East of Suez Market Update 4 Oct 2024

Prices in East of Suez ports have moved up, and VLSFO and HSFO availability remains tight in Singapore.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($25/mt), Fujairah ($22/mt) and Zhoushan ($20/mt)

- LSMGO prices up in Fujairah ($36/mt), Zhoushan ($22/mt) and Singapore ($8/mt)

- HSFO prices up in Singapore and Fujairah ($23/mt) and Zhoushan ($14/mt)

Regional bunker benchmarks have tracked an upward trend in Brent futures. Singapore’s VLSFO price has increased by $25/mt, the sharpest rise among the three major Asian bunker ports. Despite this rise, Singapore’s VLSFO discount to Zhoushan is at $28/mt, while its premium over Fujairah is at $9/mt.

Bunker demand is steady in Singapore, while VLSFO supply in the port is tight due to low stock levels and loading delays at terminals. Some suppliers are now advising lead times of over two weeks for the grade. HSFO supply is also constrained, with lead times stretching to two weeks. In contrast, LSMGO availability is better, with lead times between 4-8 days.

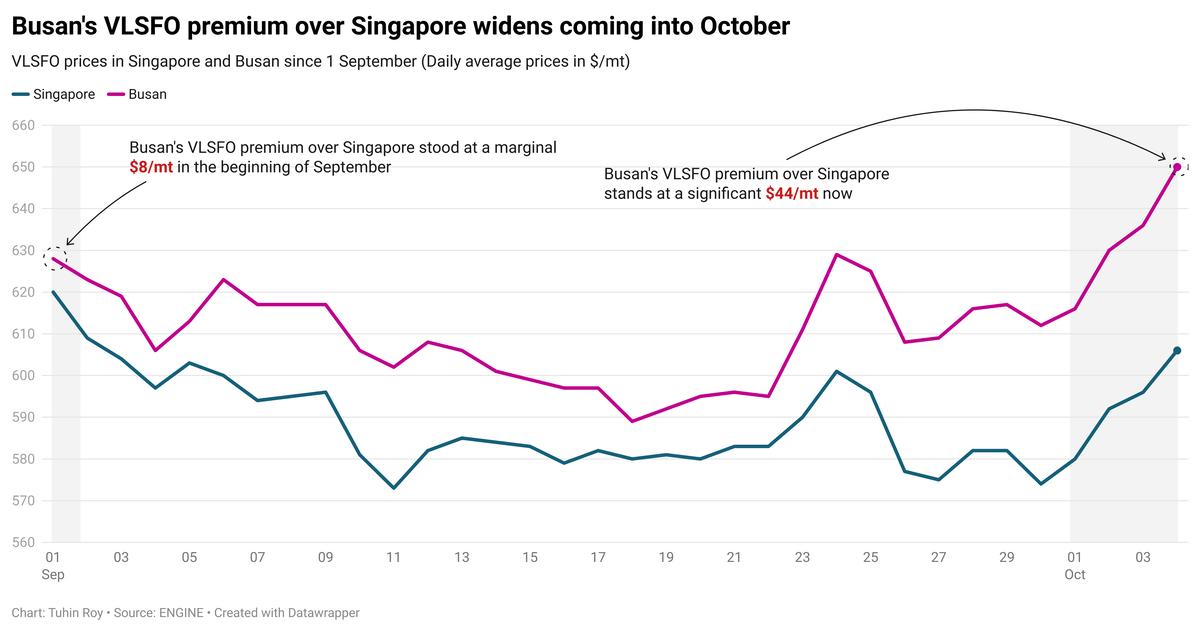

South Korea’s Busan continues to price its VLSFO higher than Singapore, with the current premium of $44/mt, despite average bunker demand.

Southern South Korean ports have stable VLSFO and LSMGO supply, with suppliers recommending lead times of 5-9 days. However, HSFO supply is tight, with lead times exceeding 15 days.

In western South Korean ports, lead times for VLSFO and LSMGO have increased to 9-15 days, compared to 7-11 days last week. HSFO lead times have also jumped to 9-15 days from around four days. Rough weather is expected to intermittently disrupt bunker operations at Ulsan, Onsan, Busan, Daesan, Taean and Yeosu between 5-9 October.

Brent

The front-month ICE Brent contract has moved $3.88/bbl higher on the day, to trade at $78.44/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Oil rallied as tensions continued to escalate in the Middle East. The conflict has now dragged in OPEC’s second-largest oil producer, Iran.

Brent’s price surged following reports that Israel’s next target could be Tehran’s oil and energy facilities, market analysts said.

“Oil prices skyrocketed… as investors scrambled for cover amid the brewing chaos in the Middle East,” SPI Asset Management’s managing partner Stephen Innes said.

The Pentagon and the Israel Defense Forces (IDF) are “discussing” possible airstrikes on Iranian oil infrastructure in response to Tehran’s missile attack earlier this week, US President Joe Biden said.

In a clip shared by Reuters, when asked if Washington would back an Israeli attack on Iran’s oil facilities, Biden responded, “We are discussing that.”

“Brent crude rose… on the news [that Israel could strike Iranian oil sites] as markets start to price in the likelihood of supply disruptions in the Middle East,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

“The region accounts for about a third of global supply,” Hynes added.

Downward pressure:

Brent’s price felt some downward pressure as Libya’s state-owned oil company National Oil Corporation (NOC), which oversees most of the country's oil resources, officially lifted force majeure on oil production and exports yesterday.

Crude oil production in the Sharara and El-feel oilfields, two of the largest Libyan oil production sites, and exports from Essider have resumed, NOC said in a statement.

The news comes as OPEC+ plans to proceed with production hikes in December, a move that will push the global oil market into over-supplied territory, according to market analysts.

Libya has a production capacity of about 1.2 million b/d, according to OPEC.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.