price.

Johan Sverdrup oil field in Norway has resumed operations after a power outage led to a halt in production on Monday, Reuters reported. This news has added some downward pressure on Brent.

The oil field produces around 755,000 b/d, “but will take some time to return to full capacity,” two analysts from ING Bank said.

By Debarati Bhattacharjee and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.