East of Suez Market Update 23 Sep 2025

Prices in East of Suez ports have moved in mixed directions, and prompt availability of all grades is tight in Fujairah.

IMAGE: Aerial view of Saudi Arabian port of Jeddah with cargo ships and dry docks. Getty Images

IMAGE: Aerial view of Saudi Arabian port of Jeddah with cargo ships and dry docks. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices unchanged in Singapore, and down in Fujairah and Zhoushan ($3/mt)

- LSMGO prices up in Fujairah ($5/mt) and Singapore ($2/mt), and down in Zhoushan ($6/mt)

- HSFO prices up in Singapore ($4/mt) and Fujairah ($2/mt), and down in Zhoushan ($4/mt)

- B24-VLSFO at a $246/mt premium over VLSFO in Singapore

- B24-VLSFO at a $254/mt premium over VLSFO in Fujairah

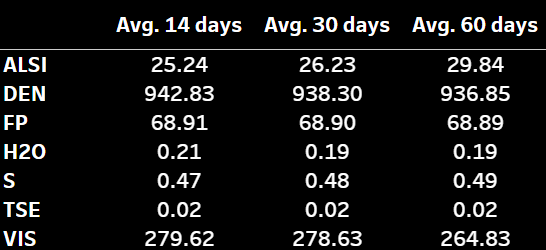

VLSFO prices have held broadly steady over the past day, with no major changes. Fujairah's VLSFO is at a $25/mt discount to Zhoushan and is nearly at parity with Singapore.

LSMGO prices in Fujairah and Singapore have edged higher in the past day, while Zhoushan’s benchmark has declined. Fujairah’s LSMGO is priced at premiums of $65/mt over Singapore and $57/mt over Zhoushan.

Prompt bunker supply in Fujairah remains tight across all grades, with recommended lead times of 5–7 days — a situation mirrored at the nearby port of Khor Fakkan

In Iraq’s Basrah, both VLSFO and LSMGO grades are readily available, but HSFO remains limited. Meanwhile, Saudi Arabia’s Jeddah continues to face limited availability of both VLSFO and LSMGO.

Brent

The front-month ICE Brent contract has lost by $0.41/bbl on the day, to trade at $66.38/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has found some support due to impending supply concerns in the global oil market.

Canadian Prime Minister Mark Carney has called for the implementation of secondary sanctions on Russia, Bloomberg reported.

The remark came days after the European Commission (EC) proposed its 19th package of economic sanctions against Russia, targeting 118 additional vessels that are allegedly a part of Russia’s shadow fleet.

“This [Carney’s remarks] revived supply concerns, which had eased late last week following an amicable exchange between presidents [Donald] Trump and Xi [Jinping],” said ANZ Bank’s senior commodity strategist Daniel Hynes.

Downward pressure:

Brent’s price has moved lower following news that Iraq has hiked oil exports this month, Reuters reported, citing Iraqi state oil marketer SOMO.

The increase in exports comes as OPEC+ producers continue gradually unwinding voluntary production cuts, deepening market concerns over a looming supply glut.

Earlier this month, eight members of OPEC+ agreed to increase production by 137,000 b/d in October - the sixth consecutive time that they plan to expedite production.

“Iraq is pumping out more barrels now that OPEC+ loosened its grip on quotas,” remarked Price Futures Group’s senior market analyst Phil Flynn.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.