Americas Market Update 19 Nov 2024

Bunker prices have moved in mixed directions across Americas ports, and bunker operations are expected to be suspended in GOLA.

Changes on the day, to 07.00 CST (13.00 GMT) today:

- VLSFO prices up in New York ($5/mt), and down in Los Angeles and Balboa ($7/mt) and Houston ($1/mt)

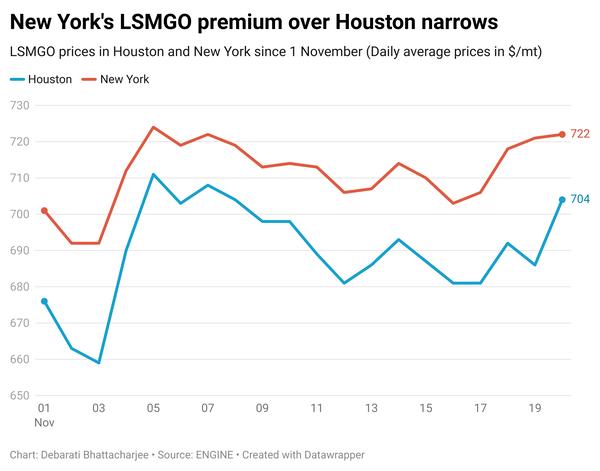

- LSMGO prices up in New York ($8/mt), and down in Balboa ($7/mt), Houston and Los Angeles ($1/mt)

