East of Suez Fuel Availability Outlook 23 Sep 2025

Bunker demand low in Zhoushan

Several East Asian ports brace for Typhoon Ragasa

VLSFO and LSMGO availability good in Oceanic ports

IMAGE: Aerial view of the Port of Brisbane. Getty Images

IMAGE: Aerial view of the Port of Brisbane. Getty Images

Singapore and Malaysia

VLSFO availability in Singapore remains steady with lead times of 7–10 days. HSFO supply is stable with 8–10 days lead time, slightly shorter than last week’s 8–12 days. LSMGO availability has improved, with lead times narrowing to 3–6 days from 4–8 days last week.

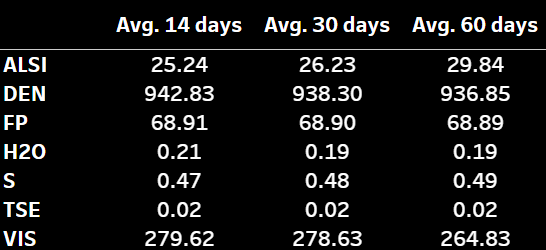

Residual fuel oil stocks in Singapore have averaged 3% higher month-on-month, with inventories now above 25 million bbls, despite a 19% decline in net fuel oil imports, according to data from Enterprise Singapore. Imports fell by 1.85 million bbls, while exports dropped by 1.16 million bbls. Middle distillate stocks have also risen, averaging 4% above last month.

At Malaysia’s Port Klang, VLSFO and LSMGO remain readily available, with prompt supply possible for smaller parcels, while HSFO remains tight.

East Asia

Bunker demand in Zhoushan remains weak, with lead times unchanged at 4–7 days for VLSFO, HSFO and LSMGO.

Operations across China are expected to stay subdued during the Golden Week holidays (1–8 October), as most suppliers will only fulfill pre-booked stems. New bookings will not be accepted after 26 September, according to a source.

Fuel availability varies across northern China. Dalian and Qingdao have ample VLSFO and LSMGO, though HSFO is tight in Qingdao. Tianjin faces shortages across all grades. In Shanghai, VLSFO and HSFO supply is strained, while LSMGO remains more stable.

Further south, conditions are mixed: VLSFO and LSMGO are constrained in Fuzhou; Xiamen has enough VLSFO but limited LSMGO; and both grades face limited delivery options in Yangpu and Guangzhou.

Typhoon Ragasa, which strengthened into a super typhoon on Sunday and hit northern Philippines, is forecast to make landfall along Guangdong’s central or western coast on Wednesday.

From Tuesday through Friday, strong winds and heavy rains are expected across the northern South China Sea and southern China’s coastal areas. Eastern Jiangsu and Anhui provinces may also see heavy rainfall, China’s National Meteorological Center warns.

This could disrupt bunkering at ports, including Guangzhou, Shenzhen, Zhuhai, and Beihai.

In Hong Kong, lead times remain about seven days for all fuel grades, but the typhoon may cause delays. Ragasa was located around 460 km east-southeast of Hong Kong this afternoon, moving across the northern South China Sea. The Hong Kong Observatory has issued a warning signal, with bunker deliveries likely to be affected.

Taiwan’s Central Weather Administration lifted its land warning for Ragasa today, but forecast continued heavy rain, especially in the east. Taichung, Keelung, and Hualien ports remain unaffected, while Kaohsiung has seen minor impact, a trader says.

Lead times at Taichung, Kaohsiung, and Hualien are currently 4–5 days, while Keelung requires around three days—longer than last week’s 2–3 days across these ports.

In South Korea, all fuel grades currently require about nine days of lead time at western ports, compared to just three days at southern ports. Last week, suppliers had recommended lead times of 4–9 days across the country.

Weather conditions are favourable, and no disruptions are expected in the coming days, a source says.

VLSFO supply remains tight across Japan’s key ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Mizushima, Nagoya, and Yokkaichi. LSMGO is generally well supplied nationwide, though prompt deliveries in Mizushima may still face delays.

B24-VLSFO remains available only on an enquiry basis at Tokyo, Chiba, Kawasaki, and Yokohama. HSFO supply is stable at most ports, but Oita is experiencing shortages of all three grades — VLSFO, LSMGO and HSFO.

In Thailand, Ragasa is forecast to bring heavy rain and flooding to northern, northeastern, central, and eastern regions this week, according to the country’s Meteorological Department. These conditions could disrupt bunkering operations at Thai ports.

Oceania

In Western Australia, VLSFO and LSMGO are readily available at Kwinana and Fremantle, with most suppliers quoting around seven days of lead time. Deliveries are typically made by barge from a single supplier, while LSMGO can also be supplied by truck. Afternoon strong winds can occasionally disrupt operations, a source notes.

In New South Wales, Port Kembla offers VLSFO via truck and pipeline at several berths, with a minimum pipeline delivery of 70 mt. Smaller volumes can be supplied by truck.

In Sydney, one barge operates alongside pipe and truck options at some berths. The barge schedule is sometimes affected by naval activity and cruise liner traffic. LSMGO and VLSFO are generally well stocked, but HSFO can be limited. A lead time of about seven days is preferred across all grades.

In Queensland, both Brisbane and Gladstone maintain adequate VLSFO and LSMGO availability with lead times of around seven days. HSFO in Brisbane is only available on request, while Gladstone can face occasional weather disruptions. Securing a berth at Brisbane’s AAT terminal can also be difficult. The port now has two barges operated by separate suppliers, both supplying VLSFO and LSMGO, with HSFO available on enquiry.

In Victoria, Melbourne and Geelong have good supplies of VLSFO and LSMGO, but HSFO availability is tighter, particularly for prompt demand. At present, HSFO is well stocked in Melbourne. A single barge serves these ports, with Bass Strait weather often posing challenges. A seven-day lead time is recommended.

LSMGO is also available by truck at smaller ports such as Portland and Port Welshpool, where lead times of 2–3 days are typical.

Overall in Australia, a seven-day lead time is recommended, though most ports can usually supply within 3–4 days given generally good availability. Ports with pipeline infrastructure, such as Darwin and Dampier, often rely on truck support, which can affect supply reliability.

In New Zealand, VLSFO deliveries are stable at Tauranga and Auckland. Tauranga also offers pipeline access at certain berths, while Marsden Point can supply VLSFO and LSMGO via pipeline at some jetties, if vessels are working cargo.

Cyclone season in northern Australia runs from 1 November to 30 April, and bunkering operations are expected to face interruptions during this period, the source added.

South Asia

Bunker supply in Sri Lanka has improved, with one supplier now offering prompt delivery across all grades, compared to lead times of about seven days last week.

Middle East

Prompt bunker supply remains tight in Fujairah across all grades, with recommended lead times of 5–7 days, a situation also seen at nearby Khor Fakkan.

In Iraq’s Basrah, VLSFO and LSMGO are readily available, though HSFO remains limited. Saudi Arabia’s Jeddah continues to face restricted availability of both VLSFO and LSMGO.

In Egypt’s Port Suez, conditions are severe, with stocks of VLSFO, LSMGO, and HSFO nearly depleted. Qatar’s Ras Laffan is also struggling with tight VLSFO and LSMGO supply. Djibouti faces acute shortages, with VLSFO and HSFO almost exhausted and LSMGO in short supply.

By contrast, Oman’s ports — Sohar, Salalah, Muscat, and Duqm — continue to maintain stable LSMGO availability.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.