Americas Market Update 15 Nov 2024

Most bunker prices in the Americas have dropped, with the notable exception of Balboa's HSFO price.

Changes on the day, to 07.00 CST (13.00 GMT) today:

- VLSFO prices down in Balboa ($22/mt), Zona Comun ($4/mt), Los Angeles and Houston ($2/mt) and New York ($1/mt)

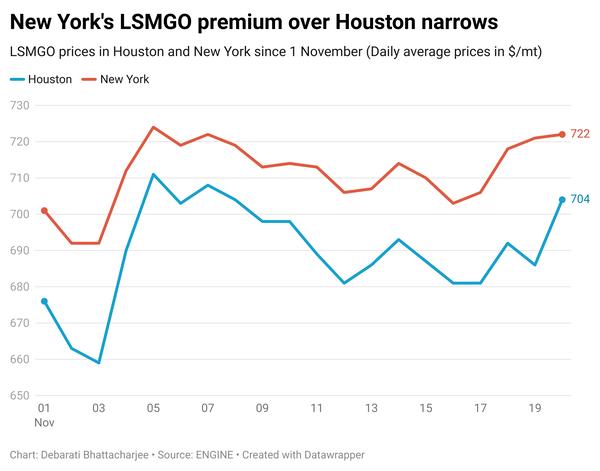

- LSMGO prices down in Balboa ($10/mt), Houston ($4/mt), Los Angeles ($2/mt) and New York ($1/mt)

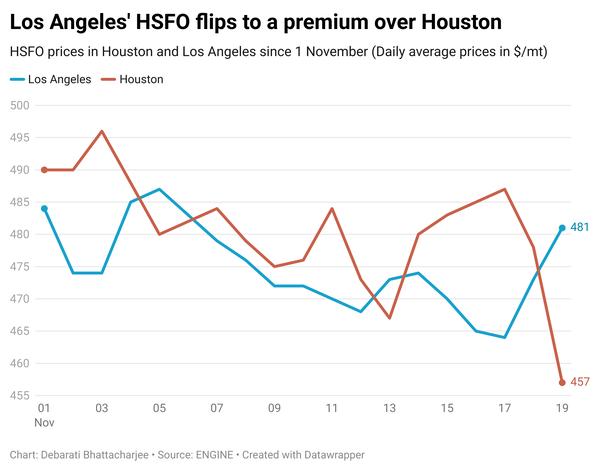

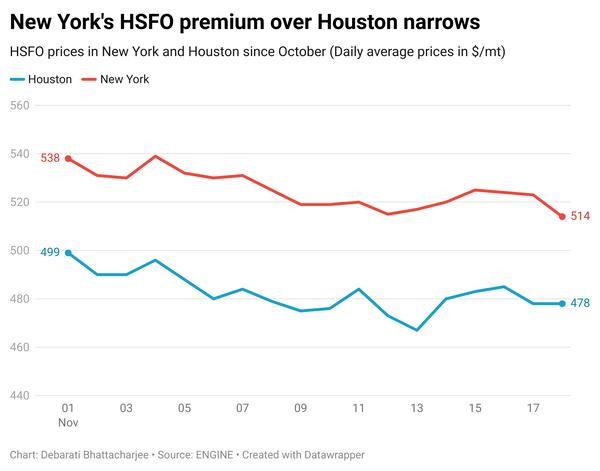

- HSFO prices up in Balboa ($11/mt), unchanged in New York, and down in Houston ($9/mt)