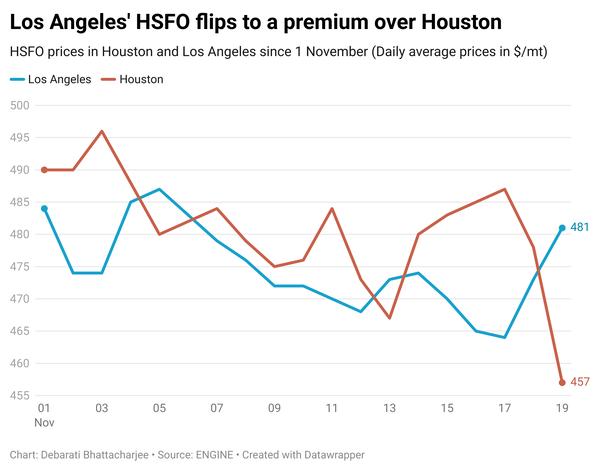

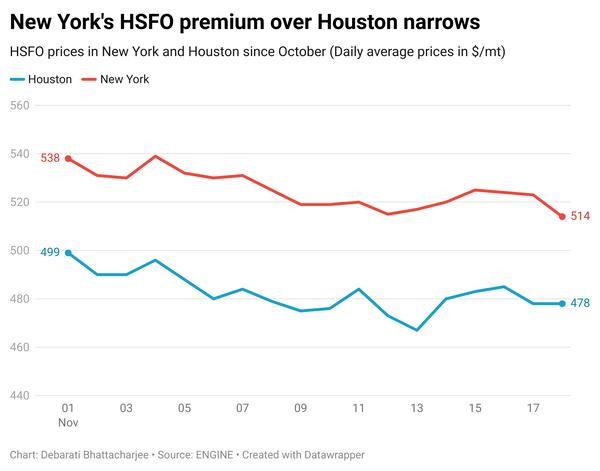

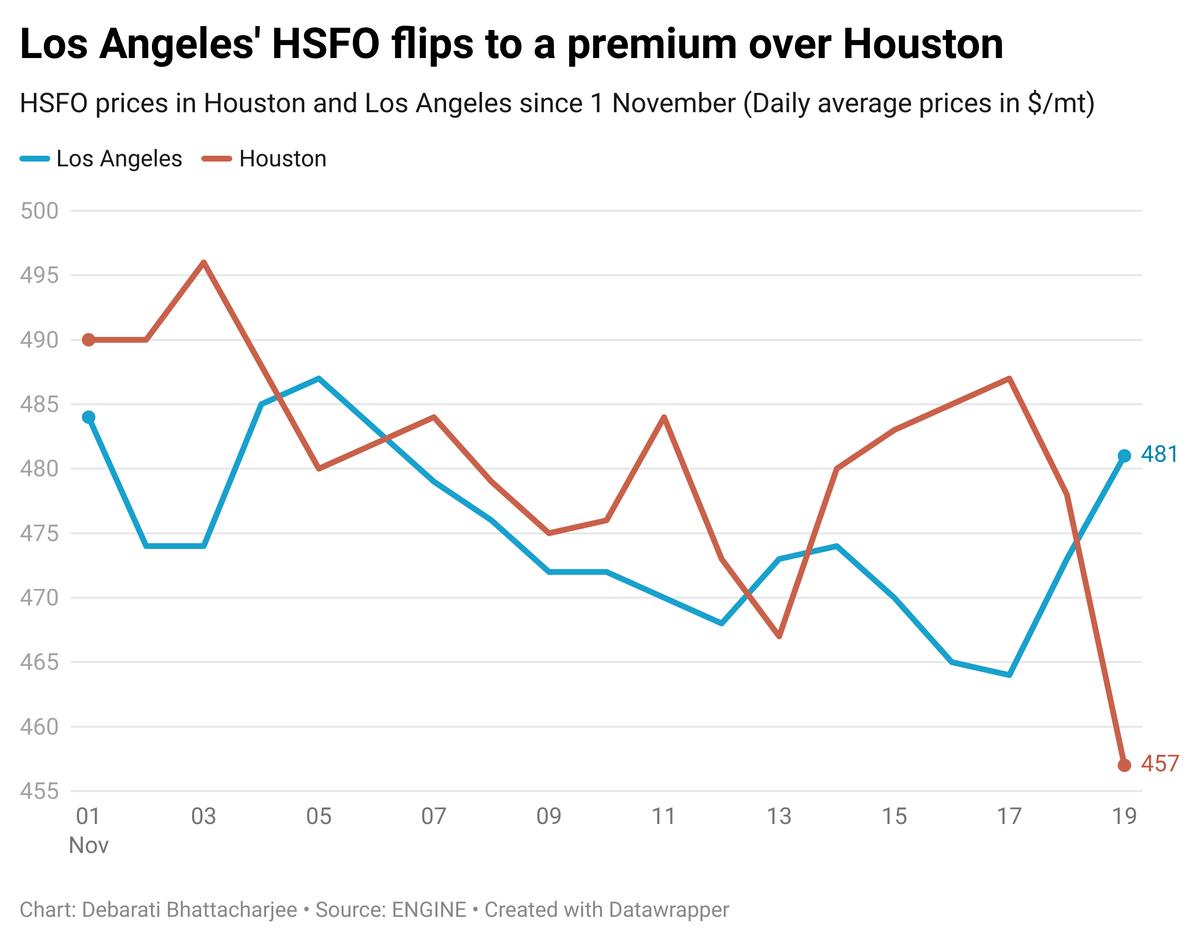

- HSFO prices up in Los Angeles ($11/mt), Balboa ($3/mt) and New York ($2/mt), and down in Houston ($21/mt)

Houston’s HSFO price has countered Brent’s upward movement and dropped in the past day with pressure from a 500-1,500 mt lower-priced stem. Meanwhile, Los Angeles’ HSFO price has gained since yesterday, flipping its $8/mt HSFO price discount to Houston, to a $24/mt premium now.

Houston’s VLSFO price has dropped marginally in the past day, widening the port’s Hi5 spread by $20/mt, to $112/mt. It is almost aligned with Los Angeles’ Hi5 spread of $111/mt. Meanwhile, New York’s Hi5 spread continues to be the narrowest in the region, with a spread of $62/mt.

Demand for all bunker fuel grades has been very low in New York, so far this week. Most suppliers can offer stems with a lead time of 3-5 days.

Bunkering has been proceeding normally in the Galveston Offshore Lightering Area (GOLA) today. But bunkering is expected to be suspended again from Friday onwards due to a forecast of wind gusts.

Brent

The front-month ICE Brent contract has moved $1.57/bbl higher on the day, to trade at $72.99/bbl at 07.00 CST (13.00 GMT) today.

Upward pressure:

The sudden escalation of the Russia-Ukraine conflict has pushed oil prices higher.

Brent’s price surged after Washington approved Ukraine’s use of long-range missiles against Russia, ramping up tensions between the two warring nations, according to media reports.

“[Brent] crude oil roared to life, surging nearly 3%, as geopolitical tensions reignited with the US greenlighting Ukraine’s use of long-range missiles against Russia,” SPI Asset Management’s managing partner Stephen Innes said.

Meanwhile, oil production of about 755,000 b/d in Norway’s Johan Sverdrup field has been cut due to a power outage, Reuters reports. This news has also supported oil prices.

“A halt of production at the 755k b/d [755,000 b/d] Johan Sverdrup field in Norway due to a power outage… provided further upside [to oil],” two analysts from ING Bank said.

Downward pressure:

Demand growth concerns simmering in China, the world's second-largest oil consumer, have continued to put some downward pressure on Brent’s price.

Chinese oil consumption in October dropped by 5.4% month-on-month, with refiners processing about 59.54 million mt of crude oil last month, according to data from the National Bureau of Statistics (NBS).

“Chinese demand concerns continue to overshadow global tight supply and optimistic predictions for the upcoming Thanksgiving travel expectations,” Price Futures Group’s senior market analyst Phil Flynn said.

Moreover, recent economic data from China has raised concerns among market participants about the inefficacy of Beijing's latest stimulus package. Earlier this month, China unveiled a 10 trillion yuan ($1.40 trillion) stimulus package to support economic growth in the country.

China's October industrial output increased 5.3% year-on-year, slipping from a 5.4% growth recorded in September, the NBS reported.

Weakness in industrial output indicates weak economic health, as well as a contraction in the manufacturing sector, which includes production, inventory levels, etc. It highlights demand growth concerns, ultimately weighing down on prices of commodities like oil.

By Debarati Bhattacharjee and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.