Fuel Switch Snapshot: Rotterdam’s bio-premiums shrink against LNG

VLSFO supply improves in Singapore

Rotterdam’s LNG only $15/mt cheaper than bio-VLSFO

Dutch rebate for biofuel move closer to $150/mt

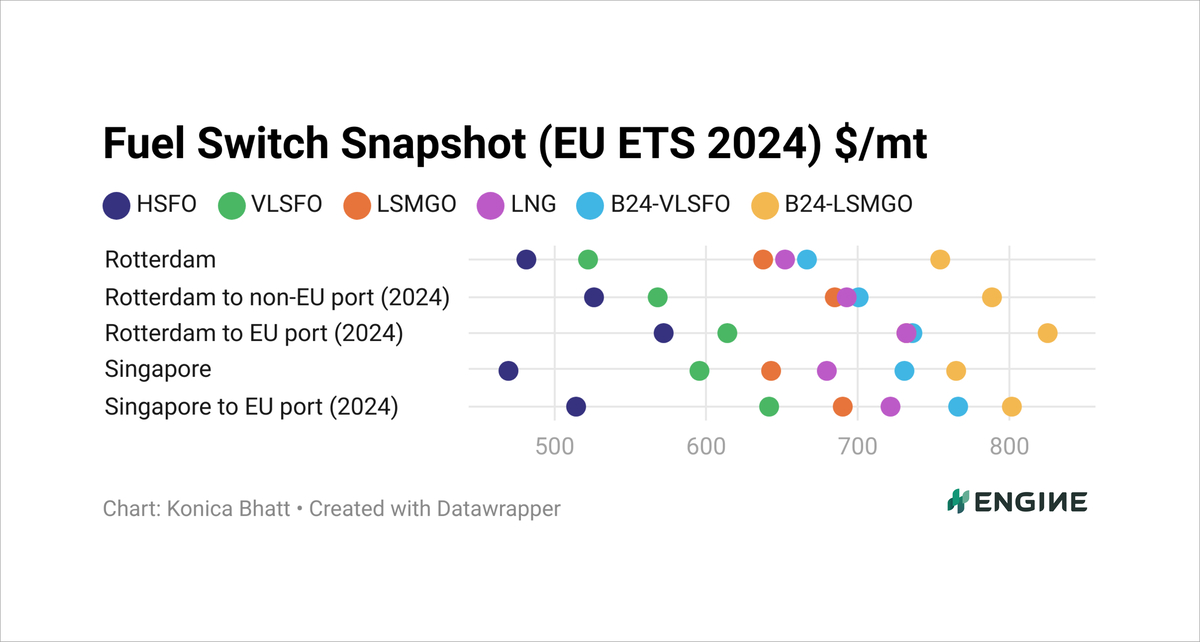

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

A sharp decline in Rotterdam’s B24-VLSFO HBE price (-$27/mt) and a nearly equal rise in LNG price (+$20/mt) have brought the two benchmarks closer together in the past week.

Rotterdam’s LNG is now $15/mt cheaper than B24-VLSFO HBE, excluding estimated costs for EU Allowances (EUAs). When factoring in EUAs, the price gap narrows even further, with LNG only $4-10/mt cheaper than the bio-blend.

ENGINE’s calculations with FuelEU Maritime default factors show that vessels consuming B24-VLSFO between two EU ports next year will be well below the required GHG intensity target of FuelEU Maritime, incurring a significant compliance surplus of $102/mt VLSFO-equivalent. This is the theoretical value in a vessel pooling arrangement and can be transferred or sold to about eight other VLSFO-consuming vessels to cover their compliance next year.

For dual-fuel shipowners, LSMGO has once again become the cheaper alternative to LNG in Rotterdam, as LNG has shifted from a $2/mt discount to a $13/mt premium over the past week. VLSFO remains a more affordable option, with a $130/mt discount to LNG.

VLSFO

The front-month ICE Brent futures contract has risen by $0.77/bbl ($6/mt) over the past week. Singapore’s VLSFO benchmark has not quite tracked Brent, edging up by just $3/mt during the same period.

Rotterdam’s VLSFO benchmark has remained relatively unchanged, with only a modest $3/mt decline.

VLSFO availability in Singapore has improved in a "quiet" market, reducing lead times to 4-7 days, from around 11 days the week week. In Rotterdam, prompt availability of the grade remains tight.

Biofuels

Rotterdam’s B24-VLSFO HBE price has dropped by $27/mt, while its B24-LSMGO HBE price has declined by $19/mt.

The Dutch HBE A ticket price for 2024 was assessed at €14.90/GJ ($15.93/GJ) on Friday, up from €12/GJ ($13.08/GJ) a week ago. This increase translates to a theoretical rebate of $142/mt for B30-VLSFO blends sold in the Dutch ports, up from $103/mt a week ago.

Singapore’s B24-VLSFO UCOME price has increased $3/mt in the past week. Its B24-LSMGO UCOME price has dropped by $9/mt, under pressure from a $13/mt drop in the underlying ENGINE conventional LSMGO price.

As Chinese UCOME is a key biofuel feedstock used for marine biofuel blending in Singapore, a recent rise in Chinese UCOME prices could add upward pressure on biofuel bunker prices in the port.

LNG

Rotterdam’s LNG bunker price has come up by $20/mt over the past week, reflecting an upward trend in the Dutch TTF Natural Gas contract.

This increase is driven by lower wind power generation, rising gas demand and storage drawdowns across Europe.

Singapore’s LNG bunker price, meanwhile, has dipped slightly amid waning spot demand and high stock levels in Asia.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.