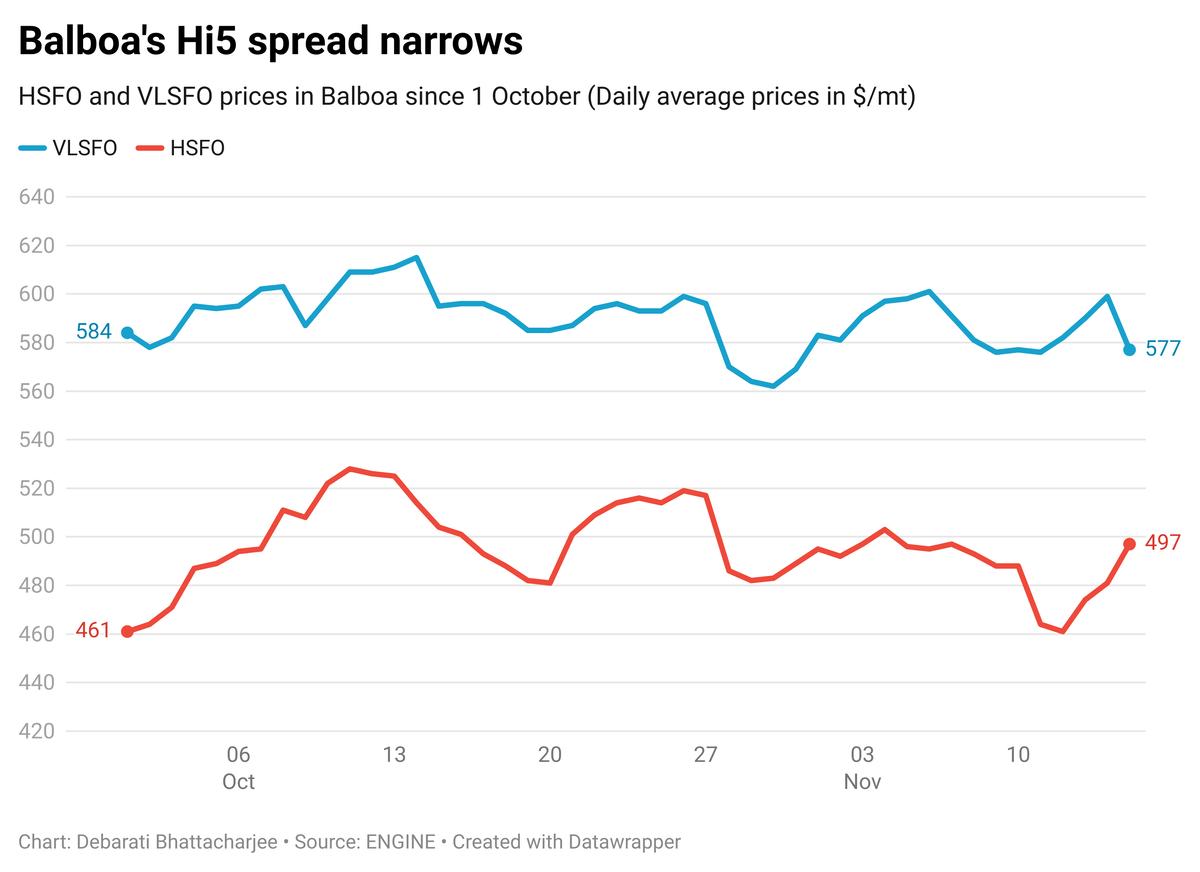

Balboa’s HSFO price has countered the general market direction and gained in the past day. Meanwhile, the port’s VLSFO price has dropped with downward pressure from several lower-priced firm offers. This has narrowed Balboa’s Hi5 spread by $33/mt to $80/mt.

On the other hand, Cristobal’s VLSFO price has had a smaller drop compared to Balboa in the past day. Cristobal’s VLSFO price has swung from near parity to Balboa’s to a premium of $7/mt now.

Congestion at Zona Comun has worsened due to bad weather and strong winds, causing delays in deliveries. The earliest delivery date for new purchases has now been pushed to 27 November, a source says.

Brent

The front-month ICE Brent contract has shed $0.53/bbl on the day, to trade at $72.26/bbl at 07.00 CST (13.00 GMT) today.

Upward pressure:

The price of Brent has gained marginally as global oil producers group OPEC+ decided to cap crude oil supply by extending cuts for another month. The group is now expected to gradually start unwinding its 2.2 million b/d cut from January 2025.

Oil market analysts expect OPEC to maintain current production levels for now, given the recent weakness in Brent. The Saudi Arabia-led group meets next on 1 December.

At the next OPEC meeting, “oil policy will be discussed, and they [OPEC] may want to send a message,” Price Futures Group senior market analyst Phil Flynn said.

Besides, crude oil production in Iraq, the group’s second-largest producer, declined by 66,000 b/d to 4.07 million b/d in October, OPEC said.

“OPEC and Russia continue to stress the importance of their cooperation and their commitment, to the oil market,” Flynn said.

Downward pressure:

Brent is on course to settle lower on the week, following a surprising weekly gain in US crude stocks. Commercial crude oil inventories increased by 2.09 million bbls over the previous week, the US Energy Information Administration (EIA) reported.

Meanwhile, the International Energy Agency’s (IEA) bearish oil market report also put downward pressure on oil prices. IEA expects that the global oil market will see a sizeable crude oil surplus of more than 1 million b/d next year, even with demand growth of 920,000 b/d.

This 1 million b/d supply surplus could increase further if OPEC+ decides to unwind supply cuts. “The IEA’s latest forecast paints a bearish picture, warning of a looming oil glut in 2025, with global crude supplies expected to overshoot demand by over a million barrels a day,” SPI Asset Management managing partner Stephen Innes remarked.

Talks of an Israel-Lebanon ceasefire deal are also in focus, analysts said. According to a Washington Post report, Israel’s Minister of Strategic Affairs has recently visited US President-elect Donald Trump and come to a mutual understanding about the situation across the Israel-Lebanon border.

“Trump has said he wants to bring an end to war in the Middle East,” ANZ Bank senior commodity strategist Daniel Hynes said.

With Trump’s return to the White House, few market participants expect a de-escalation in the Middle Eastern conflict, which could protect a major chunk of crude oil production from potential disruption.

“Israel’s recent diplomatic moves suggest a peace deal understanding with Trump, raising the possibility that he might add 'Middle East peacemaker' to his list of ambitions - a feather he desperately wants to adorn his geopolitical cap,” Innes said.

By Debarati Bhattacharjee and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.